A VC's Playbook: An Investor's Guide to Seed Investing

Seed-stage investing involves high risk and high reward, where bold ideas evolve into products with the potential for significant growth. Investors at this stage focus on assessing key factors such as founder expertise, market potential, product differentiation, and scalability. A diversified approach, thorough due diligence, and strategic involvement with founders can enhance the chances of success in this high-stakes investment space, despite challenges like high failure rates and unproven business models.

When we’re considering investing in a startup, we first want to know that the entrepreneur has a clear understanding of the market. Who are the major players? What about this market is ripe for disruption? What is this startup’s unfair advantage to disrupt this market? In the first conversation we have with a company, these are questions that we’re looking for clear answers to.”

— Mike Belsito, Startup Seed Funding for the Rest of Us: How to Raise $1 Million for Your Startup – Even Outside of Silicon Valley.

Seed-stage investing is both thrilling and high-stakes. It’s where bold ideas evolve into tangible products, where risk meets reward, and where a startup’s journey begins. For venture capitalists, seed-stage investing offers significant upside but comes with considerable risk, given the high failure rates of early-stage companies.

This blog blends key insights and best practices for navigating the seed stage, emphasizing the importance of market dynamics, founder expertise, and diversification. Whether you’re a seasoned investor or just starting, understanding the intricacies of seed-stage investing can dramatically impact the success of your investments.

The Seed Stage: From Idea to Execution

The seed stage is where startups evolve from concept to creation. Positioned between

friends-and-family rounds and Series A, seed-stage funding is often the first institutional capital injected into a startup. Founders at this stage focus on validating their business models, building a minimum viable product (MVP), and attracting early customers. This funding is pivotal in determining a startup’s trajectory and future success.

Seed Venture Investing: The Lifeblood of Innovation

Seed-stage investing is critical for fostering innovation. It gives investors the chance to help shape the early direction of a company by providing feedback on product-market fit, pricing, and team dynamics.

For many, seed-stage investments offer the excitement of discovering the next big thing. Companies like Airbnb and Dropbox began with small investments and grew into industry-defining giants.

However, seed investing is not without its challenges. The space is crowded with micro-VCs, angel syndicates, and larger venture firms moving downstream. Investors must be selective, backing startups that not only show potential but also align with long-term market trends. A strategic early investment can yield outsized returns and provide influence over the startup’s trajectory.

Frameworks for Assessing Seed-Stage Startups

Having a clear, adaptable framework for evaluating seed startups is key. At Alumni Ventures, we focus on key factors beyond traditional metrics like revenue growth. These core areas inform our decisions:

- Home

Founder DNA

At the seed stage, this is more critical than at later stages. We evaluate whether the founders have the passion, expertise, and resilience to tackle the problem they’re solving. - Home

Market Potential

The total addressable market (TAM) is crucial for assessing scaling potential. We seek large, growing markets where startups can capture significant share. - Home

Product Differentiation

Successful startups must offer something unique. We look for products or services that solve problems in new or more efficient ways. - Home

Traction and Validation

Even at the seed stage, early signs that the market is responding — such as user adoption or letters of intent — are vital. - Home

Path to Scalability

A strong business model should have scalability potential, along with defensible moats like proprietary technology or network effects. - Home

Investor Syndicate

Building a strong syndicate is vital. We want to see lead investors and partners who provide not only capital but strategic value through a demonstrated track record of investment, industry expertise and connectivity, and operational insights.

Types of Seed Venture Investors

The seed-stage investment landscape is diverse, with various types of investors offering different strategies:

- Home

Angel Investors

High-net-worth individuals who invest their own money, often providing both capital and mentorship. - Home

Seed Funds

Venture capital firms that specialize in seed-stage investments, typically investing in a larger number of companies than later-stage funds. - Home

Multi-Stage Funds

Venture firms that invest across different stages, including seed. While they invest in fewer seed-stage companies, they are often willing to take bigger bets on high-potential, early-stage opportunities. - Home

Accelerators and Incubators

Programs offering resources, mentorship, and early-stage funding in exchange for equity.

Each of these investors plays a crucial role in ensuring startups get the capital, guidance, and resources needed to succeed.

Diversification: A Key to Mitigating Risk

The high failure rate of startups makes seed stage investing particularly risky. To mitigate this, investors should build a diversified portfolio. Diversifying increases the chances that a few high-performing companies will offset losses from others, improving the potential for significant returns. This is referred to as the “Power Law” and is vital to understanding the math and potential returns of early-stage venture investing.

