What’s Involved in Performing Diligence?

We explore the due diligence process: how it’s performed, the benefits, and what venture firms look for when choosing an investment.

Venture firms invested approximately $330 billion across 15,500 deals in 2021. With so many private companies raising capital, how do VCs sift out red flags and potential winners?

Due diligence is a critical part of venture investing, as it helps VCs decipher the quality and potential of different opportunities. VC firms of all sizes perform due diligence on a company before adding it to their portfolio.

In this Venture 101 piece, we will explore the due diligence process: how it is performed, the benefits, and what VCs look for in choosing an investment, followed by a quick summary of Alumni Ventures’ own diligence process.

What Is Due Diligence?

The due diligence process involves deeply investigating a company’s fundamentals to help unveil the most promising opportunities — often done with the help of a scorecard that touches on different aspects of each company. While diligence techniques may differ between VCs, most reports focus on these key areas:

- Market Value

- Product Potential

- Management Team

- Business Model & Investment Opportunity

Evaluating Market Value

Evaluating the market value — also commonly referred to as TAM (Total Addressable Market) — helps determine potential demand for the company’s product or service and frames the company’s opportunity for growth. While targeting a large, growing TAM is typically a good start, there are also other areas to be addressed, such as:

- Competitors in the space: A large market isn’t always beneficial if it is already populated with well-established, thriving companies. For example, the online retail market is heavily saturated with top businesses like Amazon, Walmart, etc., making it difficult to compete in that sector.

- Market need: A critical question VCs ask when performing diligence on market value is whether the product/service is breaking into a new or old market. If new, is there an unmet customer need? Is the technology easily digestible? If old, what sets the company apart from current competitors (see above)? Evaluating the need is crucial to depicting whether there is space in the market for the business.

- Early traction and ability for evolution: Depending on a company’s stage, it’s helpful to see signs of early success in customer demand and revenue, as well as plans to evolve into different markets and income streams.

Since the market size and sales relate directly to a VC’s Return on Investment (ROI), addressing these points is vital in determining company potential.

Determining Product Potential

Another critical part of the due diligence process is understanding just how revolutionary a company’s product or service may be. VCs often decipher product potential by determining if it is easy to understand, solves a real problem, and is a new innovation or offers an original take on an existing product.4 Even if the market and team are stellar, odds of success are very low without a product or service that checks some of those boxes.

An excellent example of this would be the e-commerce company Alibaba. In 2000, Japanese telecom giant SoftBank invested $20 million for 34% of the company. Alibaba was in a pre-revenue and pre-business model stage when SoftBank’s founder Masayoshi Son chose to invest strictly based on the product idea.

Alibaba founder and CEO Jack Ma spoke of his partnership with Son some years later, “We didn’t talk about revenue, we didn’t even talk about a business model. We just talked about a shared vision.”

Son recognized not only the market potential of Alibaba (the Internet was beginning to take off during this time), but also the power of and demand for the product. In 2014, Alibaba sold $22 billion of stock — still the largest IPO on record.

The Conviction of the Management Team

The quality of a company’s executive team plays a significant role in their success or failure. The main areas VCs consider when analyzing the credibility of a company’s team include:

- Track record: Building a venture-backed business has its unique challenges, so a CEO with previous exits and entrepreneurial successes is a critical value-add.

- Credentials and experience: Many VCs look for teams that have strong credentials, such as a degree or multiple degrees from a wellknown college or university, as well as relevant industry experience. Specifically, experience in similar roles at startups and venture-backed companies is highly beneficial.

- Founder/market fit: In addition to credentials and experience, company founders must be a good match for the specific problem they’re tackling. For example, if the company is looking to sell a SaaS product into enterprises, it would make sense to look for a team experienced in developing and monetizing SaaS products and with a network of potential enterprise customers.

A strong team in the eyes of a VC has an entrepreneurial track record, complementary skill set, and relevant expertise and experience.

Analyzing the Business Model & Opportunity

Finding a great company is one level of difficulty; finding a great investment opportunity is a still higher challenge. Even well-established VCs invest in companies that fail, so it is important to identify possible holes in its business model before buying in. This typically involves digging into not only the company’s momentum, model, and runway, but the dynamics of the current round such as valuation, terms, co-investors, and cap table. Questions that VCs consider during this part of the diligence process include:

- What level of traction has the company achieved with its target customers? Established revenue and existing customers will decrease the risk of the investment.

- What is the capital going to be used for? Determining runway is important in knowing how long it will take a company to achieve its goals before raising its next round.

- Is the price right? Evaluating terms and valuation vs. market is imperative to ensure a VC is not buying into a company at too high a price and that incentives between management and investors are aligned.

- Is the company’s business model attractive? VCs look for strong margins and a model that can be scaled relatively easily.

Alumni Ventures’ Due Diligence

Alumni Ventures evaluates companies on many of the same metrics. However, as a co-investor, we add an additional layer of diligence. We scrutinize the lead investor in every round we join and work to decipher what makes this firm and specific partner ideal for this stage of this company’s growth. Essentially we are interviewing the Board Member who will speak for our shares in the cap table. Additionally, we strongly leverage our network of ~600,000 individuals, seeking experts with relevant backgrounds to further analyze an investment’s potential.

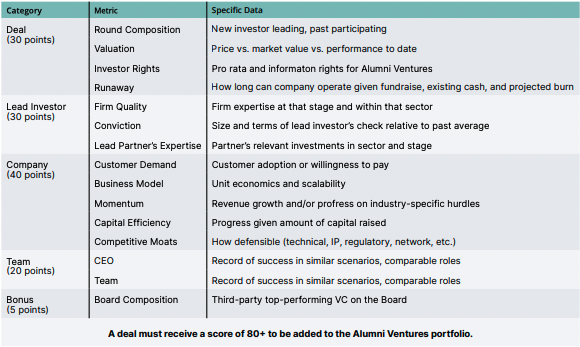

Our process is rigorous and disciplined. While we do refine our scorecard from time to time, these are the characteristics we evaluate and the relative weight we assign to each:

In addition, we use the wisdom of small crowds to validate our assessment. Professionals on our investing teams collaborate with immediate teammates, our Office of Investing, and multiple investment committees to confirm our assessments. This check-and-balance system means that every AV deal goes through the intellectual rigor of multiple experienced eyes scoring the deal. Yet because we are a co-investor, we move quickly and with minimum friction on the entrepreneur.

Final Thoughts

Venture is a Power Law asset, requiring a VC to take multiple swings at bats before hitting a home run with an investment. But practice and good form help too. This is why performing diligence on a company’s market value, product potential, management team, business model, and investment opportunity can significantly impact the success of a venture capitalist’s portfolio.

Our standards are high — Alumni Ventures reviews over 500 deals a month and only does detailed diligence on about 50. But given our large team of investing professionals, disciplined process, and vast network to source and vet deals, we have been able to to keep to those standards while delivering one of the largest venture portfolios in the world

Want to learn more?

View all our available funds and secure data rooms, or schedule an intro call.

New to AV?

Sign up and access exclusive venture content.

Contact [email protected] for additional information. To see additional risk factors and investment considerations, visit av-funds.com/disclosures.