5 Questions with Centivo

Centivo is a health plan anchored around leading providers of value-based care.

Centivo is one of the many innovative healthtech companies in Alumni Ventures’ portfolio and reflects our interest in and ability to connect with healthtech startups showing significant growth potential. Healthech has been a very active venture sector, with a 280% increase in global healthtech funding since 2016, reaching a record $39.7 billion across 1,186 deals in 2021.

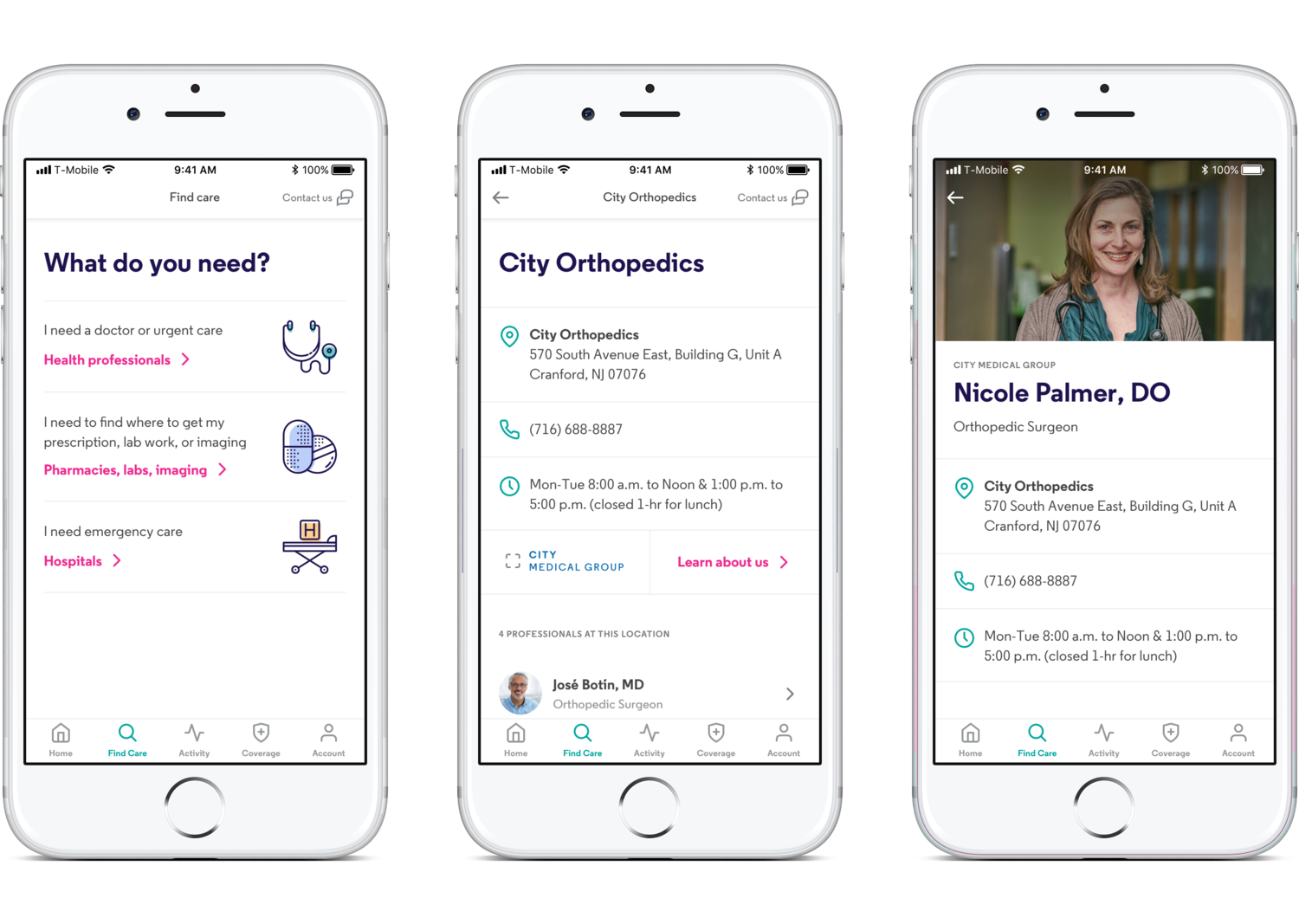

Centivo is a digital-first health insurance plan offering affordable coverage to businesses and their employees. Its mission is to bring affordable, high-quality healthcare to the millions of working Americans who struggle to pay their healthcare bills. Centivo saves self-funded employers 15% or more compared to traditional insurance carriers and is easy to use for employers and employees.

The company also differentiates itself from competitors with a platform driven by analytics and a focus on securing better rates from providers to help customers save money. This includes real-time referral management, partnerships with like-minded pharmacy benefits managers, radical client transparency with every fee and expense disclosed to the penny, and concentrating customer care options in specific geographies.

