Webinar

An Introduction to Green D Ventures

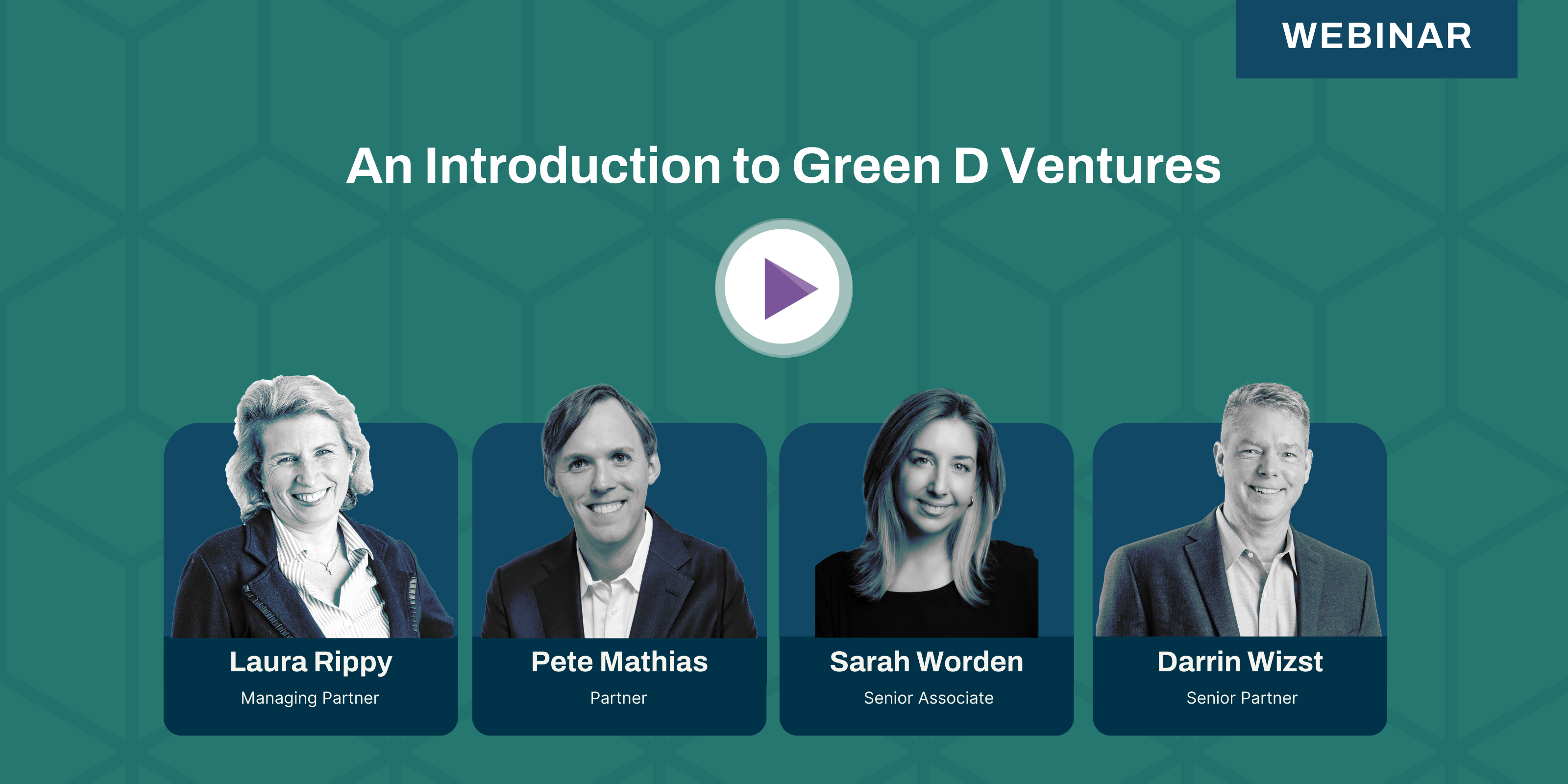

Watch this on-demand presentation about Green D Ventures, Alumni Ventures’ Dartmouth-focused fund. This is an excellent opportunity to meet the investment team responsible for building the portfolio and hear their approach to investing in private-stage companies.