Best Practices for Seed-Stage Investing

While diversification is essential, it’s also important to follow best practices for wise investment decisions:

- Home

Develop a Clear Investment Thesis

Establish focus areas, such as target sectors or technologies, and define investment criteria that align with your expertise and interests. - Home

Conduct Thorough Due Diligence

Given the high risks, due diligence is critical. Evaluate the founding team, market potential, product differentiation, and early traction. - Home

Build Strong Relationships With Founders

Seed investing can be about more than just money. Some investors also offer mentorship, connections, and operational support. - Home

Monitor and Support Portfolio Companies

Actively engaging with portfolio companies ensures they stay on track and continue progressing. - Home

Understand the Spectrum of Seed Investing

Seed companies range from pre-seed (pre-product, idea-stage) to mature seed (product in market, generating revenue). Investment strategy should adapt accordingly. Early-stage investments focus on the team and vision, while later-stage require proof of traction and scalability. - Home

Be Patient and Selective

Seed investing can be a long-term commitment. Focus on companies with strong fundamentals and growth potential. - Home

Manage Exits Strategically

Develop an exit strategy early, considering options like acquisitions, secondary sales, or public offerings.

Key Risks in Seed Stage Investing

- Home

High Failure Rate

~75% of venture-backed startups fail to return capital to investors. - Home

Unproven Business Models

Early-stage startups often have limited traction and are still refining their product-market fit, making their long-term viability uncertain. - Home

Valuation and Dilution Risks

Investing at high valuations or lacking pro-rata rights can reduce returns as companies raise subsequent funding rounds. - Home

Founder and Team Risk

The success of a startup heavily depends on the execution capabilities of its team. Inexperienced teams may struggle to effectively scale operations. - Home

Follow-On Funding Challenge

Recent data shows that only 13% of companies raising seed funding in 1H 2022 progressed to Series A, highlighting the obstacles to follow-on funding.

To mitigate these risks, investors should focus on building a diversified portfolio, conducting thorough due diligence, and being selective.

Recent Trends in Seed-Stage Valuations and Deal Sizes

Over the past decade, seed rounds have expanded significantly due to increased investor interest. Key trends include:

- Home

Rise of Specialized Seed Funds

The number of micro-VC funds (under $50M) has grown by over 600% since 2010, with many focusing on niche sectors such as climate, deep tech, and crypto. In 2023, over 400 new micro-funds were launched globally, emphasizing high-touch support and deep industry connections. - Home

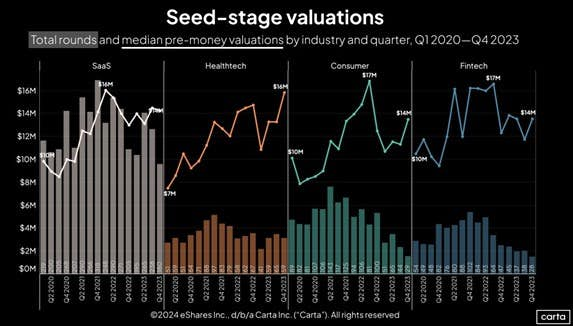

Increasing Valuations

The median U.S. seed-stage valuation reached $13M in 2023, more than double the $6M median in 2015. In AI, valuations have surged even higher, with some early-stage AI startups raising at $50M+ pre-money valuations, as investors race to secure promising deals. - Home

International Seed Ecosystems

Seed funding outside the U.S. has grown significantly, with Africa seeing a 260% increase in seed-stage investment between 2019 and 2023. The Middle East recorded over $2.5B in startup funding in 2023, with a rising share allocated to early-stage companies. Eastern Europe has also gained traction, particularly in deep tech and SaaS. - Home

Micro-Funds and Syndicates

Platforms like AngelList, Republic, and SeedInvest have led to a 300% increase in syndicated seed deals since 2016. These platforms do enable broader participation. However, they also create cap table complexities, often requiring structured SAFE or rolling fund structures to efficiently manage investor participation.

Understanding these trends helps investors refine their strategies and navigate the evolving seed landscape effectively.

Example Seed Investments

At Alumni Ventures, we pride ourselves on backing high-potential startups early. Two standout examples — TRM Labs and Sleeper — demonstrate the impact of investing in transformative markets.

TRM Labs: Blockchain Intelligence

Provides compliance, risk management, and transaction monitoring solutions for financial institutions to combat fraud in cryptocurrency transactions. Alumni Ventures invested in the Seed round (Nov 2018) alongside Blockchain Capital and Bessemer Venture Partners. Since then, TRM Labs has raised $150M+, reaching a $680 million valuation, and delivering an MOIC of 34x.

Sleeper: Fantasy Sports Gaming

A social gaming platform enhancing fantasy sports with real-time scoring and in-app chat. Alumni Ventures invested in the Seed round (May 2015) alongside Birchmere Ventures and Rainfall Ventures. The company has since raised $65M+, reaching a $400 million valuation, and delivering an MOIC of 31.4x.

These successes reinforce our commitment to identifying and supporting game-changing startups early.

MOIC (Multiple on Invested Capital) is equivalent to the multiple of return gross of fees and equals (Current Valuation + Amounts Returned) / Total Investable Capital. Reported performance would be lower if the impact of fees were reflected. The identity of a co-investor is not necessarily indicative of investment outcomes. Example investments shown for illustrative purposes only. No representation is intended that any outcome shown is or would be representative of any AV fund or the experience of any AV investor. Past performance does not guarantee future results. Example portfolio companies are not available to future investors, except potentially in the case of follow-on investment.

