Decoding YC’s S25 Demo Day — Trends & Takeaways

1,500 Investors. 144 Startups. 6 Hours. 1 Room

Last week, more than 1,500 investors squeezed into a San Francisco venue for a coveted seat at YC’s invite-only Spring 2025 Demo Day. Over six hours, 144 startups delivered rapid-fire, one-minute pitches, each launching just seconds apart. Investors furiously took notes, sized up founders, and fired off intros.

Yet Demo Day has evolved beyond a pure deal-sourcing frenzy. By the time the curtain rises, many YC teams already have term sheets in hand from top firms and are well on their way to sealing seed rounds.

Today, Demo Day’s real power lies in pattern-spotting. YC’s brand draws premier global talent, and each large batch acts as a live snapshot of the broader startup landscape. For investors, exposure to 144 lightning pitches becomes a crash course in emerging market signals — surfacing themes, identifying nascent sectors, and gleaning nuanced insight directly from domain-expert founders.

These patterns aren’t necessarily limited to the products. At Demo Day, we noticed that founders themselves often demonstrated similar patterns of technical experience: common past employers, research labs, and communities that seem to consistently produce breakout talent.

The Founder Diaspora at YC — Shared DNA Amongst YC Founders

The concept of founders sharing a common technical DNA isn’t new. We’ve seen this play out time and again — tight-knit groups emerging from tech giants like PayPal, OpenAI, or Google, forming what we now casually refer to as “mafias.”

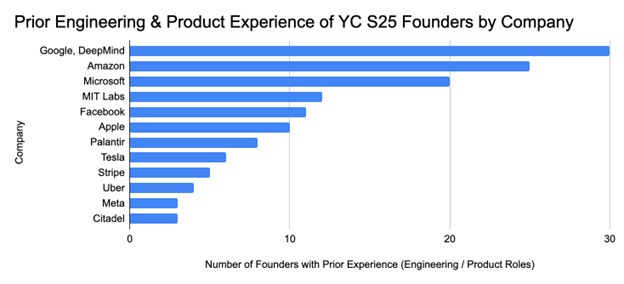

For this YC batch, we wanted to dig deeper into the network effects at play. So, we scraped LinkedIn profiles of every founder to better understand their product and engineering roots. Our goal? To spot common threads — shared work histories, stints in the same research labs, or other high-density hubs where ideas (and founders) seem to flourish.

Some results were expected. Many founders had spent time at Meta, Amazon, Microsoft, Uber, Stripe, and Tesla — reaffirming the well-trodden path from big tech to entrepreneurship. But some results were more surprising:

Google was especially prominent, with 30 founders having worked there — many specifically at DeepMind. Even more intriguing, 12 founders came from MIT research labs. What links DeepMind and MIT? Both are steeped in scientific problem-solving and the pursuit of foundational algorithms. These environments don’t just build strong engineers — they cultivate deeply technical thinkers with a bent for rigorous experimentation.

Still, it raises the question: are these institutions the new “mafias”? Could Google’s DeepMind or MIT’s AI labs be playing the same role PayPal once did for Elon Musk, Peter Thiel, or Reid Hoffman — concentrating technical talent, fostering bold ideas, and spawning new ventures? And if so, is today’s startup DNA shifting from purely engineering chops to something more research-driven?

We’re also left wondering: Just as PayPal alumni gravitated toward fintech, social networks, and VC, are YC founders’ shared experiences at places like DeepMind or Amazon driving the major innovation trends we saw at Spring Demo Day — like specialized agentic AI or accessible robotics? Understanding where a team comes from — whether a research lab, a tech giant, or a startup ‘mafia’ — often offers clues about how they think, what they value, and ultimately, what they choose to build.

So, what’s on deck? Let’s explore the nine standout trends shaping YC’s Spring ’25 cohort.

The Digital Customer Twin — Agents that automate QA via realistic customer simulation

Software development cycles have dramatically accelerated over the past year — 75% of software executives report up to 50% shorter development times by implementing AI. However, testing remains a bottleneck, still relying on manual QA and brittle automation.