During the session, we covered:

- HomeThe goal and structure of the fund

- HomeThe team and management behind the fund

- HomeGreen D Ventures and Alumni Ventures approach to investing

- HomeExamples of current portfolio companies

- HomeThe benefits of investing in venture capital

Note: You must be accredited to invest in venture capital. Important disclosure information can be found at av-funds.com/disclosures.

Frequently Asked Questions

FAQ

Hey, everybody, it looks like a few folks are joining us. This is fantastic. A team here is ready to go on this Green D Ventures adventure. I see a few folks from the fair. We got some Tequilas, Meera, and Itzaki. And I see—yep—some Geisel folks, and then of course the college. I’m in the class of ’89. Yep.

So as Dean, I’m so glad that all of you are here. I’m Laura Rippy. I’m in the class of ’89. I’m the managing partner for Green D Ventures, and we’re going to jump right in.

So first I need to go through a little bit of legalese real quick here. So this presentation is for informational purposes only and is not an offer to buy or sell securities. In addition to disclosures, we’ve also got disclosures in the lower right-hand corner of the next slide. There’s a URL: avgfunds.com/disclosures.

So with that out of the way, another housekeeping thing is—if you see in the bottom, there’s like a chat function, so you can put questions into that. I really appreciate it, and we can kind of jump in and make this interactive. So good.

All right. Well with that, welcome everyone, welcome. And I hope you join us in Green D Ventures Fund Eight. Wow. I got to say, as someone who’s been around here for a while, it’s kind of exciting to think that we are on Fund Eight. A lot of things are the same that we’ve done since the beginning, but we’re now at this point where we have kind of this platform, and it’s a little bit of a pinch-me moment.

You know, in terms of what’s the same—for those of you who have talked to me directly or have been curious about Green D—we still have the same strategy, right?

So, you know, every year we raise a fund from Dartmouth alums or friends of Dartmouth, and my team and I deploy that into about 25 companies that are diversified by stage, sector, and geography. And the way into all of those deals is through the Dartmouth community. So we’re always, always having conversations with folks that are founders and Dartmouth VCs. And then as we go into those deals, we’re always scrutinizing who is the lead investor and why does that make a difference. So that’s what we do every year. It’s no different—we’ve done that for Green D 1, 2, 3, 4, 5, 6, 7.

But what really kind of catches me and gets me excited about Fund Eight is the platform underneath, and why it makes it, in many ways, so much easier to get into those deals and really to have the confidence around all of the companies that we work with.

So, in terms of that platform, it starts with the community. Candidly, if any of you are on our mailing lists—I hope—that community now reaches out to one in four Dartmouth alums, which I’m really humbled by and appreciative of.

The community is also the Dartmouth founders and VCs—we love all of that and really appreciate it—but it’s also complemented by, concretely, the 112 portfolio companies that we have in Green D. And those are a source of deals and later-stage opportunities that we mine very aggressively. And you’ll hear a little bit about the team tell you some stories of how we do that.

And then the last piece is Alumni Ventures. So, for those of you who don’t know, this is very much a Dartmouth story—and I’m going to get to that in a moment—but the Alumni Ventures platform that we’re on, you know, we’re one fund out of 18 total school funds that started with Green D. And now Alumni Ventures is the single most active venture capital firm in the country, with close to $700 million in assets under management, and 600,000 people in our broadest community definition.

I mean, it’s a thing. We’ve got 125 employees—it’s real. And so that platform, with our portfolio companies and the community support, really makes Fund Eight exciting—super exciting—and also something that we really hope that you join and can see that success for yourself.

So with that, why don’t we talk a little bit about sort of why Green D?

