Three Founders, Three Markets, One Truth: Why Scale Remains the Ultimate Challenge

Insights from the Greenwich Economic Forum Panel on Entrepreneurship Across Borders

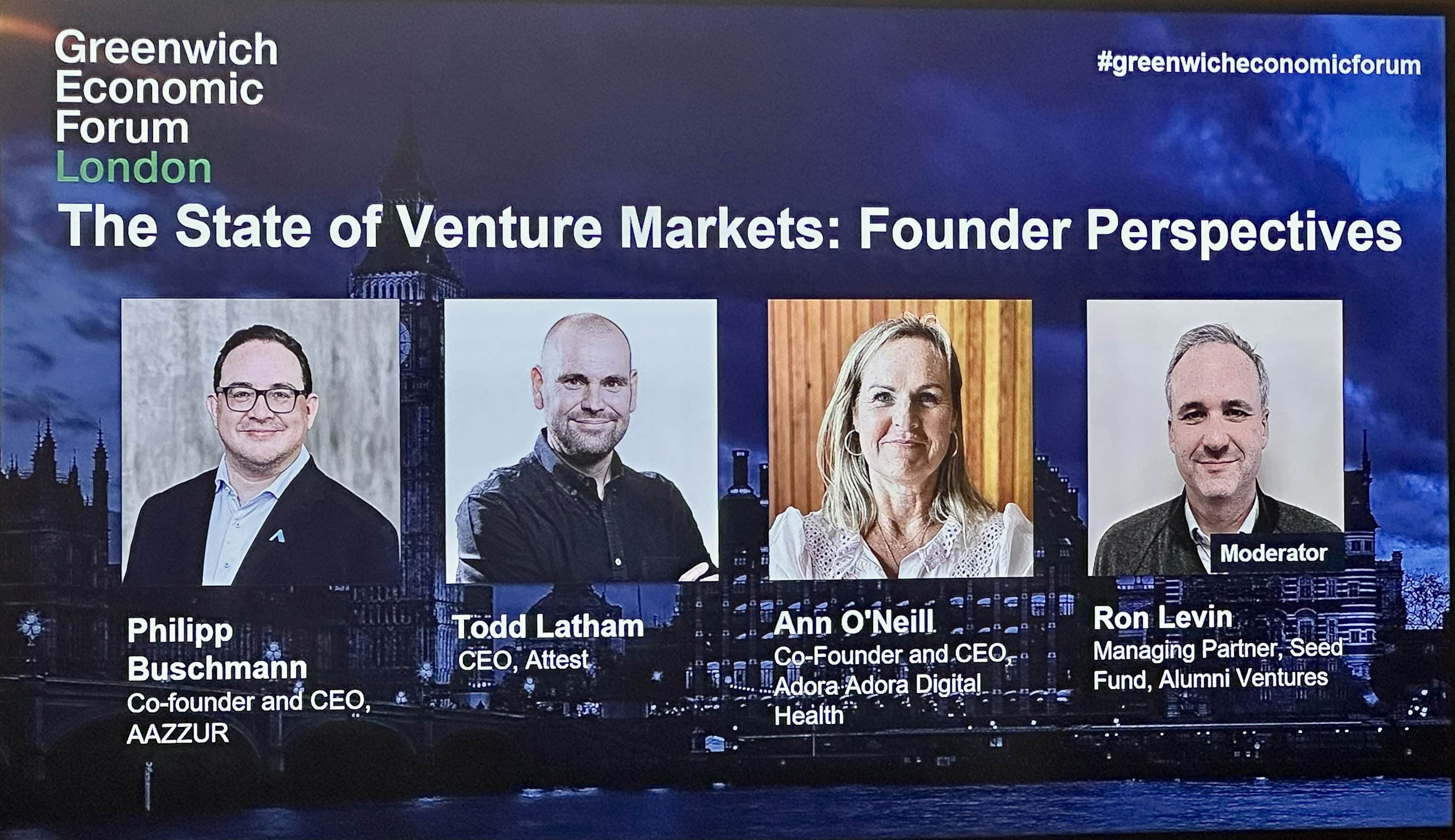

At The Greenwich Economic Forum’s inaugural London gathering, three entrepreneurs sat down to discuss what it really takes to build a company in today’s global landscape. What emerged wasn’t just another panel about startup success stories — it was a candid exploration of the fundamental challenges that define entrepreneurship across different markets, stages, and sectors.

