Five Trends Impacting the Evolving Deep Tech Ecosystem

From the use of tech to collaboration, funding, expertise, and more, we explore some trends in the deep tech ecosystem.

It’s not surprising that deep tech, at the forefront of innovation, is seeing innovation in its own ecosystem. Following are just a few of the changes the deep tech sector is undergoing.

1. Tech Enabling Innovation

While commercializing deep tech sometimes costs more capital over extended periods vs. other innovations, tech has also helped lower the hurdles. From 3D printing to open source software, powerful and cheaper computing power, to accessible scientific and tech research, the tools needed to build a deep tech business are now cheaper and more accessible.

2. Crossovers and Collaboration

More deep tech innovations are crossing into various sectors and employing a variety of deep tech solutions. For example, AI/machine learning is increasingly ubiquitous in deep tech development, no matter what the innovation. In fact, it’s estimated that over 95% of deep tech ventures use two or more technologies, and 66% use more than one advanced technology.

Further, some believe that collaboration will be the hallmark of the post-COVID era. As the Boston Consulting Group puts it, “Companies have embraced the ecosystem approach, recognizing that, especially in times of crisis, delivering a bigger pie through collaboration, rather than competing for the biggest slice of the pie, leads to better and faster results.”

Alumni Ventures’ Deep Tech Fund offers a portfolio of ~20-30 diverse companies tackling the toughest and potentially most lucrative tech challenges. Recent events have underscored the critical importance of science and rational thought for the well-being of society and the planet.

To learn more, click below to review fund materials or book a call with a Senior Partner.

3. Shifts in Funding

Funding comes from multiple sources, from universities to government, foundations incubators, corporations, and private investors such as VCs. But there are shifts in share of contributions. For example, funding from universities for spinoffs decreased by ~50% in 2019, while venture sources increased. Investment in deep tech increased 4X more than from 2016-2020, rising from $15 billion to $60 billion.

4. Technical Expertise for Founders & VCs Mixed

Increasingly, deep tech startups may not be founded by a scientist or tech specialist. A 2017 survey of 2,000+ startups in Europe (which examined both regular tech and deep tech companies) found that over 60% of the founders did not have a technical background.

Interestingly, there is a parallel trend among deep tech VCs. In one study, nearly 80% of the investing VC firms had no partners with a PhD, but instead leveraged experience as a technical operator. The outliers are those firms who commit most of their portfolio to deep tech, where advanced degrees are standard.

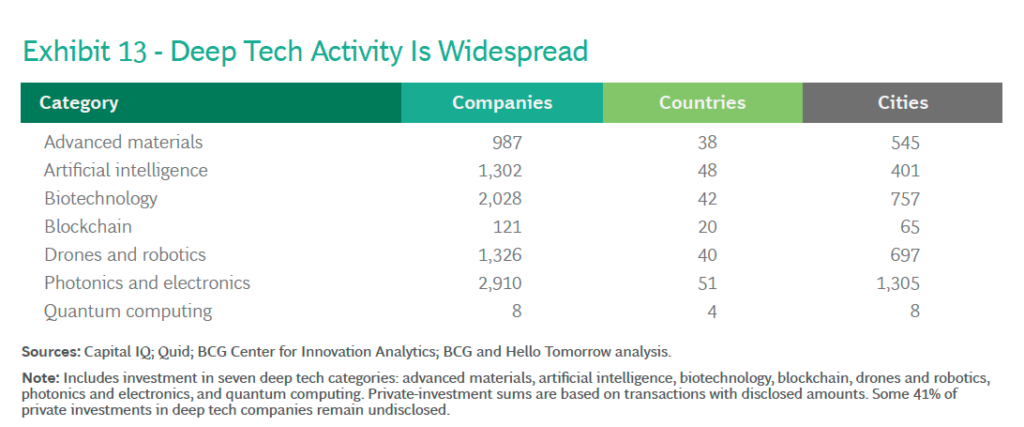

5. Worldwide Phenomenon

While the U.S. and China are still the leaders in deep tech, a number of countries and cities are innovating. We expect to see the spread, pace, and impact of deep tech innovations to continue to increase, especially as new tech applications and collaborative development spur growth.

Sources:

- https://differentfunds.com/deeptech-investing/

- https://media-publications.bcg.com/BCG-The-Dawn-of-the-Deep-Tech-Ecosystem-Mar-2019.pdf

- https://www.bcg.com/en-us/publications/2021/deep-tech-innovation

- https://www.slideshare.net/SOSv/deep-tech-trends-2019

- https://2017.stateofeuropeantech.com

- https://www.bcg.com/en-us/publications/2020/how-deep-tech-can-shape-post-covid-reality

On-Demand Webinar

Our Deep Tech Fund offers investors an easy way to own a variety of venture investments across deep tech sectors. To learn more about the fund, watch an on-demand recording from our recent fund overview webinar hosted by Alumni Ventures’ CEO Mike Collins and CIO Anton Simunovic.

Contact [email protected] for additional information. To see additional risk factors and investment considerations, visit av-funds.com/disclosures.