Castor’s Focus on Consistency and Quality

Managing Partner Chris Sklarin (SB ’88) reflects on the previous year and current macroeconomic climate

In reflecting on the previous year and current macroeconomic climate, Managing Partner Chris Sklarin (SB ’88) reiterates what we see as the three rules for investing.

In reflecting on the previous year and taking into account the current macroeconomic climate, we at Castor Ventures wanted to reiterate what we see as the three rules for long-term investing:

- Invest with optimism for tomorrow. Technology and innovation have always been the drivers of progress — and the drivers of all value creation. Venture capital is an investment in progress.

- Invest with discipline and consistency. We suggest you diversify, buy quality, and don’t time the market. And you should buy for the long-term, which by definition is what a venture investment is.

- Invest with the best. In any market, the best companies find their way to the best investors. That’s why we invest exclusively alongside other well-established VCs.

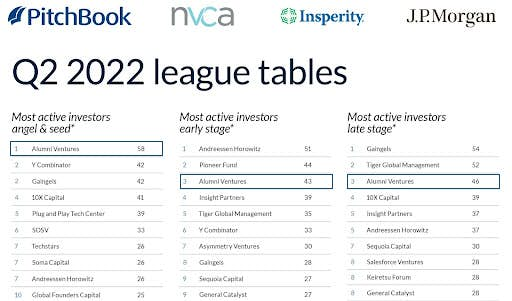

This long-term focus on consistency and quality has made Alumni Ventures a leader in activity in venture capital. According to Pitchbook / NVCA Venture Monitor data for quarter ending June 30, Alumni Ventures Tops the most active list in Q2 2022 league tables — “#1 in Angel and Seed, #3 Early Stage, #3 Late Stage.”

Please consider joining us for our new Castor Ventures Fund 7. If you’re interested in learning more, schedule a call or visit our portal.

Chris Sklarin

Managing Partner, Castor VenturesChris has 20+ years of experience in tech investing, product development, and sales engineering. He has invested over $90 million in companies from seed to venture stage. Most recently, he was Vice President at Edison Partners, where he focused on investments for Enterprise 2.0 and mobile. Previously, Chris was a Director of Business Development with biomedical venture accelerator BioEnterprise and Director of Business Development with Chrysalis Ventures. Earlier, at JumpStart, a nationally recognized venture development organization, he sourced and executed seed investments. Chris has an SB EE from MIT (’88) and an MBA from the University of California at Berkeley’s Haas School of Business.

Contact [email protected] for additional information. To see additional risk factors and investment considerations, visit av-funds.com/disclosures.