Today we’re going to go through kind of that strategy. We’re going to meet the team. I’m going to walk you through some specific companies so you can kind of see what it looks like in real life, so to speak. And then also we’re going to go through the logistics of investing real quick—just the high levels. For those of you on the call and afterward, I hope you take a look at the deck that we have—we send that out. I think Catherine sent it out—and the frequently asked questions. You would have received that in email. That’s really kind of the in-depth piece.

I want to make sure this time now is pretty quick so that we can get to your direct questions.

So with that, let me just step back and frame sort of why Green D. When I talk to investors, the number one reason why people reach out and why people join us is the desire to diversify their portfolio—their individual portfolio—into venture, recognizing that venture capital has been a historically high-performing asset class and also, coincidentally, one that is notoriously difficult to access.

So that’s where Green D comes in. That’s where Alumni Ventures comes in. With one check, you join us—one upfront check. We then, as a team, deploy it into this portfolio of about 25 to 30 companies. As I said, diversified by stage, sector, and geography for that year. It’s almost like you get an imprint of what’s happening in venture for that particular year. And then we do it again the next year.

And for you as an investor, it’s really simple. The process to join us is simple. We kick off one K-1 every year. We send the checks back to you—that’s a good, simple part. So: one check in, many checks back. And really, that’s the simple proposition.

If you feel like, from your portfolio and all the things that you do as you diversify—into domestic versus international stocks and the such—this is a way to tap into a very, very fast-moving asset class that has historically had great returns, difficult to access, but one that really changes the economy and really builds the future. That’s part of the fun of investing with us.

I promised that I would tell a little bit about the foundation story of Green D, so I’ll do that now.

Green D was started in 2015 by Mike Collins, who is a class of ’86 at the college. And, you know, he wanted to invest in venture-backed startups—not angel rounds, but really when the institutional investors came in. And he was blocked. Because candidly, it’s not a place where individual investors join. It’s not a place where, historically, there has been a way in.

And so he figured: if we bundled together as a group—right, in this case around Green D—if we bundle around Dartmouth and create a fund, and then work the networks of Dartmouth folk to get into those great deals, that that could be a thing. And indeed it was.

That was for Green D 1 and 2. And then he cloned it for Harvard, Yale, and MIT. And that worked—even, you know, he wanted to check: is it just a Dartmouth thing? ’Cause we’re kind of a helpful, friendly folk. But that worked.

And now, fast forward to today—Alumni Ventures Group has 18 school funds. We’re the single most active venture capital firm in the country. So really great Dartmouth story—Dartmouth founder, Dartmouth CEO—and of that, Green D is the largest fund. We are the most engaged. We have the most portfolio companies. So we are really kind of that cornerstone of Alumni Ventures.

And particularly as an alumni group that has fewer alumni, perhaps, than some of the big, big dogs that are out there of larger schools—we definitely punch above our weight. So it makes me really proud as an alum, and proud of what we’ve done with Green D.

Which is a great segue to meet the team.

So you saw the faces—let’s go and kind of do some of those introductions next. Great. There’s Meera, we’ve got Dean and Catherine.

So on here, you’ll see us. You’ve got me on the left here. Then there’s Catherine, our investor relations manager. So if you choose to join us, she can help if you get stuck on anything and can help along the way. She’s a good person to have in your network for what we do at Green D.

And then on the investing side: Dean, Meera, and I choose the companies. We vet them. We diligence them. We maintain the relationships with those companies over the long term. So we kind of work for you on the investing side of the house.

Meera’s background—she comes to us from Tuck. She’s nestled into Silicon Valley and working all the Dartmouth lines out there with founders and VCs and other folks. So we’re really glad that Meera is on board.

Dean is in New York and is doing the same thing in the New York network, but also comes with that extra secret sauce of being an MD/MBA and having been in venture before. So he adds a good level of scrutiny when we go into healthcare deals that we appreciate.

And overall, we’re just having a lot of fun as a team and happy to talk to you at any time about the different companies and what we see.

