3 Reasons Investors Seek Exposure to VC

Is venture capital a good fit for your portfolio?

Are you looking to maximize returns while diversifying your portfolio? Consider the potential of venture capital. With a history of solid returns and valuable access to private companies, VC is becoming an increasingly attractive choice for investors who want to achieve their financial goals. Here are three reasons why it may be worth adding this asset class into your mix.

- Home

Value Creation

- Home

Portfolio Diversification

- Home

Long-Term Investment Horizon

View Fund Performance

Login to our secure data room.

Schedule a Call to Speak with Us

Ask questions important to you.

1. Value Creation

Investing in venture capital offers an opportunity to get into innovative, cutting-edge companies at the earliest stages when valuations are most reasonable, and the potential upside is greatest.

The Role of Private Markets

The number of public companies in the U.S. peaked in the late 1990s and has been on a steady decline ever since. Plus, many companies experience hyper-growth while still private. In this video, learn about the role of private markets in value creation.

See video policy below.

2. Portfolio Diversification

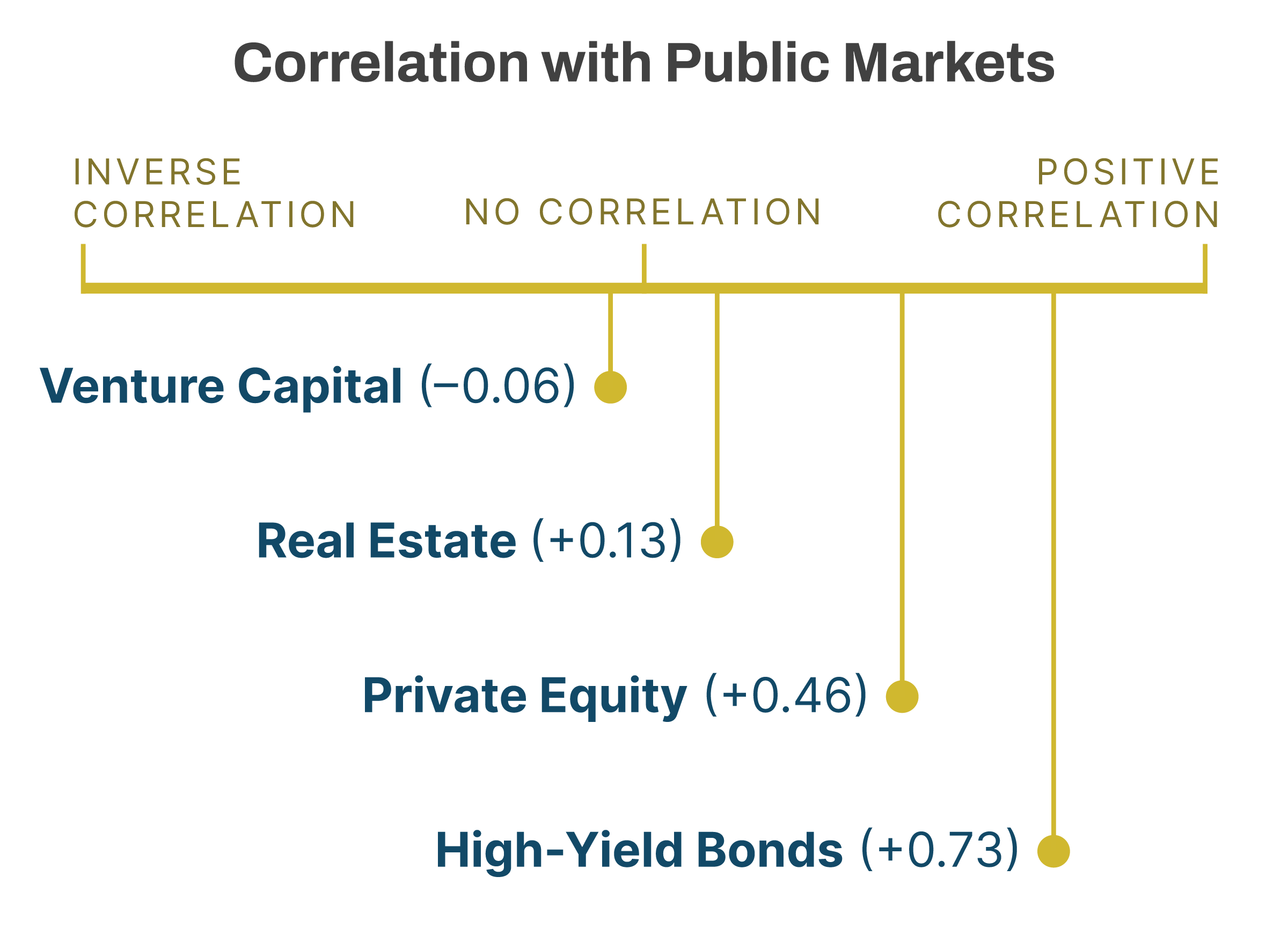

Venture returns have been shown to be largely uncorrelated to public market returns and have outperformed public market equivalents in the 5-, 15-, and 25-year periods, as of July 14, 2022.* We believe that steady, consistent investing over time in diverse assets — including venture capital — can help protect against portfolio volatility and mitigate the negative impact of macro-events in the public market.**

For example, the Yale University Endowment has a very diversified portfolio across over nine different asset classes, with a 28% allocation to venture capital. In FY 2022, amid significant market turbulence, Yale was the only Ivy League school to report a positive return on its endowment.***

VC and Public Markets Are Uncorrelated

SOURCE: Invesco, The Case for Venture Capital, Invesco White Paper Series, accessed January 11, 2022

VC 101: Why VC for Diversification

AV’s VC 101 video series provides insights on venture capital essentials. In this episode, our team explores how venture capital can provide valuable diversification to an investment portfolio.**

See video policy below.

3. Long-term Horizon

Venture investments are long-term and require patient capital. Companies mature for up to 10 years or more, meaning you enter and exit during different markets. Therefore, we don’t believe in market timing or emotion-driven investing. We think a smarter approach is steady, consistent investing in diverse assets — including venture — over time.

Avoid the Pitfalls of Market Timing

These five tips can help you refocus your finances in 2023, from the benefits of diversification to avoiding the pitfalls of market timing.

See video policy below.

Whether you’re new to investing or have been managing your own portfolio for years, it’s worth learning more about how VC can help you reach your unique objectives. Explore more at the links below.

View Fund Performance

Login to our secure data room.

Schedule a Call to Speak with Us

Ask questions important to you.

*PitchBook, PitchBook Benchmarks (as of Q4 2021), July 14, 2022; NOTE: This report contains historical performance and is not a predictor of future performance. Past performance may not be indicative of future results. Venture capital is a risky asset class where many investments lose money.

**Diversification is a strategy used to help mitigate risk but cannot ensure a profit or protect against loss in a declining market. Different types of investments involve varying degrees of risk, and this fund involves substantial risk of loss, including loss of all capital invested. Past performance does not guarantee future results.

***The manager of the AV Funds is Alumni Ventures (AV), a venture capital firm. AV and the funds are not affiliated with or endorsed by any college or university. These investments are for illustration purposes only. These investments are not intended to suggest any level of investment returns; not necessarily indicative of investments invested by any one fund or investor. Many returns in investments result in the loss of capital invested. These investments are not available to future fund investors except potentially in certain follow-on investment options. No university endowment is invested in any fund organized by AV.

Contact [email protected] for additional information. To see additional risk factors and investment considerations, visit av-funds.com/disclosures.