Day in the Life of an AV Investor

Welcome to Alumni Ventures

Investing with Alumni Ventures means joining a community of intelligent, forward-thinking individuals who are fueling the future by backing bold, innovative startups. It’s a fulfilling lifestyle of purpose-driven wealth building — where your capital works alongside top-tier VCs to shape the next generation of technology and progress. By going off the beaten path into venture opportunities that most wealthy investors overlook, you’re not just building returns — you’re making your mark on the world with vision and conviction.

850,000+ Strong Startup Community

Join a thriving community of 850,000+ innovation enthusiasts. Stand shoulder-to-shoulder with more than 11,000 active investors shaping the future. Together we fuel bold ideas and build enduring wealth.

See video policy below.

Engage Directly with Our Investment Teams

Join live deal discussions and portfolio webinars to ask questions, dig into diligence, and hear founder stories firsthand.

See video policy below.

Clarity on Every Dollar

Personal Portfolio Reports bring each of your AV investments into a single, dynamic dashboard—allocation, sector exposure, performance, and upcoming capital calls—so you always know exactly where you stand.

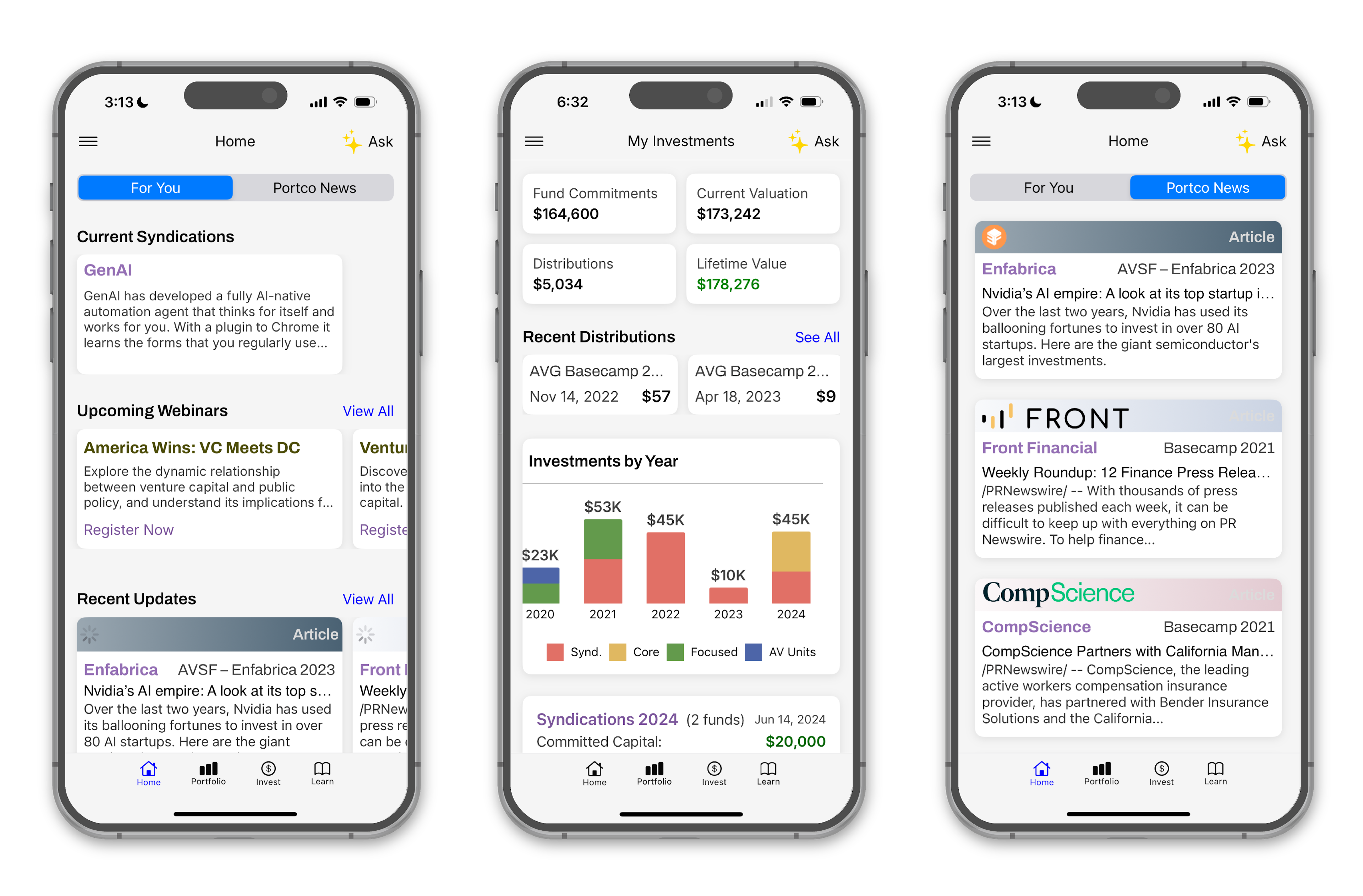

Track Every Move on the AV Investor App

Stay on top of every investment with the only tool built exclusively for Alumni Ventures investors.

- Full‑access deal flow: 100% of our AV Syndicate deals are available to all investors through the app.

- Real‑time portfolio insights: AI‑powered analytics turn raw data into clear, actionable trends.