So next up, I thought it would be fun to kind of unpack the deals that we do—some recent ones—so you can sort of see that we actually do what we say we’re going to do.

So with that, let me just kind of walk through these. First, I wanted to start with that intentional diversification and show you along the spectrum here.

So from a stage perspective, we intentionally build the portfolios about two-thirds Series A and one-third growth. That’s because Series A companies traditionally have the biggest bang when they succeed—man, you know, the fireworks go off—because you’ve come in essentially at a low cost basis, right?

But there’s also more failures there. So candidly, we’re very open—and I hope you understand this—that with venture, there will be failures. In a portfolio of 25 to 30 companies, maybe a half dozen will literally go to zero.

So you need to come in with your eyes open on that. Part of why we build a portfolio is so that you have that spectrum of companies, and that across the board you see the successes.

The third that is growth—a lot of times those are from our existing portfolio companies. That’s part of the advantage of being in Green D Fund Eight: we have those relationships already, and so we’re able to get into some of those high flyers because we’re already on the cap table.

The team’s going to kind of go through some specifics on that, but that’s why we do two-thirds Series A and seed, one-third growth.

For sector, this is a good representation of what we do—not complete, but basically it’s the sectors that venture cooperates in and invests in.

So think biotech, think robotics, think AI—artificial intelligence and machine learning. This is the nitty-gritty of venture. These are the future. These are companies that are changing the world, and those are the sectors where there’s the most innovation.

So we basically map to where the venture industry is investing, which is the world of innovation. That’s classically where we are.

Geographically, pretty easy—we’re where venture is investing. It’s about 45%–50% Silicon Valley, Boston, New York, Seattle, some international. We kind of map to where the industry is.

And then, of course, on the last section is sort of points of pride for us—our co-investors. So super clear for folks that know venture—we’re not a lead investor. We’re always a co-investor. So it really matters to us who is leading a given round, because that’s how we understand whether or not this is the right place for us to go.

We want to understand the knowledge base that that board member brings. Experience in that category helps us understand the valuation. It’s super important to our process.

So with that, let me pause and jump into some of these companies and tell you a little bit about them.

I want to start with Tundra, because it’s fun—it’s double Dartmouth founders, a couple of ’07s. This company does basically like a North American version of Alibaba.

The way we got in is we cultivated that relationship with the founders for quite a while. And when they got a term sheet—it was a preemptive Series A term sheet from Redpoint—they were getting ready to raise and this came in, and it was for nine of the ten million dollars they intended to raise.

So really confirmatory message from Annie Kadavy at Redpoint. She has tons of background in this space.

So we joined. This is a perfect kind of way for Green D to get in. And they’ve subsequently had another round—Emergence, also confirmatory, preemptive term sheet.

So Tundra is really off to the races, but it’s the kind of deal we wouldn’t be getting into if it weren’t for the Dartmouth connection. We’re very respectful of that and really appreciative of the team leading that.

Let me jump also to Strike Graph, just for a different story of how we get into deals. Because a lot of times people say, “Do you only invest in Dartmouth founders? Do you only invest in Dartmouth teams?”

And to be very transparent—about two-thirds of the deals that we do, you can see the Dartmouth breadcrumbs. But for a third, you can’t. And sometimes there isn’t any.

But I’ll tell you the story with Strike Graph, because here’s how it works.

So in the Strike Graph case, Matt McIlwain, who’s a class of ’87, is a managing partner at Madrona, which is a top venture firm. They really are very strong in Seattle in particular.

And so I met with him, and he introduced me to the Madrona Labs team, which is like the incubation team at Madrona. And then from there we got to know Strike Graph.

So in that case, there’s nobody at Strike Graph that went to Dartmouth—but it was because of the introductions. And that’s really how this whole process works. The Dartmouth community has been so generous to us in terms of those introductions, and it gets us in places that are really high potential because of that.

So in the case of Strike Graph, we actually invested in their seed round, in part because of the specific lead investor.