Alumni Ventures invested in Centivo’s $34 million Series B led by B Capital Group and a $51 million Series B1 co-led by B Capital and Maverick Ventures.1 We were impressed by Centivo’s proprietary technology stack, experienced team of entrepreneurs and operators, well-established investor syndicate, and massive market opportunity — with 155 million Americans covered by employer-sponsored insurance.

See below for an interview with Founder and CEO Ashok Subramanian to learn how Centivo is addressing the significant issue and opportunity of healthcare affordability.

Ashok Subramanian

Founder & CEO of CentivoAshok founded Centivo in 2017 after observing the inefficiency in the healthcare system and the pain that has resulted for employers and employees. Prior to Centivo, Ashok co-founded Liazon, the nation’s industry-leading private benefits exchange for active employees. Liazon was acquired by Willis Towers Watson in 2013, and after the acquisition, Ashok served as Managing Director for the Willis Towers Watson Group Exchange business. Earlier, Ashok was at McKinsey and Co., where he served as a leader in the firm’s healthcare and private equity practices. In addition to his role at Centivo, Ashok serves as a Senior Advisor to Silversmith Capital, a growth equity firm. Ashok received his undergraduate degree from Princeton University, a Master’s degree from Stanford University, and an MBA from the Stanford Graduate School of Business.

What problem or opportunity is Centivo addressing?

Centivo is a new kind of health plan anchored around leading providers of value-based care. We serve self-funded employers, typically companies with 50 or more employees all the way up to Fortune 50 companies. We focus on the portion of the workforce that can no longer afford their healthcare, even if they have typical commercial insurance. Under our plan, the average member pays about $20 to $25 per month, which is the equivalent of what Americans paid back in 1985.

What inspired you to launch Centivo?

Entrepreneurship didn’t necessarily come naturally to me. I wasn’t the person who had a lemonade stand as a kid. My inspiration came from the opportunity to address a problem that larger organizations aren’t doing effectively. I’ve been working in and around healthcare for 20 years, first as a consultant and then as a startup founder of Liazon and now Centivo. I think it’s clear that healthcare affordability is a top three issue in this country, and we’re not getting solutions from the traditional players — the large insurance carriers and pharmaceutical benefit managers. It just felt like one of those classic opportunities where there’s a huge market, a huge problem, and the ability to do well and do good at the same time.

What unique challenges and opportunities have you experienced in the healthtech space?

It’s been really exciting to go from an idea on a cocktail napkin to serving 50 clients of all sizes and tens of thousands of employees and their family members. There’s an incredible level of trust that a person and a company put in our solution. They’re basically saying, “We want you to help make sure that we have good, affordable healthcare in a time of need.” There’s a real satisfaction that comes from being the stewards of a family’s health.

That very opportunity is also a challenge. There’s a lot of work that we have to do to build confidence with our clients and make sure that they have a really good experience. The easier approach is to keep doing what everyone is doing and blame the world for healthcare costs going up. There’s an assumption in this industry that “it is what it is,” and we can’t do better. And yet, the five largest health insurers in 1980 no longer exist. New companies took their place because they delivered better business models, better service, better experience, and better costs. We’re really proud to work with a number of progressive companies who share our view that there has to be a better way.

Why did you decide to partner with Alumni Ventures? What makes us stand out?

I’m proud to be both an investor and a recipient of funds from Alumni Ventures. I think there are a few different ways to think about financing a company and creating a diverse bench, in terms of the management team, board, and investor syndicate. Alumni Ventures provides a really unique value proposition, which is not only the opportunity for capital, but the ability to connect with a broader network. There’s just an element of extra help and support and doing whatever it takes to help move companies forward.

When I first connected with Tom Meyer of Nassau Street Ventures [for the Princeton community], we weren’t raising capital. Tom really focused on sharing more about the fund and Alumni Ventures, which I think is exactly the right approach. A lot of venture firms don’t do a great job of cultivating relationships and just try to jam you into a process. Tom and the team did a really good job of understanding the psyche of the entrepreneur and building that relationship ahead of time. When our next round came together and we had room, it was a natural phone call to get back in touch.

What is next on the horizon for your organization, and how can our community support you?

If anyone in the community is a business owner or works in finance or human resources at a larger company, we’d be happy to work with you and your workforce to help provide affordable healthcare. Some of our clients have as few as 50 employees, and others have over 100,00 employees.

Second, we’d love to partner with healthcare providers and anyone who works in a healthcare ecosystem, especially if you’re in the digital health space. We’re always interested in talking about ways to partner together to continue advancing the ball on affordability.

Want to learn more?

View all our available funds and secure data rooms, or schedule an intro call.

New to AV?

Sign up and access exclusive venture content.

Contact [email protected] for additional information. To see additional risk factors and investment considerations, visit av-funds.com/disclosures.

1Past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and this fund involves substantial risk of loss, including loss of all capital invested. To see the performance of each exited investment for all Alumni Ventures funds over the last twelve months and our historical performance since 2014, click here.