At Demo Day, we saw startups like Bluejay and Propolis building agents that simulate realistic AI users, eliminating manual testing and boosting deployment confidence. Janus applies customer simulation to conversational AI agents, while Kestral automatically evaluates customer feedback, prioritizing fixes and features for highest impact in real-time.

Democratizing Development — Automation that simplifies software development

Tools like Cursor have seen explosive hypergrowth, democratizing software development by allowing non-technical users to build and customize applications. This momentum was reflected at Demo Day — a major trend we saw was toward tools that enable easier, faster, and more accessible software development.

Startups like Jazzberry, Bloom, Vybe, and Waffle are bridging the gaps left by traditional vibe coding platforms such as debugging, cross-platform vibe coding, and easier backend functionality development. Other startups are focused on completely eliminating the need for coding — Odapt and Plexe let anyone build AI-powered software using plain language, while Operative simply connects into an organization’s internal backends to automatically generate frontend code.

Smarter Defense for Smarter Tech — Agents that save time on cybersecurity

As writing code becomes more accessible, so do data breaches. In fact, 73% of enterprises experienced at least one AI-related security incident in the past year, with average breach costs amounting to $4.8M. These AI incidents also take 40% longer to detect and resolve than non-AI ones.

YC startups are building to protect users from this new risk layer. BitPatrol, Casco, and Mindfort are building tools that help enterprise customers use AI safely, without the fear of high-impact data leaks. Meanwhile, Cotool is automating cybersecurity workflows, freeing teams to focus on threat hunting over manual tasks.

Compliance at Scale — Agents automating legal workflows for the enterprise

With regulations like the General Data Protection Regulation (GDPR), Health Insurance Portability and Accountability Act (HIPAA), and Sarbanes-Oxley Act (SOX) rapidly evolving, companies are facing increasing pressure to stay compliant, but often lack the legal headcount to keep up. This year, YC startups are building agents to automate compliance and streamline legal workflows across sectors and company sizes.

WorkDone focuses on healthcare compliance, Rimba targets industrial compliance, and Clarm enables enterprises to build deep research agents while remaining compliant. Probo is making it easier for startups to stay compliant from day one. Meanwhile, startups like Crimson, Third Chair, and Vesence’s are helping legal teams automate repetitive tasks so they can focus on higher-importance work.

Simplifying Robotics — Making robotic manufacturing accessible and affordable

YC’s spring batch highlighted two major trends in robotics. First, startups like The Robot Learning Company, Almond (only $7/hour), and Vassar Robotics are building affordable, general-purpose robots, making robotic automation accessible to businesses of all sizes. MorphoAI is further driving down pricing by streamlining the manufacturing of robotic hardware itself via AI, cutting R&D costs.

Second, Zeon Systems and Mbodi AI are simplifying robotic control by enabling users to direct complex, specialized automation using natural language prompts, bringing robotic operation to non-technical users.

AI in Charge — AI agents for C-Suites and executives

At Demo Day, many startups were focused on improving workplace productivity. Some companies, like Vesence’s “Cursor for Lawyers” and Den were building AI agents designed to automate and assist in manual tasks for knowledge workers.

However, alongside these startups, we saw a new wave of innovation focused on automating executive-level roles. BOND is creating an AI Chief of Staff for busy executives, Minerva is building an agent with CFO-level accounting intelligence, and Mesmer is developing Cursor-like tools for founders and CTOs.

Agents for Agents — Agents that create, deploy, and optimize agents

Everyone’s racing to build AI agents to automate just about every possible task. But as software systems grow more complex and teams scale, we’re seeing a wave of startups creating agents that act like staff engineers: agents that build and manage other agents.

Theta and RunRL are focused on real-time agent optimization, while The LLM Data Company and Kashikoi are simplifying how teams evaluate and benchmark agent performance. Meanwhile, Lumari, Den, and Sim Studio are streamlining the building process itself, turning agent creation, testing, and deployment into minutes-long tasks. Blaxel’s platform is giving agents access to run end-to-end agentic workloads.

Talking Tech — Voice AI agents to automate call systems and sales

Voice AI has become a foundational element of modern business strategy. Low levels of satisfaction with legacy IVR-systems has inspired further investment into next-gen voice AI agents for tasks like customer service.