- Engagement in one tap: RSVP to webinars, portfolio briefings, and in‑person events directly from your phone.

- Portfolio news: Regular updates on the companies you own and how they are performing.

Priority Access to Exclusive Opportunities

Gain early, often private, access to high-conviction deals curated by our investment team.

Diamond Club: Our most-active investors receive first looks and larger allocations in limited high-impact opportunities.

Welcome to the Club. As a valued member of the Alumni Ventures community, you’ve earned access to an elevated investor experience — designed to reward engagement, provide exclusive opportunities, and keep you connected to our growing network.

Want to learn about the Diamond Club?

Speak with a Senior Partner

Map Your Venture Investing Journey

Our Venture Planning Tool translates your goals and time horizon into a personalized roadmap for constructing a well‑diversified, long‑term portfolio. Though we can’t offer specific advice, our belief is that the combination of consistent annual investing, reinvestment, and time will eventually lead investors to a self-funding venture portfolio.

Stress‑Free Reporting & Tax Docs

Access every quarterly statement, K‑1, and performance summary in our secure, two-factor-authenticated AV Investor Portal.

Our streamlined platform is designed with busy investors in mind, offering real-time transparency and seamless document delivery so you can focus on growing your portfolio—not chasing paperwork. With timely alerts and intuitive navigation, staying organized and informed has never been easier.

See video policy below.

