Energy and Minerals: The Physical Bottlenecks to Innovation

Backing the builders powering the AI age — with energy, materials, and industrial muscle.

The foundational bottlenecks of technology have shifted from software layers to physical constraints like energy, critical minerals, and manufacturing capacity — now the true rate-limiters to AI and reindustrialization. As megawatts and metals become the new protocols of progress, venture-scale opportunities lie in upgrading power infrastructure, securing domestic mineral supply chains, and accelerating extraction, refining, and recycling. The Energy & Strategic Minerals Syndicate is backing the founders building solutions for this new industrial frontier, where power availability and resource resilience define the future of innovation.

Silicon Valley has long conceptualized technology progress through different stacks, with each layer becoming a tollbooth once it emerged as the throughput limiter. We’ve seen this cycle play out repeatedly: NVIDIA with GPUs at the hardware layer, OpenAI at the model layer, ScaleAI at the data layer. Each bottleneck produced trillion-dollar opportunities when it became indispensable to scaling the layer above it.

But we are now entering a new era where the bottlenecks no longer reside in software abstractions, but in physical constraints. The core rate-limiters of the 21st century are megawatts, molecules, and minerals. These cannot be solved with code or algorithms alone but require advances in infrastructure, manufacturing, and resource supply chains.

Start Investing With Energy & Strategic Minerals Syndicate

Take 5 seconds. No document uploads.

Energy, not compute will be the #1 bottleneck to AI progress.”

– Mark Zuckerberg (on Dwarkesh Podcast)

The math behind this rationale is staggering: Datacenter electricity consumption is expected to double to 945 TWh by 2030, more than the entire power consumption of Japan today. From a new capacity perspective, U.S. firms proposed 134 GW of new data center buildout, which equates to over 3.5 million metric tons of on-site copper, before accounting for transmission and distribution. Coupled with reindustrialization, mass electrification, and national security concerns, energy and critical minerals are at a global inflection point that creates a compelling opportunity for venture-scale returns.

AI datacenters are a high-profile example, but the problem is system-wide. Mass electrification of transport, reindustrialization, defense modernization, and the green transition are colliding in the same grid. Power availability, not algorithms, will define the frontier of what’s possible — from training GPT-6 to manufacturing EV fleets at scale.

Every frontier industry — from batteries and semiconductors to satellites and hypersonics — depends on metals. Copper, lithium, nickel, rare earths, and high-purity silicon have become the new “protocols of progress.” Without solving mining, refining, and recycling, we cannot scale any future-facing industry.

At the same time, geopolitical competition is accelerating demand for resilient supply chains. The bottlenecks in rare earths, uranium, and advanced materials aren’t just commercial — they’re defense imperatives. The U.S. is reprioritizing industrial capacity as a security asset, reshaping both investment opportunity and exit potential.

Rare earth metals are the most important DoD issue in the White House right now.”

— CEO of IQT (VC firm for US Intelligence Community)

The Energy & Strategic Minerals Syndicate invests in these new bottlenecks and tollbooths, the layers of megawatts, metals, and materials that underpin the scalability and profitability of AI and reindustrialization.

The New Arms Race

For most of economic history, aggregate GDP largely tracked population and labor participation: more people meant more output. As AI agents and robotic automation augment and substitute real human labor, this constraint shifts from population to energy capacity. Intelligence at scale becomes a function of reliable, low-cost electricity and the efficiency at which we convert kilowatt-hours into compute. That, in turn, pulls critical mineral supply chains to center stage:

- Copper for cabling and motors,

- Electrical steel for transformers

- High-purity silicon for chips and solar

- Rare-earth magnets for drives and cooling, and

- Lithium, nickel, manganese, cobalt, and graphite for batteries, storage, and power conditioning.