Navigating the Seed Stage with Confidence

Seed-stage investing is a high-risk, high-reward endeavor that provides investors the opportunity to shape industries, build relationships with visionary founders, and support transformative companies. By developing a clear investment thesis, diversifying across startups, and maintaining a rigorous due diligence process, investors can increase their chances of success during this crucial phase of the startup lifecycle. Thoughtful, strategic investments can yield outsized returns and play a pivotal role in the rise of the next generation of groundbreaking companies.

Where Alumni Ventures Fits In

Building a diverse, well-vetted portfolio of seed-stage startups is no easy task. If you’re looking for a venture partner to help you assemble a high-quality, selective seed portfolio, Alumni Ventures can be that partner.

Our network-driven approach leverages our investors—many of whom are alumni from top universities—along with our broader community and experienced investing team to source promising startup opportunities. Through disciplined diligence and expert evaluation, we narrow the field to the highest-potential companies.

Beyond capital, Alumni Ventures actively supports startups by connecting founders with alumni networks, experienced mentors, and strategic business partners. This ecosystem not only helps companies grow but also enhances deal flow, providing investors with access to top-tier opportunities across industries like SaaS, healthcare, and deep tech.

If this model resonates with you, let’s connect and start building your seed portfolio today.

Learn More About the Seed Fund

Invest in entrepreneurial companies at the earliest stage where the opportunities for value creation are typically highest and company valuations are usually at their lowest.

Max Accredited Investor Limit: 249

Jason Bird

Associate, Seed FundJason contributes his expertise in financial analysis, sales development, and market research to the Seed team. Previously, Jason served as an Analyst at Yard Ventures, specializing in sourcing and conducting due diligence for investment opportunities across various stages. His professional background is primarily in sales, with significant experience in real estate and tech sales. Jason is also an entrepreneur, having co-founded Hinzu, a one-stop promotional outlet offering development, design, marketing, and startup advice services to artists. Jason is an alumnus of Babson College, where he earned a Bachelor of Science degree with a focus on entrepreneurship and finance.

This communication is from Alumni Ventures, a for-profit venture capital company that is not affiliated with or endorsed by any school. It is not personalized advice, and AV only provides advice to its client funds. This communication is neither an offer to sell, nor a solicitation of an offer to purchase, any security. Such offers are made only pursuant to the formal offering documents for the fund(s) concerned, and describe significant risks and other material information that should be carefully considered before investing. For additional information, please see here. Achievement of investment objectives, including any amount of investment return, cannot be guaranteed. Co-investors are shown for illustrative purposes only, do not reflect all organizations with which AV co-invests, and do not necessarily indicate future co-investors. Example portfolio companies shown are not available to future investors, except potentially in the case of follow-on investments. Venture capital investing involves substantial risk, including risk of loss of all capital invested. This communication includes forward-looking statements, generally consisting of any statement pertaining to any issue other than historical fact, including without limitation predictions, financial projections, the anticipated results of the execution of any plan or strategy, the expectation or belief of the speaker, or other events or circumstances to exist in the future. Forward-looking statements are not representations of actual fact, depend on certain assumptions that may not be realized, and are not guaranteed to occur. Any forward-looking statements included in this communication speak only as of the date of the communication. AV and its affiliates disclaim any obligation to update, amend, or alter such forward-looking statements, whether due to subsequent events, new information, or otherwise.

Frequently Asked Questions

FAQ

Speaker 1:

Hi everyone. I’m Ron Levin and we’re here to talk about an investor’s guide to seed investing. So really I’m here to help address questions, things you might be thinking about, but really what we’re here to talk about is: What if you could access the most interesting, high-potential seed stage venture startups, just like an elite venture capitalist?But the trick is, how do you do it if you don’t have lots and lots of insider connections? And how do you do it if maybe you don’t have millions of dollars to invest as a traditional investor in many of the well-known venture capital funds that have very high requirements just to get access to the asset class?

Alumni Ventures is here to make seed investing accessible, at just a $10,000 minimum, and get you invested into a well-diversified venture portfolio alongside very well-established VCs—names like Andreessen Horowitz, Sequoia Capital, Kleiner Perkins, etc.

Investing in seed stage startups obviously is done for returns, but it’s more than that. It’s about supporting visionary founders at the earliest stages and getting into groundbreaking innovations that could reshape entire industries, while also potentially generating outsized returns that only a field such as venture capital is able to deliver.

So let me just note a couple of disclosures before we get started. We’re speaking today about Alumni Ventures and our views of the associated investing landscape. This presentation is for informational purposes only and is not an offer to buy or sell securities, which are only made pursuant to the formal offering documents for the fund.

So a little overview on what we’ll talk about today. I’ll give you some background on who we are at Alumni Ventures. We’ll talk about seed investing generally—some of the basics of what is seed investing and why and how do we do it? How do we evaluate deals? What are our best practices for finding and selecting investments? And what’s the hidden edge of Alumni Ventures? What are some of the risks? There’s no free lunch in this world, so there are some risks that come with venture investing. And what are the trends? And I’ll also share some stories from some of our founders and then go into some testimonials from a few of our investors. I’ll save time at the end—we have had a few questions submitted to us and I’ll cover a few of those by the end of this presentation as well.

