Backing Bluesky: Building a World Without Caesars

Mundus sine caesaribus — Latin for “a world without emperors” — was boldly printed on Jay Graber’s shirt as she took the stage at South by Southwest this March. It wasn’t just Latin flair, but a pointed parody of Mark Zuckerberg’s infamous motto, “aut Zuck aut nihil” (“either Zuck [Caesar] or nothing”). One shirt imagines a world without emperors. The other suggests total domination.

Was it a subtle jab at Zuck on the part of Graber, the CEO of Bluesky and a longtime advocate for decentralized social media? Maybe — but what’s not subtle is the idea that Elon Musk’s X and Zuckerberg’s Threads were bleeding users, and the battle lines had become unmistakable. Bluesky — the decentralized social media platform Graber is building — has become a magnet for the “Twitter quitters” who have abandoned mainstream platforms over frustrations with utility, politics, or principle. Could this be a David vs. Goliath story in the making? Time will tell. But for now, the winds are shifting, and they’re blowing toward Bluesky.

The company first came to my attention in August 2024. During a regular catch-up call with a friend from another VC firm, she mentioned that she was excited about Bluesky: “This is a really cool new social media company that competes with X; it’s had some crazy growth recently — and it’s led by two women. You should take a look!”

A competitor to X and Threads? I was skeptical. Anyone taking a swing at the big incumbents gets applause from me, but also my raised eyebrow. I decided to look into the tech, and here’s what I found.

A Calmer, Customized Social Web

Internet protocols are like the wiring behind a city’s power grid — essential, invisible, and connecting everything. When you send an email, you’re using a system called SMTP (Simple Mail Transfer Protocol) that enables you to send an email from your Gmail to someone using Outlook. Just as a power grid delivers electricity to any home, no matter the appliance brand plugged in, protocols like SMTP deliver data seamlessly across platforms — ensuring everything works, even between different systems.

Bluesky is trying to bring that same openness to social media with its own system: the Authenticated Transfer Protocol (AT Protocol). That’s a fundamental shift from how today’s major social platforms operate. Incumbents like Facebook, TikTok, and Instagram operate like gated communities where you can’t follow someone on TikTok from your Facebook account, and where everything you’ve posted on Instagram stays with Meta if you leave. These platforms are designed to be closed, locking users in.

The AT Protocol flips that model on its head. It’s built for openness and interoperability, making it hard for any one company to monopolize the network. It’s a throwback to the early ideals of the internet — where anyone could build, connect, and share freely.

Bluesky is the proof of concept for that decentralized, open future. It gives users more control over both content moderation and feed customization. Unlike mainstream platforms, Bluesky allows users to tailor their experience by deciding what content they see and how it’s moderated, intended to create a more positive, personalized environment. Many Bluesky users say they appreciate its calmer, more civil atmosphere, comparing it to the early days of X — before widespread negativity took over.

I was intrigued. For someone in my role as a Partner on both the Blockchain Fund and the Women’s Fund at Alumni Ventures, this deal checked every box: decentralized tech and women-led startups. I slacked my Managing Partner, Ray Wu: “Let’s talk to them!”

A week or so later, the intro from my VC friend came through, and we huddled over Zoom with the Bluesky team. Both Jay Graber, Bluesky’s CEO, and Rose Wang, its COO, joined the call.

Jay, a former software engineer in the blockchain space (Zcash), was handpicked in 2021 by Twitter co-founder Jack Dorsey — who originally launched Bluesky — to head the initiative. She’s proven her ability to lead and execute effectively, with Bluesky gaining traction as a serious new contender in the social media space. Rose, a seasoned founder and operator, is known for scaling community-driven products. A Harvard grad and Forbes 30 Under 30 honoree, she previously co-founded Chirps and led customer experience at Forethought AI. Together, this dynamic duo walked us through what they’re building — and the impressive momentum behind it.

One of the most critical questions we VCs ask when evaluating an early-stage startup is this: How quickly is the company expanding? And what is the underlying why — is this growth a result of relentless marketing pushes, or is it being organically pulled by customer demand?

Product–market fit (PMF) indicates the pivotal moment when a startup transitions from trying to convince people to use its product to struggling to keep up with demand. It’s the difference between pushing a boulder uphill and having it start rolling on its own. When PMF clicks into place, we see a fundamental shift: customer acquisition becomes easier, retention improves, and users start evangelizing the product. It’s a sign the startup has moved beyond a hypothesis into validation.