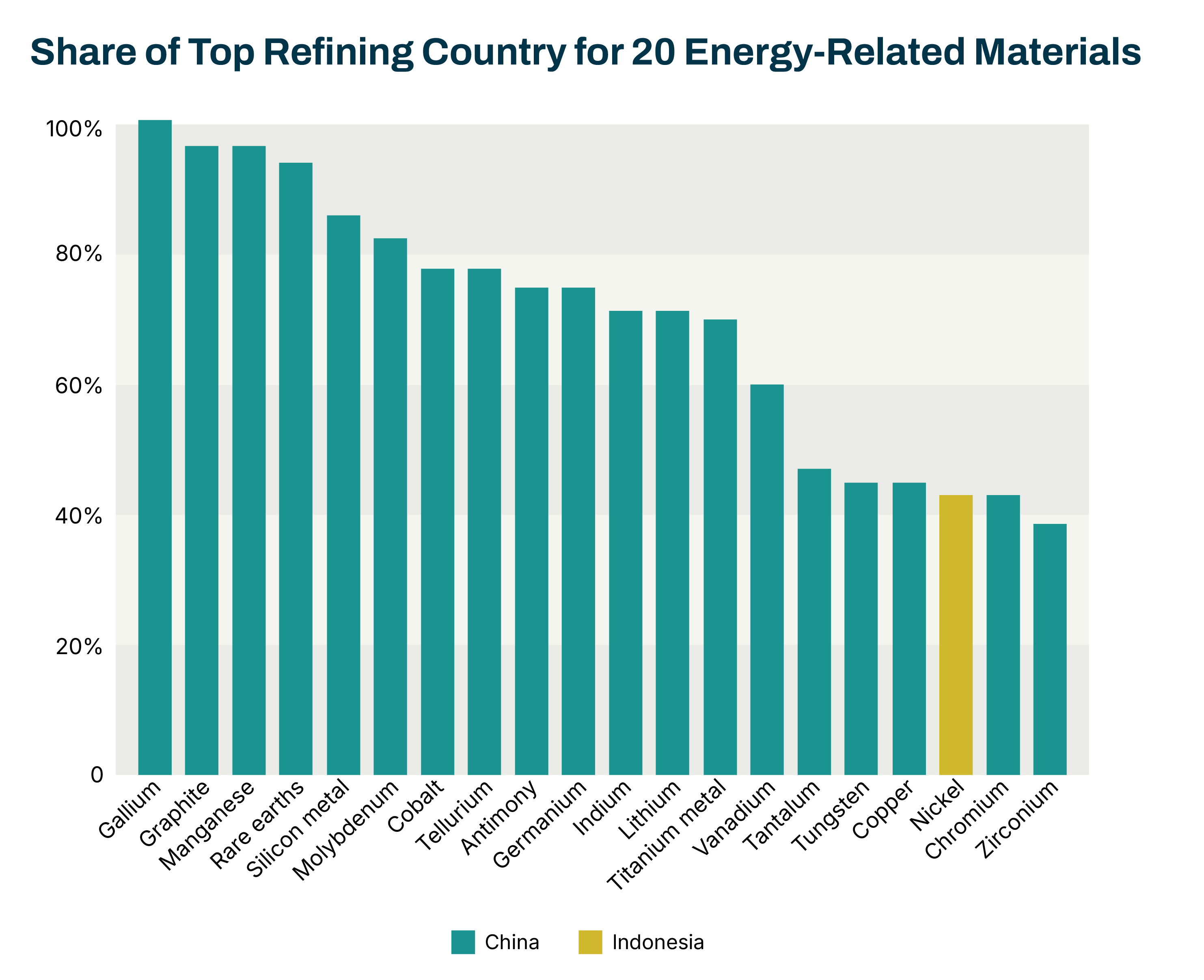

We are now entering a new arms race for megawatts and metals, and China is off to a significant head start. While U.S. power projects wait in regulatory limbo for licensing, permitting, and connection to the grid, China added over 6x the solar capacity of the U.S. in 2024. It also has 29 nuclear reactors under construction, while the U.S. has zero after Vogtle-4 entered commercial service in April 2024. Down a layer from power, China is the dominant refiner, with 70% average market share for 19 of 20 strategic minerals. It also handles 90% of rare-earth processing and produces +10x more crude steel than the U.S.

Start Investing With Energy & Strategic Minerals Syndicate

Take 5 seconds. No document uploads.

Policy Tailwinds

China has demonstrated a willingness to use its dominance to weaponize rare earth elements, critical minerals, and indirectly, power, for political gain. In 2010, it halted rare earth element shipments to Japan during a maritime dispute. In 2023, Beijing put gallium and germanium under an export-license regime and added permit requirements on key graphite grades used in chips and EV anodes. In 2025, it tightened the screws again, adding export-license requirements on a multitude of medium and heavy rare earths in response to Trump’s tariffs, slashing magnet exports 74% and forcing temporary production stops at Ford’s Chicago plant and other sites.

In response, the U.S. has moved on several fronts. In January 2025, it declared a national energy emergency, directing agencies to speed approvals and use emergency tools to stabilize power and fuel. In March, it ordered immediate measures to increase mineral production, placing priority projects on the federal permitting dashboard and opening financing under the Defense Production Act. In April, it ordered a national-security review of reliance on imported processed minerals and set a program to map, lease, and develop offshore and seabed resources while scaling domestic processing. In May, it authorized privately funded advanced nuclear reactors at federal sites serving national-security and AI loads, plus created a fuel bank with at least 20 metric tons of high-assay, low-enriched uranium.

The orders are clear. Securing domestic energy and mineral production is a top priority, and our Energy & Strategic Minerals Syndicate is backing founders who rise to the challenge.