So a little bit on myself. I’m Managing Partner here at Alumni Ventures. We’ll be coming up on six years here with the firm. I was actually previously an investor myself in Alumni Ventures through one of our funds originally—the Yard Ventures fund is our fund that works with the Harvard alumni community. And then subsequently I also invested in Castor Ventures, our MIT alumni fund, as I have some family connections there, and got more and more interested in what the firm was doing and then came to work here in 2019.

Currently, I lead our Seed Fund as well as our Super Angel and Scout program, so really the most active invested member of our firm leading seed investments.

Prior to Alumni Ventures, I’m a graduate of Babson College, where I went to study entrepreneurship. I’ve been fascinated with entrepreneurship and startups since I was a kid. I started my own business when I was just 11 years old that I ran all the way through college. So that’s what got me interested in entrepreneurship from an early age and why I went to Babson, which was at the time a pioneer in entrepreneurial education and remains so today.

Later I went to receive my MBA at Harvard Business School. I began my career in the first dot-com wave around 2000 with Lycos, one of the pioneer search engines and web portals. There were many around. Some of you, depending on what generation you come from, may remember them—alongside the Yahoos and Infoseek and AltaVista, a number of others kind of in that world—before Google came and consolidated and led that whole market. But I was there in the early days, working on the in-house M&A team, so got exposure to many digital brands very early on in my career.

Later, I moved into consulting—sort of post-MBA I joined McKinsey, where I got to do strategy consulting for a couple of years, focused heavily on the travel industry. My two dual professional interests through much of my career have been aviation/travel as well as digital and technology. Of course, that’s what led me into travel technology.

I specifically went to Booking.com, which is arguably the global leader and most valuable company in the travel industry, broadly speaking. I spent a couple of years there doing strategy and leading the new B2B division that they created of services that were sold and marketed to other hotel companies, where we were able to partner with brands from Marriott down to individual hotels and hospitality groups.

From there, I started feeling a little more entrepreneurial. I wanted to come back to that and finally do a tech startup, as I’d sort of been hoping to do at some point in my career. I partnered with two folks that I’d met through my experience at Booking, and we started a company out of Barcelona called Travel Perk, which is an enterprise travel platform.

We saw an opportunity from our collective experiences in travel technology to build a new platform for booking business travel. I left fairly early on in our journey. I was the founding CEO, raised our seed capital, hired our first employees, and went through our first pivot. I left early, but the company has scaled quite dramatically since then. It has now most recently raised a Series E financing round. The latest valuation was at $2.7 billion.

So while I don’t personally claim credit for scaling the company, I was there in the foundation, where we identified the opportunity and put the initial tools in place to build a great company.

As I’ve been investing here now at Alumni Ventures for close to six years, I’ve developed my own interests and passions. I love investing in companies that are creating societal change that will hopefully make the world a better place in one form or another. I blog about that, and I also published a book in late 2023 called Higher Purpose Venture Capital, which shares the stories of venture-backed startups that I feel are helping to make the world a little bit better in a variety of different ways.

Here at AV, I’ve now invested in dozens of different companies, both at seed stage and at some later stages. A few notable ones include Boundless, which is now the market leader in digital immigration services within the U.S. market. I’ve also been in Hydrow, a leading company in the connected fitness space, specifically in rowing, and also in a fintech in the buy now, pay later space called Sunbit, which has also become a unicorn since we initially invested. Just a few out of many examples of what I’ve done here at Alumni Ventures.

But we’re not really here to talk about me, so we’ll move on from that.

So Alumni Ventures was founded in 2014 to offer individuals the opportunity to own a smart, simple venture capital portfolio—and you might say, to democratize venture capital as an asset. We’ve now introduced thousands—I believe over 11,000—investors to venture capital, many of whom had never invested in the asset class before, simply by making it more accessible.

As I said in my introduction, traditionally you would need to be a large institutional investor—an endowment, a pension fund, something like that—in order to gain access. And you’d need checks that are often in the seven or even eight figures just to get into some of the world’s leading venture capital funds.

We try to get around that by providing individuals with access to the same deals that those incredible VC firms are participating in—but doing it by working with individual accredited investors. And our minimum now is only $10,000 to access one of our funds.

We have raised $1.4 billion to date from those 11,000 individuals and invested into over 1,500 different companies, which makes us one of the most active venture capital firms globally by almost any measure.

We have about 120 employees located across five offices around the country. About 40 of us are full-time on the investing side.

We’re not only known for our volume of deals—quantity is important—but more importantly, for the quality of the deals we’re doing. CB Insights, a leading market research firm, referred to us as one of the top 20 venture capital firms in North America. We’re the only firm on that list that specifically works with individual investors.

We’ve also been named one of the most innovative companies by Fast Company and one of the fastest growing companies by Inc., among many other accolades.