Demo Day reflected this trend — startups like Atlog, Kanava AI, and Lyra are leveraging voice AI for sales automation, while SynthioLabs and Trapeze have found a niche for voice AI in healthcare. Others, like VoiceOS, provide voice AI tools for interviews, while Willow is rethinking the need for keyboards by building an AI-powered dictation platform.

Intelligent Content Creation — AI-generated hyper-personalized content

Attention spans are decreasing, and the demand for personalized content is only growing. Company success now hinges on their ability to build relatable, engaging relationships with consumers.

Enter hyper-personalized AI-generated content. Throxy is combining AI agents with human experts to deliver hyper-personalized campaigns at scale. One of the most interesting startups we found in this niche is Neoncoral, essentially a social media platform with hyper-personalized AI-generated videos.

Connecting Founder Pedigree to Investor Interests

What stood out just as much as the products were the people building them. Many of this batch’s most compelling startups were led by founders with shared technical roots — ex-Google and DeepMind engineers, MIT researchers, and builders from places like Amazon, Stripe, and Tesla. These aren’t just impressive résumés — they’re signals of where talent density is forming and where future innovation is likely to emerge. Just like the PayPal Mafia helped define an era of fintech and web infrastructure, today’s founder networks may be laying the groundwork for what’s next in AI, robotics, and enterprise automation. If Demo Day is any indication, we’re watching the earliest chapters of some very big stories unfold.

Invest In Our Funds

Let our expert team handle it. Our award-winning investment professionals will build a diversified portfolio of venture-backed companies.

Invest Deal-By-Deal

You make your own investment decisions. You’ll see 1-2 deals per month, including all AV diligence materials, and select which companies you want to invest in.

This communication is from Alumni Ventures, a for-profit venture capital company that is not affiliated with or endorsed by any school. It is not personalized advice, and AV only provides advice to its client funds. This communication is neither an offer to sell, nor a solicitation of an offer to purchase, any security. Such offers are made only pursuant to the formal offering documents for the fund(s) concerned, and describe significant risks and other material information that should be carefully considered before investing. For additional information, please see here. Achievement of investment objectives, including any amount of investment return, cannot be guaranteed. Co-investors are shown for illustrative purposes only, do not reflect all organizations with which AV co-invests, and do not necessarily indicate future co-investors. Example portfolio companies shown are not available to future investors, except potentially in the case of follow-on investments. Venture capital investing involves substantial risk, including risk of loss of all capital invested. This communication includes forward-looking statements, generally consisting of any statement pertaining to any issue other than historical fact, including without limitation predictions, financial projections, the anticipated results of the execution of any plan or strategy, the expectation or belief of the speaker, or other events or circumstances to exist in the future. Forward-looking statements are not representations of actual fact, depend on certain assumptions that may not be realized, and are not guaranteed to occur. Any forward-looking statements included in this communication speak only as of the date of the communication. AV and its affiliates disclaim any obligation to update, amend, or alter such forward-looking statements, whether due to subsequent events, new information, or otherwise.

ABOUT THE AUTHORS

Meera Oak

Partner, Seed FundMeera’s background includes strategic, financial, and operational experience from her time at Yale University, where she managed a $1B budget (of a $4B organization), led M&A transactions, and secured business development relationships with corporate partners. Most recently, she worked with early-stage venture funds and incubators like Create Venture Studio and Polymath Capital Partners and was responsible for launching business ventures and sourcing investments in enterprise SaaS, infrastructure, and ecommerce. Meera has a BA in Economics from Swarthmore College and an MBA from the Tuck School of Business at Dartmouth.

Anika Chebrolu

Summer AssociateAnika Chebrolu is a Summer Associate at Alumni Ventures, where she focuses on pre-seed and seed-stage investing. She is also the Managing Director at Moso Capital and a Venture Fellow at Arkitekt Ventures, with a deep interest in health, bio, and climate tech. With experience spanning private equity, scientific research, and grassroots fundraising, Anika brings a multidisciplinary lens to venture investing, grounded in both analytical rigor and a passion for impact. She is currently pursuing her undergraduate studies at the University of Pennsylvania, where she combines her interests in business, science, and social impact through hands-on roles in early-stage consulting and impact investing.