Typically, this shift is reflected in the data — spikes in adoption, surging user engagement, low churn, increased referral activity, and even signs of virality. These metrics are the electric surges that suggest the grid is not only working, but also being tapped at scale. Just as protocols silently power the internet and the grid powers our homes, PMF powers sustainable startup growth — often invisibly, but undeniably.

Strong signals that Bluesky was onto something hit me when Jay walked us through this slide of the deck during our Zoom chat. Both Ray and I burst out: “Wow!”

From Zero to 35 Million: Bluesky’s Breakout Year

While Bluesky may still be the new kid on the block, it’s already hitting all the right quantitative signals. Since launching as an invite-only platform in early 2023, it has grown from just 30,000 users in April 2023 to over 10 million by September 2024 — around the time of our initial conversation with the team. Then came the breakout moment: in the weeks following the U.S. election, user numbers soared past 24.7 million accounts by early December 2024. As of this writing, Bluesky has surpassed 35 million accounts.

During our September conversation, the numbers were already hinting at virality as monthly active users (MAU) crossed the 10 million mark, and daily active users (DAU) topped ~5M — a remarkable 10x surge in active engagement within a short window.

Rose highlighted a key inflection point in Bluesky’s user growth: when Brazil’s high court temporarily banned X, over 2 million new users flooded into Bluesky in a single month. The momentum was further amplified when President Lula publicly named Bluesky as his top social app, catapulting it into the national spotlight.

In turn, I shared with Jay and Rose what sets AV apart. We bring not just capital but a powerful network that can drive tangible outcomes. Our community includes over 800,000 highly engaged members — a good portion from top-tier universities and Ivy League institutions — alongside 10,000+ accredited investors and a portfolio of more than 1,500 companies.

This ecosystem isn’t just a vanity metric. It’s a living, active network that consistently delivers value across customer adoption, talent acquisition, strategic partnerships, and growth acceleration.

I closed with: “We see our community as a growth engine that can help accelerate Bluesky’s trajectory. And our CEO Services team is here to help you plug into exactly the right node — whether that’s early users, potential hires, or distribution partners.” Jay and Rose nodded in agreement.

After our first meeting with Bluesky, we dug in deeper. We looked at the opportunity size. We found that the total addressable market (TAM) for global social media is projected to reach over $1 trillion by 2025 and $3.3 trillion by 2029. Huge stakes.