In the elegant setting of London’s Greenwich Economic Forum, three entrepreneurs sat down to discuss what it really takes to build a company in today’s global landscape. What emerged wasn’t just another panel about startup success stories — it was a candid exploration of the fundamental challenges that define entrepreneurship across different markets, stages, and sectors.

The conversation, moderated by Ron Levin, Managing Partner of Alumni Ventures’ Seed Fund, brought together voices from three distinct corners of the innovation economy: Ann O’Neill, founder of UK-based seed-stage startup Adora Digital Health; Todd Latham, CEO of consumer research platform Attest with offices in London and New York; and Philipp Buschmann, CEO of AAZZUR, Germany’s embedded finance platform which he reports is profitable and growing. As one of the most active venture capital firms globally and ranked among the top 50 unicorn investors, Alumni Ventures has witnessed firsthand how these challenges play out across thousands of portfolio companies worldwide.

The Paradox of Modern Entrepreneurship

Perhaps the most striking insight came from Buschmann’s observation that while it’s never been easier to start a company, it’s simultaneously never been harder to scale one successfully. This paradox captures the essence of today’s entrepreneurial landscape — where democratized access to tools, cloud infrastructure, and initial funding has lowered barriers to entry, but where breaking through to meaningful scale requires navigating increasingly complex regulatory, competitive, and capital environments.

“The tools are there, the infrastructure is there,” Buschmann reflected, “but the path to sustainable, scalable success has become more treacherous.” This rings particularly true for international entrepreneurs who must navigate not just one market’s complexities, but multiple regulatory frameworks, cultural expectations, and competitive dynamics simultaneously.

Gender, Geography, and Capital Access

Ann O’Neill’s perspective added a crucial dimension to the scaling challenge. As founder of Adora Digital Health — a platform addressing women’s health management through conversational AI — she highlighted how certain entrepreneurs face compounded barriers. The statistics she shared were sobering: a 28% reduction in workplace roles for women during menopause, representing a massive talent drain that her platform aims to address through employer partnerships.

But O’Neill’s challenges extend beyond her mission’s importance to the fundamental structure of venture capital itself. “Raising funds as a female founder in health tech,” she noted, “requires not just proving your business model, but often educating investors about markets they haven’t traditionally focused on.” This observation underscores a broader truth about international venture capital: the most innovative solutions often emerge from underserved markets and underrepresented founders, yet these same entrepreneurs face the steepest funding challenges.

The panel revealed how Alumni Ventures’ diversified, thesis-driven approach to global investing helps address this gap, providing capital to founders who might struggle to access traditional venture pathways while building portfolios that reflect the true diversity of innovation worldwide.

The AI Native Transformation

Todd Latham’s insights from Attest illuminated another critical shift shaping the international startup landscape. As CEO of a consumer research platform serving giants like Microsoft and Disney, Latham has witnessed the transition from “cloud-native” to “AI-native” companies — organizations built from the ground up to leverage artificial intelligence as a core competitive advantage.

“Large organizations struggle to keep pace with market trends,” Latham explained. “Our role is to use AI not just to collect data, but to create automated insights and storytelling that help these companies make better decisions faster.” This evolution reflects a broader theme: successful international companies increasingly differentiate themselves not through geography or market access, but through their ability to harness AI for sustainable competitive advantages.

The implications for international investors are significant. Companies that can demonstrate AI-native capabilities — whether in health tech like Adora, financial services like AAZUR, or market research like Attest — are positioning themselves for global scale regardless of their geographic origins.

Regulatory Realities and Political Pressures

The conversation took a sobering turn when discussing geopolitical impacts on business building. Buschmann, having navigated AAZUR through various economic cycles including the recent banking sector turbulence, emphasized how political stability directly impacts entrepreneurial success. “Politics affects everything we do,” he observed, referencing experiences during the Ukraine conflict and broader European regulatory shifts.

This reality is particularly acute for international entrepreneurs operating across multiple jurisdictions. The panel highlighted how regulatory differences between markets can either accelerate or severely constrain growth trajectories. O’Neill’s work with the UK’s NHS pilot programs, for instance, demonstrates how forward-thinking regulatory approaches can enable innovation, while overly restrictive environments can stifle it.

For sophisticated international investors, this underscores the importance of thesis-driven investing that accounts for regulatory tailwinds and headwinds across different markets — exactly the kind of nuanced, global perspective that Alumni Ventures brings to its investment decisions.