So at Madrona, the partner who led the round was Hope Cochran. She is a serial CFO—taking a couple of companies public. She’s now on the board of public companies like Hasbro and MongoDB.

Because of her experience as a CFO and as a venture investor—as a general partner at Madrona—her book of business, her focus, her real sort of concentration is startups in the service of the CFO. And that’s exactly what Strike Graph does.

So they do cybersecurity, fintech—they basically have a platform that starts with SOC 2 compliance, and have a whole vision of where it takes them.

But to have Hope, with her very, very deep set of knowledge about how they’re going to be successful, along with the power of the venture firm of Madrona—that’s the kind of deal we really love.

So let me squeeze in—Meera, why don’t you jump in and share a little bit about Canvas?

Speaker 2:

Yeah, I know. I think I’m going to tug on that thread of the generosity of the Dartmouth network there.

Because, you know, switching gears—Canvas is actually a construction robotics company that installs drywall on construction sites.

I think we were all excited about this because robotics has just been such a compelling investment vertical for so many years, and we were just really excited to meet with the team.

And so, with such a great value proposition, it was just no surprise that a fund like Menlo Ventures—with a demonstrated track record in robotics and manufacturing—would step in to lead the Series B.

And as you can probably imagine, as soon as Menlo came in, the round was just quickly oversubscribed.

So I think the deal dynamics actually here bring to life the power of the Dartmouth community. I think it’s something we all experienced while at Dartmouth, but to see it in action really crystallized the power of the network—and specifically Green D’s ability to harness the network.

And in this case, it was really Laura’s relationship with Andrew Beebe, who is the managing partner at Obvious Ventures. He’s a board member of Canvas and he’s also a Dartmouth ’93. And that relationship allowed Green D to walk into this deal led by Menlo Ventures.

So we were just thrilled with this connection point, and we’re excited to see what’s in store for this company moving forward.

Speaker 1:

Nice. That’s great. Yeah—how about Dean, jump in on Cipher?

Speaker 3:

Sure, absolutely. Cipher is on the life sciences side of things, and it’s a company that, candidly, I was really excited to already see was part of the Green D portfolio when I had the opportunity to join the team last fall.

Briefly, Cipher is a precision immunology company that is commercializing a blood test that will help patients, providers, and even payers be able to identify whether a test is the right test for the right patient at the right time.

This was an investment that Green D did in Green D Five—the fifth vintage. And so then they came up for their subsequent fundraise, and now we had an opportunity to come in as already an existing investor.

Northpond, the lead in the prior round, was actually increasing their ownership from 13 to 23%. That’s something we love to see—in terms of conviction from an existing, prior lead investor.

And the company Cipher was able to attract a new lead investor—Clal Biotechnology Industries, the largest healthcare investor in Israel—to lead this new round.

And so this is a dynamic that we saw in Green D Seven, and we’re really excited to move forward into Green D Eight and beyond in terms of leveraging our portfolio companies to get into later rounds.

Speaker 1:

Absolutely. Yeah, no—it’s a great story. Cipher is one where, when we invested, mRNA was not quite as cool as it is now. And we’re pretty glad we’re a part of that wave. So neat.

All right, well, let me just—before we leave this—I just want to give everybody kind of the Dartmouth folk at these:

So Grace—Dartmouth CEO. Julia Cohen-Sebastian, Class of ’89, works for Years. Led by Akil Vora ’08—he’s the ex-Tuckie.

The next one, which I would love to tell you the story of, is a Dartmouth ’07—Google Ventures is leading that round. Love that team.

Gatik—no Dartmouth folk. Kindbody has a Dartmouth founder, Joanne Schneider. They do health tech. I should have said—Gatik does autonomous vehicles, kind of the middle mile. They just got picked to be a Davos company. Really on fire. Absolutely on fire.

And—Sorry—WorkSphere does software that helps folks plan the return back to the office.