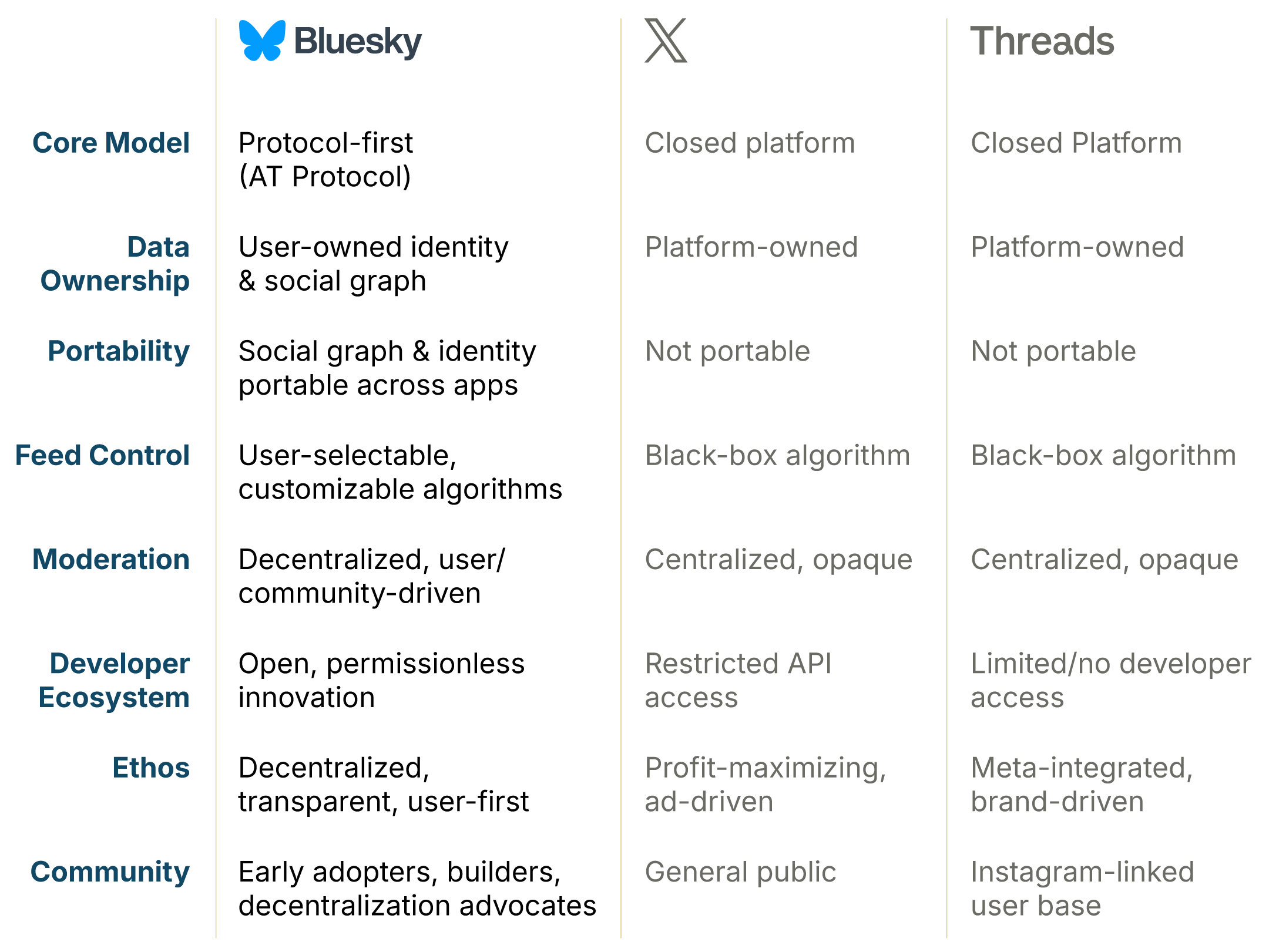

We also compared Bluesky to competitors.

While incumbents like X and Threads still dominate, they represent the old guard of the centralized web — where control over content, algorithms, and user data lies firmly in the hands of a single company. In that model, users are essentially renters, not owners, of their digital identities and networks.

In contrast, Bluesky is pioneering a fundamentally different path. With its decentralized architecture and open protocol, Bluesky isn’t just building another social network. It’s laying a new foundation for social interaction online where users have more control, developers aren’t beholden to gatekeepers, and data sovereignty is a feature, not a bug.

For instance, instead of being fed content by a black box algorithm optimized for platform engagement, Bluesky users can select from a marketplace of moderation tools and feeds — opting in or out of specific content streams. Want to filter out political noise and prioritize cat memes? That’s not only possible, it’s built into the model.

Because the platform is open and decentralized, anyone can build on top of the AT Protocol — apps, tools, moderation layers, new feeds, and more. This fosters a permissionless innovation environment, reminiscent of the early open web that many still pine for. Centralized platforms, by contrast, tend to be extractive: they limit API access via restrictions or behind a paywall, cutting out community-driven innovation.

Bluesky is laying a new foundation for social interaction online where users have more control, developers aren’t beholden to gatekeepers, and data sovereignty is a feature, not a bug.

Bluesky also introduces a major shift in ownership. With decentralized Identifiers (DIDs), users can actually own their online identity — and take their social graphs (followers, posts, relationships) with them across any client built on the AT Protocol. Leave the Bluesky app, keep your community. On X or Threads, leaving means starting over.

When we analyzed the differentiations, it was clear. Bluesky is building a competitive moat that sets it apart — another key consideration in deal evaluation.

So far in the diligence process, so very good.

From Signal to Commitment

A few days following our Zoom call, Rose dropped by our Menlo Park office. We shared our premonition of Bluesky’s future as not just an alternative to X or Threads, but as decentralized foundation on which entirely new applications and ecosystems could be built.

Later, Ray slacked me: “I think we passed the vibe test.”