I think it really speaks to our community, our engagement, and the fact that we are kind of unique among venture firms. We work with such a broad community of folks—not only investors and founders, but also a network of experts and others we tap to be helpful and create this vast community.

We also publish quite a bit of content—written articles, webinars like this—where we share our thoughts on venture capital, startups, innovation, and technology. We publish a list of what we feel are our top companies, such as our Apex 50 list. So we’re really trying to actively engage with folks who are interested in being part of the venture capital ecosystem in one way or another.

As I said, our model is about co-investment. We don’t lead investments; we don’t take board seats. That allows us to focus on gaining access as a co-investor to the best deals out there.

We’ve co-invested alongside the biggest names in venture capital—from Andreessen Horowitz and Sequoia, to Bessemer, Y Combinator, and many others. I just attended Y Combinator Demo Day and met with many other leading VCs and top startups there—like Khosla Ventures, NEA, and so on.

We’re alongside almost all of the major venture capital firms you could think of, particularly in North America. And that’s really our model—to get our individual investors access to the same great deals they might not otherwise be able to access.

And we do that not just by working with other VC firms as partners and co-investors, but also through our relationships with terrific founders we’ve developed.

So, let’s talk a little about seed investing. This is really where bold ideas get nurtured at the earliest stages. There are different terms for this—pre-seed, seed—we can sort of bucket it together a bit for this conversation.

But this is high-risk, high-reward investing. There’s no doubt about it. Startups will not all go on to greatness. But what we look for are opportunities that have significant upside.

We look for trends in the market. We look for terrific founders who are deeply experienced and knowledgeable. But we also believe in diversification.

A key concept in this business is the power law, which basically says: you need to place many bets on promising young companies in order to find a few that are going to have outsized returns—and potentially return the entire fund from just one deal out of many.

We look for the opportunities that have the potential to become very big. You might call them moonshots. Companies where there’s an opportunity to address a large market, where there’s some interesting, compelling technology and vision from the founding team. And where we think, if things go well, this could really become something quite big.

Those are the opportunities we like to invest in—especially now, at the seed stage—where valuations are very low and the opportunities for significant returns are quite appealing.

So yeah, a few more basics on investing. There are different stages of fundraising. If you are a founder or know a founder, they might start out by raising what’s first sort of a friends and family round that can sometimes be a hybrid with what we call a pre-seed. Pre-seed is usually still in the ideation stage. There’s an initial hypothesis about a problem to solve, an idea about how one might solve it, and some initial product development that gets built out and maybe some first test or pilot customers.

That then progresses to the seed stage, which is usually where a company starts thinking about a go-to-market. Now, obviously, it depends on what industry you’re in. There are some deep tech life sciences companies that might still be in the R&D phase at seed, but in general, for many companies such as in software or consumer, they’re kind of going to market initially at the seed stage.

Series A is about really making sure that you have that product-market fit and that you can start driving a repeatable sales process. It’s about building that first sign of scalability—that we can grow maybe beyond a first market—whereas Series B, C and beyond is really about taking that initial success and building out a viable market that will absolutely grow across many sectors, many geographies, and the economic model becomes more apparent that this business can really be profitable and sustainable and potentially go on to either an IPO or potentially a big M&A type of exit.

So many technology companies—we’ll talk more about this—really just start from this very early pre-seed and seed. Every company starts from somewhere, and a lot of the biggest names in technology today just got their start as an idea in the garage—either a metaphorical or a literal garage—and developed from there with great attention from the founders and great supporters along the way, including hopefully some strong partners such as some of the VC firms that get in early on.

So as we evaluate seed stage startups, when we look at deals, we have a checklist we use—a scorecard methodology. We’re looking for that founder DNA: the passion, the expertise, resilience—and really lean into founders that have either been in startups before or have great knowledge of the industry that they’re addressing and have shown the ability not just to have technical knowledge but also build a team, build a culture. That’s very important too.

We love these large addressable markets that are usually in the billions of dollars. If things go well, really addressing a big problem in a big market. A differentiated solution—something that’s new, that’s novel, unique, something that can also be defensible. Once there’s either some IP—whether it’s patents or whether it’s some sort of go-to-market or customer differentiation and protection—that can be great as well.

Sometimes it’s working with certain partners that gives you a moat and a leg up in a market. And some early signs of traction or validation depending on what stage of seed it might be. We do look to see what they have been able to prove so far through a go-to-market strategy. We’re kind of looking across the board at all the pieces that make something work. Not every deal at the seed stage has everything fully baked—we certainly understand that—but we do look among this pool of different attributes. Are there signs that this thing could grow and become big? And do they have the right team to execute on it?

So it’s very important to see this path to scalability. We look for the resourcefulness of the founders—that’s one big important thing. How much of a team are they building around them? Other co-founders? Advisors? Other investors? Do we know that this is a good market?

So we look to check the market. Who else is there from a competitive standpoint? Potentially partners? And we look for what moats could be developed. Sometimes at these very early stages, they don’t have these moats yet, but we want to know what the plan is to get there, because ultimately that’s what’s going to make this stand out. Once others catch on that they’ve identified a great opportunity, how do they protect themselves as a market leader?