So let me go back down the list here. Beam is a micro-mobility company in Asia. Mark Inkster is the head of business development there.

Tundra—we talked about. Canvas, Cipher.

And then Flexe has a Tuckie CEO—Karl Siebrecht. So they basically do like an Airbnb of warehousing. Their customers are like Walmart and Lowe’s, and they basically allow direct-to-consumer e-commerce companies to site inventory close to customers so they can respond with Prime-like efficiency.

So anyway—lots of really cool companies. This is emblematic. These are recent investments. It gives you a sense of what we do.

So a little more faces—if we can have Darren back in—there he is. So there’s three folk here: Darren, Stacy, and Dan. And they, should you choose to want to talk to us and sort of ask some specific questions we don’t catch in this webinar, the three of them are registered representatives and can help you with the decision-making process.

I’m available. My team is available as well. But most of the time, Darren, Stacy, and Dan can answer some of the big questions that folk have.

And then last, before we get to the Q&A—this is our cherished companies. There are about 112, and we’re really proud of them. Lots of Dartmouth folk sprinkled across here. Really part of the strength of what we have for Green D Fund Eight and why it’s sort of getting increasingly easier to do our job—just because we have this great network that we’ve built in a very short amount of time, due to the responsiveness in the Dartmouth community.

Really proud that Green D is the largest fund in Alumni Ventures Group because of the commitment level of the Dartmouth community. And I hope you join us for Fund Eight.

So with that, let’s go to Q&A.

Speaker 3:

Let’s do it. Okay, we’re getting a lot of great questions—and just to start things off, know that if we don’t address all of them, we’ll be sure to follow up one-on-one over email. I’ll do my best to try to group some of these into categories.

First off, we’re getting some questions about our diligence process. And in particular: how do we diligence all the deals that we see each year? And this one I thought is pretty neat—asking in particular, under what conditions do we typically say no, and why?

Speaker 1:

That’s a double whammy. Those are good questions, guys.

Okay, so let’s start with the diligence part, and then we’ll go to where we say no.

So the diligence part is: we work with these companies, we research the business model, we work with the founder to understand all that. We unpack the opportunity at hand by always doing a call with the lead investor—because that’s a big part of what you heard is our process.

So we write up a diligence memo of 15–20 pages. And then an interesting step in the process is—we score it. We’ve got a scorecard at Alumni Ventures that, I don’t know, 10,000 companies have gone through at this point.

But we also have a sibling fund score the deal. So there’s kind of a check and balance so that we don’t get too in love with our own favorite deals.

And then, if it’s a larger opportunity—if it’s a bigger check that we’re writing—we also pull in our investment committee. You can see those folks on the website. They are investors in the fund and they have special expertise—either VCs or a few of ours are subject matter experts. I’ve even got folks who are former CEOs within the Green D family.

So to kind of do another check and balance. And in that process, you get this kind of holistic picture before we actually go in.

So that’s all of the deals at Alumni Ventures Group—they go through all of that rigor: diligence, scoring, sibling fund scoring, and investment committee for the largest opportunities. No matter which deal you see through syndication with us, know that it’s a pretty darn rigorous process.

So then—why do we say no?

So, we say no—I would say there’s sort of three buckets.

First off, there’s a lot of companies that aren’t venture-backable. Let’s just be clear. And they come to us—you know, if we’re talking to one in four Dartmouth alums every month, there are some deals that come in that, candidly, aren’t venture-backable.

So venture-backable means they’re high-velocity, huge ambitions, right? Moats—things like that—where there’s intellectual property that kind of protects it. They’re going to go and change the world. These are venture-backable—big ideas.

Not every company is that. Not that they aren’t a big idea—but maybe they’re not going to grow like a hockey stick. And that’s the kind of company that we go into.

So that’s one level.

The second level is—we really unpack the lead investor, right? So is there a logic? If we’re going to go into a cybersecurity fintech company, we want somebody who knows something about that, right? We don’t want a consumer tech or healthcare tech lead VC leading that round. We want the expertise in the lead investor and a track record of doing really well in venture investing before we are comfortable with that.