Others agreed with our take on the company. Kinjal Shah, General Partner at Blockchain Capital — the lead investor in Bluesky’s Series A — put it this way: “We see Bluesky building a social media ecosystem that empowers the people who use it.”

Blockchain Capital is one of the earliest and most respected venture firms in the Web3 space, with a track record of backing foundational companies in decentralized technology — including Coinbase, Kraken and OpenSea. Given their deep domain expertise, network, and history of helping build breakout Web3 platforms, they struck us a highly strategic lead investor.

At Alumni Ventures, our co-investor model is designed precisely for this type of opportunity. We invest alongside established lead VCs and a strong cohort of co-investors. This plugs us into high-quality deal flow. As a core part of our due diligence process, we always make it a priority to connect directly with the lead investor. Hearing their perspective helps us triangulate conviction, gain insights from their underwriting process, and round out our own view of the opportunity.

Following our conversation with Kinjal, we completed our process and closed our investment into Bluesky’s Series A round in October 2024.

A Shift in the Wind

As we approached the November U.S. election, public sentiment around traditional social media platforms began to shift dramatically. Headlines painted a picture of growing user dissatisfaction toward platforms like X and Threads, driven by concerns such as algorithmic manipulation, content moderation bias, concern for data privacy, and the centralization of control.

At X, Elon Musk’s increasingly polarizing decisions — including erratic content policy changes, high-profile account reinstatements, and a perceived erosion of platform neutrality — sparked widespread frustration. While positioned as a calmer alternative, Threads was also being criticized for its opaque algorithms and deep integration into Meta’s centralized data stack.

Following the election, these tensions culminated in a mass exodus of users from both platforms, with people searching for a more transparent, user-centric alternative. And they found it on Bluesky.

Today, the current user number is 35.4M and continues to grow (you can see the live tracking here).

When I asked Jay if she has a call to action to the AV community, she responded:

We are excited to have the support of the Alumni Ventures community. We worked with Sophia from the AV team to create a starter pack* to help you onboard to Bluesky and find each other immediately. Your support is bringing us one step closer to an open social web that distributes control and power from centralized platforms to users and their communities.”

She’s right. We’re at a real inflection point where the old, closed systems are starting to crack open and something more transparent and human is taking root. Users are moving toward a future defined by choice, ownership, and community governance.

It’s not just a platform shift. It’s a cultural one.

And if we get it right, we won’t just be building a new network. We’ll be building a world without Caesars.

Learn More About the Women’s Fund

Invest in women entrepreneurial leaders bringing their talents and perspective to promising markets — from femtech to software, pharma, biotech, CPGs, and more.

Max Accredited Investor Limit: 249

This communication is from Alumni Ventures, a for-profit venture capital company that is not affiliated with or endorsed by any school. It is not personalized advice, and AV only provides advice to its client funds. This communication is neither an offer to sell, nor a solicitation of an offer to purchase, any security. Such offers are made only pursuant to the formal offering documents for the fund(s) concerned, and describe significant risks and other material information that should be carefully considered before investing. For additional information, please see here. Achievement of investment objectives, including any amount of investment return, cannot be guaranteed. Co-investors are shown for illustrative purposes only, do not reflect all organizations with which AV co-invests, and do not necessarily indicate future co-investors. Example portfolio companies shown are not available to future investors, except potentially in the case of follow-on investments. Venture capital investing involves substantial risk, including risk of loss of all capital invested. This communication includes forward-looking statements, generally consisting of any statement pertaining to any issue other than historical fact, including without limitation predictions, financial projections, the anticipated results of the execution of any plan or strategy, the expectation or belief of the speaker, or other events or circumstances to exist in the future. Forward-looking statements are not representations of actual fact, depend on certain assumptions that may not be realized, and are not guaranteed to occur. Any forward-looking statements included in this communication speak only as of the date of the communication. AV and its affiliates disclaim any obligation to update, amend, or alter such forward-looking statements, whether due to subsequent events, new information, or otherwise.

Frequently Asked Questions

FAQ

Speaker 1:

Hi everyone. I’m Sophia Jao, partner at Alumni Ventures, and I’m so excited to be here and share the story of how we backed BlueSky, a company that’s building a world without Caesars.Before we get started, I’d like to share that we’re speaking today about Alumni Ventures and our views of the associated investing landscape. This presentation is for informational purposes only and is not an offer to buy or sell securities, which are only made pursuant to the formal offering documents for the fund. And here are the rest of the legalese.