The Long View on Healthcare and Financial Services

Despite the challenges, all three founders expressed measured optimism about their respective sectors’ futures. O’Neill sees massive potential in digital health solutions, particularly as demographic shifts create urgent needs for scalable healthcare interventions. “The aging population isn’t slowing down,” she noted, “and the technology to serve them is finally catching up.”

Similarly, Buschmann’s perspective on embedded finance reflects broader trends toward financial democratization. AAZUR’s platform enables traditional and innovative banks to offer sophisticated financial tools, potentially reaching underserved markets that traditional banking has struggled to address profitably.

These sectors — healthcare and financial services — represent exactly the kind of massive, regulation-heavy industries where AI-native approaches can create sustainable competitive advantages for international companies willing to navigate complex market dynamics.

What This Means for International Investors

The Greenwich panel revealed several key insights for sophisticated international investors:

- Home

Scale Remains Everything

While starting companies has become easier, achieving meaningful scale requires navigating increasingly complex challenges across regulatory, competitive, and capital landscapes. - Home

Diversity Drives Innovation

The most compelling opportunities may come from underrepresented founders addressing underserved markets — but these entrepreneurs frequently face the steepest funding challenges. - Home

AI-Native Advantage

Companies building AI capabilities into their core operations from day one are positioning themselves for global competitive advantages regardless of geographic origin. - Home

Regulatory Arbitrage

Understanding regulatory differences across markets can provide significant advantages for international companies and their investors. - Home

Long-Term Perspective Required

The most impactful opportunities in sectors like healthcare and financial services require patient capital and deep understanding of complex market dynamics.

The Alumni Ventures Approach

As one of the most active global venture investors in recent years, Alumni Ventures has built its international strategy around exactly these insights. By maintaining a diversified, thesis-driven approach that spans geographies, sectors, and founder backgrounds, the firm positions itself to capitalize on the full spectrum of global innovation — from AI-native startups to regulatory-advantaged healthcare solutions to embedded finance platforms.

The Greenwich panel reinforced why this approach matters: the most compelling investment opportunities increasingly transcend traditional geographic and sector boundaries, requiring investors who can recognize and support excellence wherever it emerges.

For international investors interested in learning more about Alumni Ventures’ strategies available for international investors, please email us at [email protected]

Colin Van Ostern

Senior AdvisorColin Van Ostern serves as Senior Advisor at Alumni Ventures, where he has worked previously as President & COO beginning in 2019. Van Ostern is a business executive with a background supporting startups and technology companies across fintech, edtech, consumer goods and nonprofit. Earlier in his career, he helped launch a new online college at Southern New Hampshire University, which is now the largest online university in the United States, and was a founding board member helping develop the US Department of Commerce-designated “Tech Hub” for regenerative manufacturing of human cells, tissue, and organs. Previously, Van Ostern was publicly elected to serve two terms as Executive Councilor for the State of New Hampshire. He holds an MBA from the Tuck School of Business at Dartmouth and a BA in International Affairs from George Washington University.

This communication is from Alumni Ventures, a for-profit venture capital company that is not affiliated with or endorsed by any school. It is not personalized advice, and AV only provides advice to its client funds. This communication is neither an offer to sell, nor a solicitation of an offer to purchase, any security. Such offers are made only pursuant to the formal offering documents for the fund(s) concerned, and describe significant risks and other material information that should be carefully considered before investing. For additional information, please see here. Achievement of investment objectives, including any amount of investment return, cannot be guaranteed. Co-investors are shown for illustrative purposes only, do not reflect all organizations with which AV co-invests, and do not necessarily indicate future co-investors. Example portfolio companies shown are not available to future investors, except potentially in the case of follow-on investments. Venture capital investing involves substantial risk, including risk of loss of all capital invested. This communication includes forward-looking statements, generally consisting of any statement pertaining to any issue other than historical fact, including without limitation predictions, financial projections, the anticipated results of the execution of any plan or strategy, the expectation or belief of the speaker, or other events or circumstances to exist in the future. Forward-looking statements are not representations of actual fact, depend on certain assumptions that may not be realized, and are not guaranteed to occur. Any forward-looking statements included in this communication speak only as of the date of the communication. AV and its affiliates disclaim any obligation to update, amend, or alter such forward-looking statements, whether due to subsequent events, new information, or otherwise.