And then the third piece I’d say is the deal dynamics. So the deal dynamics are kind of the nuances of like—huh. Are they investing? If they usually invest $2 million in a Series A, are they investing three? Or are they investing $100,000?

Just because it’s Sequoia leading the round—if they’re not leading it with affirmation and excitement, we don’t want to be in that round. Right?

So we really look at that. We look at the valuations. We look at—did the investors from the prior round do their piece (they’re called pro rata)? Are they doing it? Are they doing more? How much energy and excitement do they have in that round?

And that piece—some of that is a little bit of signaling, and it really comes from the fact that we do a lot of deals. I mean, we do a lot of deals, and we see a lot. And it enables us to be able to make and sort of read those tea leaves and see the nuances behind the business.

Obviously, for any one of the things that we do, we have to look at the foundation of the company—but that’s sort of a prerequisite for kind of bringing it into the company, and seeing the potential of the management team and the total addressable market and the opportunities ahead of themselves.

Speaker 3:

Great. We’re also getting some questions related to performance. And one in particular here is quite specific. It says: “I heard from a classmate that there was a recent exit that you were in. Can you tell us more about that?”

Speaker 1:

Yes! So that is pretty fun. I’m fairly sure it’s Upstart.

So let me sort of frame all of performance—but I do love the Upstart story. So this is a Dartmouth ’88 in our Green D 3 portfolio. You can look it up—we got in early.

We’re not fully out, so there’s nothing to announce quite yet. But it is a great Dartmouth story. So I think that’s probably what the question was about.

But just more broadly on performance: just as a macro perspective—most venture returns happen in years 7 to 10. We are six years in. So it’s very much a back-end-weighted asset class.

For the first six years of our existence, we are tracking right with the thick of venture. We’re doing really well. So in terms of where our performance is—know that so much is still yet to be determined.

So if you are someone who’s making a decision based on 10 years of performance—we’re just, candidly, not that old. And the tea leaves won’t show you the answer in this case.

The reason why is sort of that answer with Upstart, and also what I mentioned earlier: there are companies that won’t make it. So in any given portfolio that we have—25 to 30 companies—there will be a handful that are the absolute rockstars, and there will be a few that absolutely don’t make it.

And so part of the performance of the fund is to recognize that it’s a power-law game. And so those ones that do knock it out of the park can individually deliver the whole fund back to us.

So part of the performance measure that you should take away from this is: it’s early, and also that we have some early signs that are probably positive. But really—we want you to know that as you look at your own individual portfolio, you will see variance in the individual companies. And because it’s a portfolio and you’re looking at the net results, that’s really where I think we’re going to see some pretty interesting stories as everything pans out.

Speaker 3:

Okay, I want to be mindful of time, but I think we have room for a couple more. One I think would be great for Darren, if he wants to pop back on—this relates to the logistics of investing. Can I only invest in cash, or are there other methods of investing as well?

Speaker 4:

Great. Thanks, Dean. Hi everyone.

Yeah, great question. We get it a lot. The most common way folks invest is via cash—either a check or a wire. But the second most common is probably through a self-directed IRA. Probably 25% to 30% of our investors invest via an IRA.

We also enable folks to invest via trust or entity as well. And then finally, for folks that are non–U.S.-based, they can invest in Green D Ventures via our offshore vehicles.

So—a lot of flexibility there for folks to invest in whatever’s most appropriate for them.

Speaker 3:

Awesome. Great. Thanks, Dan. And Laura, I guess to wrap things up—a few questions around the timeline for funding?

Speaker 1:

Yeah. I mean—we’re kicking off, so this is fantastic. Love that everyone is a part of this.

We will wrap up by the end of the summer. And so please dig in.

As I said, the process is really easy, right? So you can sign the documents and let us know you’re coming in. If you’re waiting for, like, the sale of a house, or there’s a bonus or something—that’s totally fine.