So please allow me to quickly introduce myself and share my journey into venture capital. My background is in finance and startups where I work with a ton of CXOs and entrepreneurs in the capacity of corporate banking, capital advisory, BD, and operations. These experiences have taken me around the world on cross-border opportunities, whether it’s fundraising from Silicon Valley and Asia, BD in South Africa, and institutional partnerships with LATAM and EU.

I am very humbled to have learned a lot from smart people and built my own pattern recognition over the years, mostly revolving around recognizing great leaders and what it takes to build a great company.

I joined Alumni Ventures Blockchain Fund in 2021. After spending a few years in the Web3 space, I worked at Galaxy Digital, Web3, US, and Crypto.com. As part of my job, I personally also enjoy being plugged into hackathons, accelerators, tech clubs such as Techstars, Yale’s Innovation Center, Ethereum Global, et cetera.

I’m educated in both Canada and the US and I graduated from Yale School of Management in 2017. Something fun about me is that I love nature and I love growing herbs and edible flowers for food decoration.

So for today’s agenda, we’ll start with the BlueSky opportunity, why this matters and what makes it so unique. Then I will share with you how we discovered BlueSky.

We’ll talk about the leaders, Jay and Rose. They are two incredible women with very different but complementary superpowers. And from there we’ll get into signals that told us this wasn’t just hype, but real product market fit. We’ll explore the massive market BlueSky is aiming for, how we approached the investment, and what we learned along the way. And finally, we’ll end with some reflection and an invitation to join the movement.

So now picture this. It’s March, 2025. A young CEO walks onto the stage at the South by Southwest. She’s wearing a black t-shirt with a bold Latin text, Manda Caelum, which means “a world without Caesars.” And it wasn’t just a fashion flair—it was a direct shot at Mark Zuckerberg. Because at Meta’s annual event in 2024, Zuckerberg had worn a custom shirt with a Latin phrase Aut Zuck aut nihil, meaning “all Zuck or all nothing.”

So Jay’s t-shirt represents an open world, one built on freedom and decentralization, while Zuckerberg’s t-shirt symbolizes a worldview of dominance and control. So these shirts are battle flags of two radically different social apps.

For years, users have felt boxed in by the one-size-fits-all approach of traditional social platforms where a single company decides what content gets shown, what gets removed, and how conversations are ranked. That lack of transparency and choice has led to growing frustration, mistrust, and ultimately user fatigue.

BlueSky flips that model by giving users a choice—not just over their content, but on how their experience is shaped. You can decide what kind of content you do or do not want to see, choose your own moderation services. You can host your own server, or you can use BlueSky’s server. And if one day you don’t want to use BlueSky anymore, you have the option to quit and take your social cluster with you.

So how are users able to do that? Well, BlueSky is built on something called the Authenticated Transfer Protocol, or AT Protocol. It’s a decentralized open-source framework for social apps like BlueSky and allows users to own their identity—like their handles and profiles. One, you can own your identity across apps. Two, you can move your data—meaning your posts, follows, et cetera—freely between platforms. And three, you can connect with users on different apps built within the same protocol.

So as you can imagine, this is a huge differentiator because all of the above give users more control over their data. It helps apps integrate and interoperate, and you avoid being locked into a single platform.

Fun fact: BlueSky was originally started by Jack Dorsey, who was the co-founder of Twitter. BlueSky was later spun out as an independent company and now it’s led by two exceptional women executives.

Jay Graber is BlueSky’s CEO. She’s uniquely qualified to lead this shift. She’s a software engineer with early research into decentralized social networks, and she was actually handpicked by Jack Dorsey to start building what would eventually become BlueSky. She decided to push BlueSky to spin out as an independent entity long before Twitter exchanged ownership. That was really bold and visionary. She was not following the trends—she was shaping them. And in a poetic twist, her Chinese name, Lian, literally means “BlueSky.”

Alongside her is COO Rose Wang. She’s a dynamic operator with roots in both entrepreneurship and user-centric design. Before BlueSky, she co-founded Chirps, a sustainable protein startup that landed on Shark Tank, and she was named to Forbes 30. Rose brings a mix of startup grit and strategic thinking, and she’s definitely instrumental in growing BlueSky’s community—especially as it scales internationally.