So we’re really looking for some validation from the founders, from other investors in the deal to see how they think about it, and sort of looking across the broad market to really understand what the scalability potential is of this company.

So there are different types of seed investors. You might hear, as you’re doing research, different words being thrown around. There are angel investors. This is typically individuals that like to invest in very early stages in companies to get these big outsized returns.

There are angel groups that get together and collectively make investments as well. There are seed funds—there are funds that specifically focus on seed investing. I lead the Seed Fund within Alumni Ventures. While Alumni Ventures is a multi-stage firm, this particular fund focuses on pre-seed and seed for investors that really want to get in at the earliest stages.

There are other venture capital firms that are multi-stage funds that intentionally invest across seed, Series A, Series B, and even later in order to have the benefit of diversification. From investing at multiple stages, you do de-risk a little bit as you invest at later stages—although obviously, valuations tend to go up, so there might be less return potential.

So it’s a bit of a balance, and some investors like to have a little bit more diversified approach to that. You also hear about accelerators and incubators. You might have heard about Y Combinator, Techstars—there are others. Some are regional like MassChallenge—that help early stage founders really get their ideas vetted and off the ground.

And so, lots of different folks who play a role within the startup and venture ecosystem.

So as we started to mention, there are best practices for seed stage investing. We do believe that diversification is essential. I think from personal experience—I’ve also done some personal angel investing—and I know that having a diversified portfolio makes a lot of sense and is very important. One, because a lot of startups at the earliest stages will not go on to succeed. But also, sectors can go in and out of favor.

So a personal investor might have a strong network within one particular area, such as FinTech or cybersecurity or life sciences, but things go in waves. And having a well-diversified venture portfolio can be very valuable as well to generating the highest possible returns. That said, it’s important to have a clear thesis on what you want to do. There are funds that focus on particular sectors, and that’s great too if that aligns with a vision.

At Alumni Ventures, we do offer funds that are focused on some specific sectors as well, and that can make sense. If you have a strong thesis and deep knowledge within a particular space and want to focus on that, that can work very well too. Very important to vet deals thoroughly. Evaluating founders is extremely important—identifying the market potential, the product differentiation. Really having that deep sector knowledge is important.

For us, we need to build relationships with founders. Many people ask, do we get our deals through other VCs? That does happen, but at the end of the day on every deal we do, we need to form a relationship with a founder. And they need to understand why we would make a helpful and valuable investor for them. We like to kind of get to know them and, if things continue to go well, invest more money in their companies as things move along.

It’s very important to monitor and support these companies. We want to obviously know how well they’re doing—should we be potentially investing follow-on capital into the companies that are doing well? That’s very important for venture returns too. Within the seed fund, we do reserve some of our capital for follow-ons into the successful companies that we have as we get to see how they perform.

And we need to see how we can be helpful. We do have a platform team—which we call CEO Services—within Alumni Ventures that’s here to be helpful, make introductions, and serve our portfolio companies in a whole variety of different ways. We have to keep adapting to the investment spectrum. As we see companies that are very, very early pre-seed and others that are maybe maturing more into the later seed stage, we look across all of those within the mandate of the seed fund. And it’s important to be patient as well.

Not invest into everything that crosses our desk—we wouldn’t be able to keep up with that—but really maintain a vision on what we look for and what sort of qualifies as a great seed opportunity. And then think toward the future: How does the company eventually exit? It might be 5, 10, 15 years down the road, but eventually a company should be able to be acquired or go public.

There is a more liquid market now for secondary sales as well into private companies. So just start thinking about how we eventually will get our money back because every venture investor will eventually need capital returned at some point.

A little more on some of our deals that we do—we think we have a real hidden edge to identifying great deals. A deal we did quite recently: Trilobio is in the bio lab automation space, a very interesting company that is going to revolutionize this industry and just make it much more efficient through the use of AI and robotics.

We participated in a seed round led by Initialized Capital, which is a phenomenal Silicon Valley–based fund. We got access to the deal through another Boston-based VC, Argon Ventures, that is also an investor in this company. And because of our relationships with other VCs such as this, that got us a leg in to participate in a highly oversubscribed round that we’re excited to gain access to.

Another deal—LinCode—is one that we were excited to get into where we invested alongside Accel, one of the storied venture capital firms, which uses AI in machine vision technology for quality inspection in manufacturing. Originally the go-to-market was working with OEMs and auto and other Tier 1 and Tier 2 suppliers—so very important for picking up on quality errors that the human eye cannot necessarily detect. Some really groundbreaking technology—we’re excited to participate.

We’ve invested twice now into this company, and this was referred to us through one of our angel partners. So we’ve developed a Super Angel Partner Program, where we work with experienced, active, and deeply knowledgeable angel investors who share deals that they themselves are investing in. And this was a big win, as this came to us through one of these angel partners that we have. So just more on how we use our network to gain access to deals.

Next one—I did mention we need to be fully transparent that there are risks to startup investing. Most venture-backed startups do not end up returning their capital to investors. But the ones that do, of course, generate such outsized returns that it makes up for the ones that do not return.