Catherine, who you met earlier—you just kind of email Catherine and say, “I want to fund at the end.” That’s fine.

Most people get it done—just sort of knock it off pretty quickly off their to-do list.

If you decide to do a self-directed IRA, there’s a couple of extra steps in there, so know that that will take a little bit of extra time.

And we’re flexible—because fundamentally, I mean, this isn’t Charles Schwab or Bank of America, right? This is a bunch of alums. And we recognize that our investors are also high-impact people.

And so we want to make sure that we work with you to get you involved. I mean, Green D has been a great success so far, and I really hope that you join us as part of Fund Eight.

And really glad that everybody here was part of the call. I hope you reach out with questions if you have any.

So thank you all so much. Thanks, Dean, for the questions. Thanks, everybody.

We’ll sign off. See ya. Bye.

About your presenters

Overview:

Laura Rippy is a Managing Partner and Board Member at Alumni Ventures. She runs the Harvard-focused fund (The Yard Ventures), the Dartmouth-focused fund (Green D Ventures), the Women’s Fund at Alumni Ventures, and helps our US Strategic Tech fund. Alumni Ventures is “America’s Largest Venture Firm for Individuals” with $1.5B raised, and 1500 portfolio companies. AV is one of the top 3 most active venture capital firms globally, per Pitchbook 2018-24.

Previously, Laura was a serial CEO, Chairman, Board Member, Advisor, and Executive in high-technology companies including Microsoft. Business Insider ranked Laura in the Best Early Stage Investors of 2024 and 2025.

Laura Rippy holds an MBA from Harvard Business School and an AB in Government from Dartmouth College.

Funds Actively Worked On:

- Yard Ventures

- Green D Ventures

- Women’s Fund

- US Strategic Tech Fund

Investment Lens:

Laura’s investing areas at AV leverage her operating experience in consumer internet, enterprise software, and novel technology innovations. She is inspired by founders aiming to build “N of 1” companies, ideally with IP or other moats. Business Insider ranked Rippy in the Top 100 Early Stage Investors of 2024 and 2025, and #1 in the Top Female Seed Investors of 2025.

Former Partner, Green D Ventures

Pete worked at Alumni Ventures from January 2022 to July 2025. Pete joined Alumni Ventures from the $1.5B+ venture capital arm of Bertelsmann, where he was a Senior Director across the European Union, China, and U.S startup ecosystems. Previously a fellow at .406 Ventures and alumnus of the Harvard Innovation Lab, Pete has substantial entrepreneurial and startup operating background. He has an MBA from the Tuck School at Dartmouth, an MPA from Harvard’s Kennedy School, a Master’s with Distinction from Oxford, and a BA (magna cum laude) from Dartmouth. He has recently been selected as a member of the Council on Foreign Relations. Pete has a creative core as drummer for the indie rock band Filligar, which has been designated as “Cultural Ambassador” by the U.S. Department of State. He is an avid skier, marathon runner, and ice hockey player.

Senior Associate, Green D Ventures

Sarah comes to Alumni Ventures from Citi Ventures, where she worked in Strategy & Operations to create and communicate the strategic vision and performance of Citi Ventures activity. Prior to working at Citi Ventures, Sarah earned her MBA from the Tuck School of Business at Dartmouth and received her undergraduate degree from the College of William & Mary with a dual major in International Relations and Economics. Her prior work experience also includes strategic regulatory initiatives and risk management, as well as investment banking with industry coverage in consumer & retail. She is passionate about traveling, food, and wine, and loves the beach, skiing, running, and staying active.

Senior Partner

Darrin is an investment professional with an extensive background in financial services and B2B. Throughout his 25 year career, he has worked with individual investors, investment advisors and their clients, and institutional (foundations and endowments) clients, with various investment vehicles including mutual funds, separately managed accounts, socially responsible portfolios, and alternative investments. He earned a BA in Economics & Public Management from UMaine and an MBA from Boston College.