So together, Jay and Rose are not just building a company, they are shaping the next chapter of the internet and leading a cultural shift.

So how did BlueSky land on our radar? It wasn’t some glossy pitch deck that was sent out in a big fundraising blast. It was actually through a catch-up call with a VC friend who was also an investor of BlueSky.

Upon learning that I’m backing decentralized tech and rooting for women leaders for both our blockchain fund and women’s fund, my friend shared: “Hey, have you seen this new social app that’s taking off? It’s woman-led. It’s growing like crazy. It might be worth a look.”

Well, I have to admit that initially I was quite skeptical—because to me, anyone taking a big swing at the social media giants gets both applause and a raised eyebrow.

Then we met Jay and Rose over Zoom and learned more about the vision, the tech, and the traction. BlueSky has a clear technical foundation—the AT Protocol—and a vision that resonated, which is user ownership, user control, and user choice. The BlueSky team was shipping really fast, iterating really fast, and gaining traction organically.

Which brings me to the next slide. As VCs, we’re always hunting for that pivotal moment when a startup stops pushing and starts getting pulled by demand. It’s the difference between rolling a rock uphill and watching it roll downhill on its own.

Product-market fit isn’t just about growth—it’s about the right type of growth. Because we want to know: is this happening because of relentless marketing spend, or are customers organically demanding more?

On the right-hand side of this slide is a graphic from BlueSky’s Series A deck.

When Jay walked us through it, we went—wow. In April 2023, BlueSky had about 30,000 users. And at the time of our initial conversation, it had about 10 million users.

One of the key inflection points included when a Brazilian court banned X, and President Lula publicly endorsed BlueSky as his go-to app. BlueSky then saw a surge of 2 million new users in a month.

This has a few important implications. First, it showed that demand for open, decentralized social media isn’t limited to the U.S. Second, it proved that BlueSky can scale quickly and organically when there is a compelling moment. The Brazil spike wasn’t from a marketing push—it was grassroots. It was a user-driven migration.

And lastly, this moment underscores BlueSky’s potential to become a true global network, especially in countries where users are seeking not just better features, but a fundamentally different mode of ownership and governance online.

Not to mention, at that 10 million user mark, the daily active user count reached about 5 million, which is a clear indication of strong stickiness. Later, by December 2024—after the U.S. election—the total numbers shot up to 25 million. And as of today, they have over 36 million users and growing.

Again, this growth is not driven by ads or paid campaigns. It was all organic, viral, and fueled by real user demand.

Product-market fit in action—when you stop pushing and start pulling—is definitely here. The product is resonating and the culture shift is happening.

So at this point in the conversation, we were definitely very interested in partnering with BlueSky and emphasized our value-add to Jay and Rose.

At Alumni Ventures, we’re bringing a powerful network of over 800,000 community members, over 10,000 accredited investors, and a portfolio of 1,500+ companies. We position ourselves as a growth engine, connecting startups with early users, talent, partners, and distribution channels.

Our CEO Services team plugs startups into exactly the right node of the network to help accelerate their trajectory. That is the value we bring to the table—and it definitely resonated with the BlueSky team.

So after the meeting, we continued our diligence and looked at the big picture and the competitors. For BlueSky, we see it as a blue-sky opportunity—because the global social media TAM is projected to hit $3.3 trillion by 2029. So, huge.

And I’m sure many of our audience use at least one of the centralized social apps like Facebook, TikTok, and Instagram.

These centralized social apps are like gated communities. You can’t follow someone on TikTok from your Facebook account. And if you leave Instagram, you lose your followers or the posts you saved, and you have to start all over again somewhere else.

So players like X and Threads represent this old guard of centralized control, while BlueSky is pioneering something fundamentally different.

In the traditional model, users are essentially renters of their digital identities—where the platform owns everything: your data, your followers, your content.

And for BlueSky, it flipped this completely.

Users own their identity. You can port your social graph across different apps—apps built on the AT Protocol—and if you want to leave the platform, you can take your community with you. It’s the difference between renting an apartment and owning your home. On X and Threads, the platform decides what you see through a black box algorithm designed for profit, not for your interest. And on BlueSky, you choose from a marketplace of feeds and moderation tools.

