Evaluate a Sample Venture Deal with a Senior Partner

As an exclusive offer to those interested in becoming investors in our funds, we invite you to join a Senior Partner to evaluate a sample deal in a short 15-minute session.

We’ll evaluate due diligence in the four major categories by which we evaluate deals.

Listen, absorb, and process the information to practice your ability to think like a savvy VC investor.

Please note: Entrepreneurs seeking funding, please contact us to submit your company here.

STEP 1: Reserve a Time for Your Session

STEP 2: Explore the Snapshot Below of the Deal You’ll Review

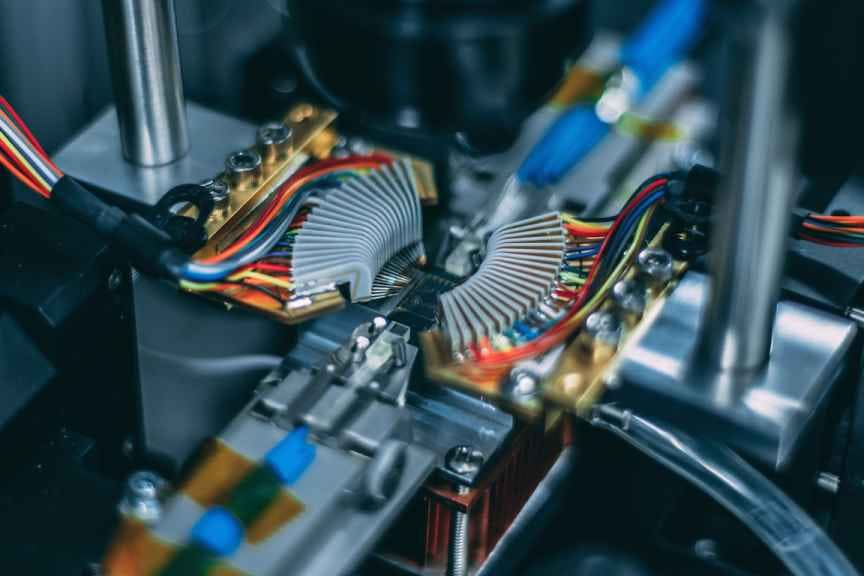

Cutting-Edge Quantum Computing

This company is aiming to bring the first commercially-available quantum computer to the market and recently eclipsed a valuation of $1B.

Step 3: Learn More About Becoming an Investor with Alumni Ventures

Are you missing out on generational wealth creation?

- HomeOver the 5, 15, and 25-year periods, venture capital has outperformed the public markets, according to Cambridge Associates (1)

- HomeVenture has been the highest performing alternative asset class of the last decade, according to JP Morgan (2)

- HomeVenture has little to no correlation to the public markets, according to Invesco (3)

Over 600k professionals have joined our community.

Join us!

We have more than 30 funds to choose from.

See testimonial policy below.

Introduction to Alumni Ventures

- HomeOver $1B in capital raised

- Home1,100+ portfolio companies

- HomeMore than 9,000 investors

- HomeCo-investing alongside other established venture firms

See video policy below.

(1) Cambridge Associates, Building Winning Portfolios through Private Investments, August 2021

(2) JP Morgan, Guide to Alternatives, Q4 2022

(3) Invesco, The Case for Venture Capital