So I think one of the things that’s important to mention as a seed investor is: it takes some patience. And you could say intestinal fortitude—to know that in the early years, you’re going to probably see some failures. But that doesn’t mean that your investment is failing because the big winners tend to get those big returns in the later years.

So you might have to wait until year seven or ten or something like that before you actually recognize these big returns. So it’s a little bit hard—it’s not like looking at your stocks which move on a day-to-day basis. This takes years. Failures are to be expected, but the big winners are going to come in the later years. And that is what has happened and has been proven to happen over years and decades of venture capital.

So there are a lot of reasons why startups fail. They don’t find product-market fit. Execution and operational issues. All these things that one might expect can contribute to that. But that’s part of venture investing. If you want the outsized returns, there is this risk that is entailed—and it does take time, of course, for these returns to be fully recognized.

Some of the recent trends we’re seeing are more and more specialized seed funds coming into the market. We think it’s important, of course, to invest alongside experienced investors that have track records. That’s why we have our co-investment model that we’ve been using and has been proven very valuable for the model that we have here at Alumni Ventures.

Valuations have kept increasing on the seed stage. I think over the last couple of years, things sort of puttered out a little bit, but things seem to be returning in terms of the valuations we’re seeing. More happening internationally in terms of venture ecosystems developing across the world.

Obviously a lot of activity has been seen in Europe, and certainly Israel has a well-developed venture ecosystem. But really across the world now, we see activity in Africa, the Middle East. I’ve been in conferences recently from Hong Kong to Europe to Asia and in Hong Kong and have seen quite a proliferation of venture development really across the globe.

We do invest globally. If we can find terrific opportunities outside the US, we will certainly do that—and we have done many investments internationally. Lots of syndicates—people are putting together their own syndicates through platforms like AngelList to bring their friends or others together to invest in deals that they vet. I think that’s great. I think the more investment activity there is, the better for everybody to support tremendous founders with brilliant ideas.

But one thing you get with Alumni Ventures is a well-diversified, professionally managed investment portfolio. And I think that’s sort of what makes us stand out from, for example, going to necessarily an AngelList syndicate that you might find.

So we have founders that are really embedded in our communities now. We think it’s really important. This is our value—our network. And so one example: Tony Shu from Parker, a real estate investment platform that’s developed. We are investors, and Tony has attended some of our events and has tapped into our expert community and has shared a lot of thoughts about how we—even though we’re not a lead investor or a board member—are still adding a lot of value and helping him.

He’s even been able to come and work in our offices, for example. So we really try to leverage everything we have as an investor to try and help our portfolio founders.

Another quick one—Billables is another one in the legal tech space where we’ve also been able to introduce the founder to experts to talk with other lawyers, for example. And some of those expert conversations have actually led to customer contracts.

We think that’s terrific—when we can be a matchmaker and help members of our community connect and find reward in that. We are very excited to do that and we do it every single day.

ROI is another company in the data and analytics space where we’ve also been able to help get the founder connected. We made a great connection with Morgan Stanley that’s added a lot of value for them, and they’re very proud to share about that. We love it when founders can tell stories like this because that’s what helps build our brand and helps us get access to other founders of companies that we want to invest in.

A couple other examples from the portfolio—a couple of seed investments that we’ve made at AV that have had really amazing returns so far. TRM is in the blockchain space, compliance tools. We invested alongside Bessemer, among others, and we now have a 34x kind of return. It’s on paper at this point—before a company goes public—but we are able to monitor their progress. As companies raise subsequent funding rounds, we’re able to see how they’re doing, and this is an amazing success story. Another one is Sleeper, in the fantasy sports games space, where we also have more than a 30x return so far based on our initial investment.

So keep in mind, great value is created in the earliest stages of investing. If you look at the 10 most valuable companies in the world—at least at the particular date and time we have here—seven out of the 10 initially started as venture-backed companies. And they’re all names that you know well, from Microsofts, Apples, and Metas to more recent explosions from companies like Nvidia in the AI chip space. So VC plays a very, very important role in the broader economy and creating value in companies that eventually lead in the stock market and the public equities realm.

A little more on my team here at Alumni Ventures: I lead the team as Managing Partner. I’m based in our Boston office. We also have Mira Oak, who’s in our Menlo Park office in Silicon Valley—another very experienced venture investor. Jason Bird has been with our team for several years, also in Boston. We actually have someone new on our team now in New York. And we have a whole network of others that help us.

Those include some terrific interns—some young blood on our team to keep ideas fresh—as well as some venture fellows, professionals who work with us on the side and are located in different locations, spotting opportunities for us. As I mentioned, we have Super Angels, we have scouts, we have experts in our community who help us evaluate and source deals. So we really bring this community that’s very hard for an individual to put together. We’ve been at it for a number of years now and have a full team that’s actively looking to invest into the best possible deals we can find and build unique value for these companies.