So overall, it’s not just a platform shift. BlueSky is proposing a new foundation for how we are interacting online. So for us as an investment team, we realized we’re not really just investing in a company—we’re investing in a future of digital freedom.

So after that first Zoom call, we wanted to go deeper. Rose came to our Menlo Park office on a beautiful sunny afternoon. We had coffee and we talked about our shared BlueSky vision and we knew we were aligned. Then we aligned with Blockchain Capital, the Series A lead, and it has a stellar track record in Web3. We spoke with GP King Gel Shaw, and that provided additional confidence.

Co-investing alongside respected lead investors like Blockchain Capital is a key part of our investment strategy. We regularly engage with other investors to share deal flow, compare notes, exchange insights. And when a round is led by a top-tier firm with deep domain expertise, we see it as a valuable opportunity to leverage their diligence, perspective, and conviction as a complement to our own.

We closed the investment in October 2024, and within just a couple of months, BlueSky’s user base exploded from 10 million to over 36 million. And that trajectory doesn’t happen by accident—it happens when the timing of a product and team all click into place.

So what did we learn from this journey? Well, first of all, open protocols like AT Protocol have the power to transform how we communicate online. Secondly, we are living through a cultural shift away from walled gardens and algorithmic manipulations. We’re sailing toward a world of choice, ownership, community governance.

Third, founder quality matters. Jay and Rose are the real deal—and so does market timing. The dissatisfaction with X and Threads was reaching a boiling point and BlueSky was ready to come in.

And finally, our network model works. It was our community, our relationships, our due diligence process that brought us this opportunity and helped us bring it home with confidence.

Here’s my invitation to the audience: We would love for you to join us on BlueSky. We’ve created an Alumni Ventures Starter Pack to help you onboard, connect, and be a part of this next-generation social layer.

So please take out your phone and scan the QR code and join us on BlueSky. Let’s build this world together—a world without Caesars.

And now before we wrap up, I do want to share with everyone how we work with our large, diverse group of investors. Let’s talk briefly about who our fund is built for. I won’t go into all the specifics, but at Alumni Ventures, we partner with a wide range of accredited investors, and we design our fund to meet the people where they are.

For example, you might be a successful professional or executive who wants exposure to high-growth private companies but just doesn’t have time to vet every deal. That’s what we do for you. We build the portfolio, we manage the process, we get you the opportunity—backed by some of the best lead investors in the market.

Or you might be an operator or founder. You’re someone who understands venture but wants to diversify across sectors and let a trusted team drive the deal flow. You build companies—now you’re ready to back the next wave without having to lead the charge.

We’re also seeing many young investors as part of our community—professionals in their thirties or forties who are just starting to build their exposure to alternatives. And venture is a long-term game, and this is a great way to start planting the seeds in the next generation of market leaders.

And of course, we work with enthusiasts who simply want to see the very best deals to include in their broader investment portfolio strategy.

So whether you’re investing personally, through a trust or retirement dollars, or through an offshore vehicle, we built this to be frictionless and accessible. Our goal is to make sure that we make world-class venture investing available to anyone who’s ready to back bold founders and solve real-world problems.

So beyond our tremendous growth, we are extremely proud of our achievements to date—from being a world leader in access to venture capital for individuals to being recognized as a Top 20 VC by CB Insights—we’re beyond proud. Please follow us on LinkedIn and engage with our material on our website to learn more about our ever-growing accomplishments.

We also want to back companies alongside people who have very strong track records and are well regarded in the ecosystem because it adds an additional layer of validation and gives us even more confidence in our investment. Similar to what I shared earlier about BlueSky, we were very, very happy to be investing with Blockchain Capital, which is a tier-one Web3 VC.

Ultimately, it’s about collaboration. When thoughtful investors come together around a great founder, we’re increasing our chance of helping that particular company succeed.

So on this slide you can see a couple of names that we regularly invest with, such as a16z, Sequoia, Bessemer, Kleiner Perkins, et cetera.

So if you’re ready for the next step, which is to learn more about the Blockchain Fund and the Women’s Fund, please go to our website or scan a QR code. Here we have a full-service team of amazing colleagues that will help you with our fund offering and how to get started.

Last but not least, we would love to be your venture partner. And thank you for joining us on this masterclass. We hope to bring you more insightful stories going forward. And thank you again for joining us today. And that’s it.