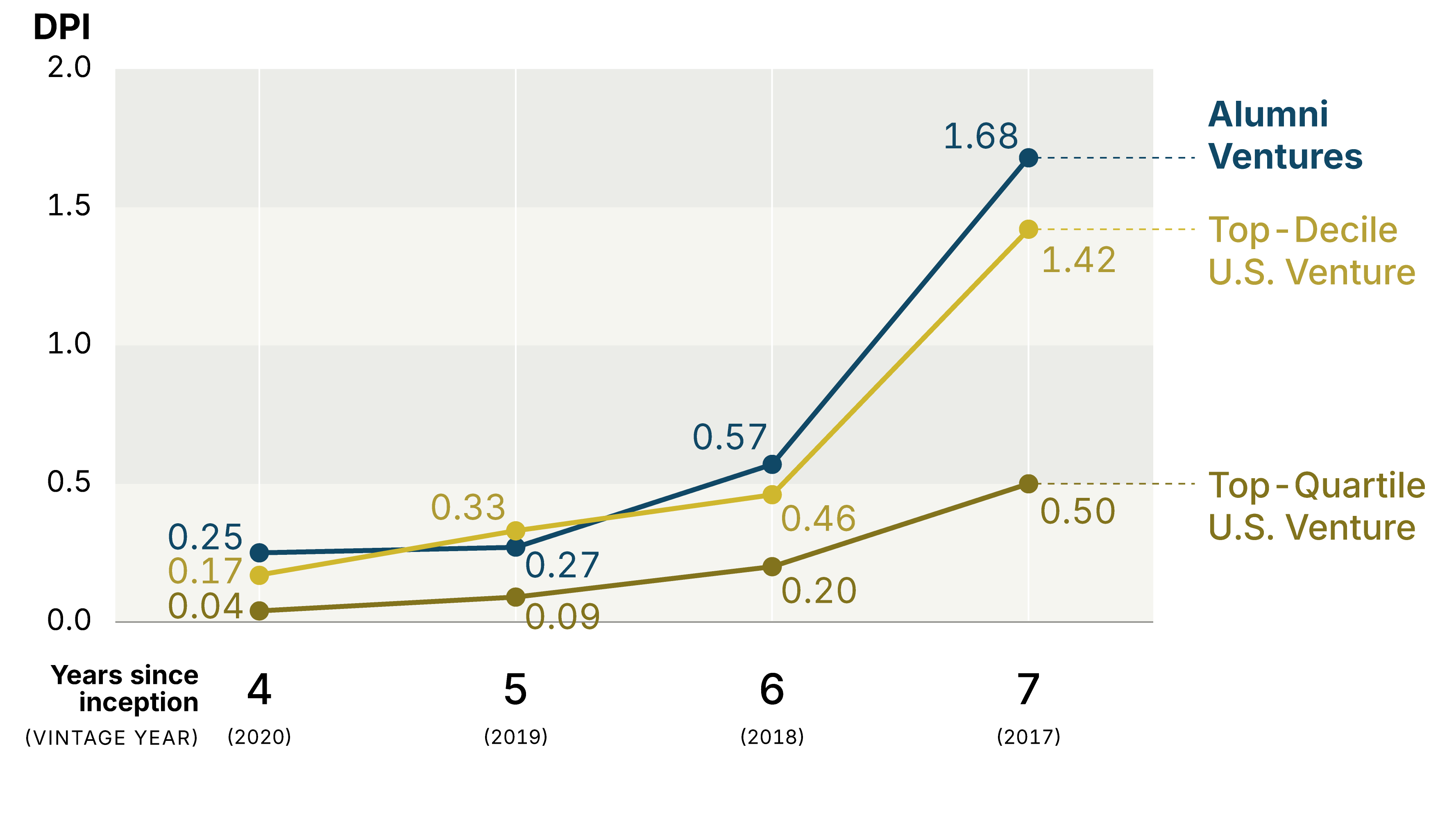

Alumni Ventures DPI vs. U.S. VC

Top-Decile and Top-Quartile DPI by Vintage

Venture returns are typically harvested in years 6–10. Isolating some of our more mature vintages, AV consistently performs in the top decile against U.S. VC Industry Benchmarks. Of course, these vintages all still have time to play out, and the DPI metric will only increase as time goes on.

NOTE: Graph compares Alumni Ventures’ 2017–2020 fund vintages against peer group data published by Carta. Performance shown is Distributions to Paid-in Capital, which is Amounts Returned to Investors / Paid-in Capital, and is net of all applicable fees. Carta data is available here. Performance as of 12/31/24. For information on the performance of all AV fund vintages, please see here.

Meet Matt H.: AV Investor with an Extraordinary Journey in VC

See testimonial policy below.

Meet Rohit: AV Investor Crafting a Diversified Portfolio of Startup Investments

See testimonial policy below.

Your Venture Investing Partner

Whether you want to choose your own deals, or let our team of 40 venture investing professionals construct a diversified portfolio for you, AV is your one-stop shop for all your venture investing interests.

Invest In Our Funds

- Home

~20-30 investments diversified by sector, stage, geography, and lead investor.

- Home

Investments sourced by our entire team of ~40 full-time venture investing professionals.

- Home

Co-investing alongside other established venture firms like a16z, Sequoia, and more.

- Home

Funds typically reserve 20% for follow-on opportunities.

- Home

Access exclusive engagement and education opportunities with our investing teams and founders.

Invest Deal-By-Deal

- Home

No sign-up fee. Investors must complete an identity and accreditation verification process to access.

- Home

You decide how often you want to see deals and whether or not to invest.

- Home

AV diligence and Investment Committee materials are shared via a secure data room.

- Home

All deals are sourced by our ~40 full-time venture investing professionals and invested alongside elite venture firms like a16z and Sequoia.

- Home

Attend live deal discussions with our investment teams to help make your decision.