Many of our investors who have been with us for a while really appreciate what we do and see the unique value in it. So a couple of testimonials—I won’t read every word of them for you—but just know that there are lots of investors who joined us, found us, have been with us now for some time, and who are very happy about both the returns we generate and how we communicate with them. As an investor, you get access to an investor portal, so you’re always informed about what companies are in your portfolio, how they’re doing. And we have a full team here on our end that’s always available to talk, email, or answer any questions you may have. It’s very important for us to maintain strong relationships—not just with other VCs and founders—but most importantly with our investors, because all of this we do for you.

Just to mention, there are different types of investors out there that we work with. And it’s important to know—you’re not alone. If you’re kind of new to this, we have investors who come to us because they’re really interested in being on the forefront of technology and innovation. They’re enthusiasts, and they want to play a role in investing in the future of technology and the economy.

There are others who’ve maybe never done venture before, but they’re interested in perhaps learning about what venture capital is all about. And by joining us, they get access to more information and really start to learn—by having a portal and access to all the content we develop—and are using this as partially a way to learn. There are legacy builders who are very much return-focused, who want to build a venture portfolio for their family and want their investments to play a role in developing a better future for the world.

There are also investors who are really seeking big opportunities—we call them trophy hunters. They know that only through investing in very early stages are they going to be able to get in early on the next great companies and big brands that are going to change the world. And there are others who are simply looking at this very strategically as an investor. They want a diversified portfolio that might go beyond traditional stocks or bonds. And for some, it’s real estate—but for others, they want to diversify beyond that into what we call alternative assets. And venture capital, we feel, is one of the most exciting and fastest-growing opportunities in another asset class.

So we’d like to be your venture partner—and we’re here to help. You’re more than welcome to reach out. This is our QR code. You can always find us through our website: av.vc.

I also want to use this opportunity to address a few questions that we’ve received. Let me just cover a few of those quickly.

Q1: How does Alumni Ventures determine which lead VCs to follow when co-investing, and have you ever declined opportunities led by prominent firms because your diligence revealed concerns they may have overlooked?

That’s a really important question because our model is contingent upon co-investing alongside great VCs. We follow the track record of other venture firms. There’s quite a lot of information available to us—some of it we get through subscription services that we pay for, which let us know which companies different VC firms are investing in.

We actually know when certain VCs have invested. You start to understand why certain VCs have built a name for themselves—because you can see it in their track record. We have a good idea of which firms have had the most success investing. Some are generalist investors, others are more sector- or stage-focused. And we look at that on every deal—not just at the firm level, but at the lead investor level—to understand what expertise they bring and what record they’ve had.

That said, who’s in the round is not enough. I won’t invest in a deal just because a top-name VC is investing. That’s important, but not the only factor.

And yes, I’ve personally passed on deals led by some of the biggest name VC firms in the world. Because if something in the round dynamics or the company looks off, we will walk away. Even the best firms don’t have a 100% success rate. We’ve even talked to lead investors who’ve warned us not to invest—because of behind-the-scenes issues the founder didn’t disclose. So every deal is evaluated case by case.

Q2: Can I invest through an IRA?

Yes, that is possible using self-directed retirement funds. There’s a third-party platform we use to enable that. You’re welcome to talk to our investor relations team to learn more—it’s very simple, and many of our investors already do this.

Q3: How has the rise of AI and automation tools changed your due diligence process compared to five years ago? Are there aspects of evaluation that you believe technology will never replace?

Absolutely—it’s changing our process. We use AI tools now to source deals, evaluate deals, even review legal documents. There’s a lot of automation we’ve brought into our process.

But there are aspects that technology will never replace. Human relationships, communication with founders and co-investors—that’s something no AI tool can do. You could have an AI find a thousand startups raising money, but that doesn’t mean they’re high quality, or that you can get into their rounds.

We sometimes joke that we’re like Groucho Marx—we don’t want to be part of any club that would have us. Meaning: we want to get into the oversubscribed deals where we have to fight for a spot. And that takes a human being at the end of the day.

Q4: How do you approach founder relationships differently from other VCs, and what post-investment support creates the most meaningful impact?

We don’t take board seats. We try to be like a helpful, supportive aunt or uncle—asking, “How can we help?”

We have over 700,000 people in our community—8,000+ are part of our expert community. Some are investors, some aren’t. We connect people daily. We have a full-time team based in New York that supports portfolio companies: intros, practice pitches, content, office space, events, founder-to-founder connections. This is a unique platform that supports companies in ways many lead investors can’t or don’t.

Q5: Looking at successful investments like TRM or Sleeper, what non-obvious indicators predicted their success?

There’s no single secret sauce. But execution is everything—even if product-market fit isn’t perfect. Agility, resilience, and a hunger to win at all costs make the difference.

We look for founders who grind, hustle, are smart, but also build culture, teams, and find their market. And with time, you get a feel for those founder types—what they’ll do when things don’t go according to plan. Because they rarely do.

Final thoughts:

Thank you. Really appreciate you taking the time to join us today. Please reach out—whether it’s on LinkedIn or through our team directly. We’re here to help, and we’d love to support you on your venture investing journey. Hope to meet you soon.