Key Trends We’re Watching

New Energy Capacity

AI and reindustrialization are now power limited. We prioritize firm, low-cost electrons that can be built near load. Advanced fission scales reliable heat and power for data centers and industry (Valar Atomics, X-energy, Radiant, Aalo Atomics), while fusion pushes the frontier for compact, high-temperature sources that can follow demand (Thea Energy, Avalanche Energy, Pacific Fusion). We pair generation with firming and storage so capacity is bankable and dispatchable. That includes fuel-flexible linear generators that drop into constrained interconnects (Mainspring), solid-state batteries for high-cycle reliability (Ion Storage), and thermochemical storage that delivers industrial-grade heat and power at cost (RedoxBlox).

Fixing Existing Infrastructure

While we are optimistic about tomorrow’s energy sources, we still want to make the most out of today’s infrastructure. Equilibrium Energy optimizes wholesale positions and shaping so existing generation serves new load more efficiently. David Energy orchestrates distributed energy resources and retail supply to flatten peaks and free capacity at the edge. Arcadia unlocks meter data and scales community solar enrollment so that customer-side supply is visible and dispatchable. Omnidian monitors and maintains distributed solar fleets to keep output at spec. ARIX puts robots in refineries for pipeline inspection for oil, gas, and power assets, cutting leaks and forced outages and extending asset life. Quilt electrifies residential heating and cooling with next-generation heat pumps, replacing fossil-fuel HVAC systems while integrating seamlessly with grid flexibility programs. Together these platforms upgrade brownfield assets into a controllable, financeable system that can absorb new load without waiting for new substations or transformers.

AI-driven Critical Mineral Discovery

Critical mineral supply dictates everything from motors to chips, so the discovery stack needs orders-of-magnitude faster signal with lower capex per target. Fleet Space brings high-resolution subsurface imaging and satellite-enabled sensing to exploration. Mineral Forecast uses probabilistic and optimization tooling to improve targeting and mine planning. Novamera closes the loop with automated, surgical drilling that cuts time and disturbance. The result is a faster discovery-to-extraction cycle that pulls forward timelines to meet the needs of today.

Start Investing With Energy & Strategic Minerals Syndicate

Take 5 seconds. No document uploads.

Next-gen Extraction, Automation, and Refining

Once resources are identified, the challenge shifts to extracting and refining them with higher yields, lower costs, and reduced environmental footprint. Lilac Solutions develops ion-exchange technology to extract lithium from brine with higher recovery rates and lower water consumption. Nth Cycle uses an electro-extraction process to recover critical metals like nickel and cobalt from mine tailings, low-grade ore, and scrap, offering a cleaner alternative to traditional smelting. Alta Resources Tech harnesses advanced biochemistry to cost-effectively source the high-purity rare earth elements and other essential minerals. Impossible Metals pioneers autonomous, buoyant robots that harvest seabed nodules without destroying fragile ecosystems, unlocking new sources of nickel, cobalt, manganese, and copper. Alongside robotic drilling, sensor-based sorting, and precision chemistry, these platforms are rewriting the economics of extraction and refinery. The result is more capital-efficient and environmentally friendly processes that accelerates the buildout of critical supply chains, shortens time-to-market, and increases domestic resilience.

Critical Mineral Recycling

Even with faster discovery and smarter extraction, the metals already in circulation remain the most immediate source of supply. Ascend Elements drives closed-loop battery recycling, transforming end-of-life lithium-ion cells into high-purity cathode materials at industrial scale. Redwood Materials builds a circular battery supply chain by recovering lithium, nickel, cobalt, and copper and returning anode and cathode materials directly to manufacturers. Cyclic Materials targets rare earth recovery from motors, turbines, and electronics, addressing a critical bottleneck in magnet production. By reducing reliance on new mining, these platforms cut emissions, lower costs for frontier technologies, and increase supply security. Recycling is no longer just a sustainability measure but a strategic pillar of economy — particularly where near-term domestic capacity is constrained.

Conclusion

The next great wave of innovation will not be bottlenecked by code, but by the physical world that powers it. The capacity to generate, move, and store energy — and the ability to mine, refine, and recycle the minerals that make that possible — will define the limits of global progress. In the same way that GPUs unlocked the AI revolution, the infrastructure of megawatts and materials will unlock the next.

At this inflection point, energy and minerals are not just commodities; they are strategic leverage points that determine who leads in intelligence, industry, and security. Nations that secure these supply chains will define the technological frontier for decades to come.

The Energy & Strategic Minerals Syndicate exists to back the founders building those foundations — the companies transforming the physical constraints of today into the trillion-dollar opportunities of tomorrow. By investing in the tollbooths of energy and material scalability, we are not just fueling the AI economy; we are financing the infrastructure of the future.

Featured Authors:

Carl Choi

Partner, Strawberry Creek VenturesCarl brings a systems-level mindset to venture investing, shaped by two decades of experience across public equities, M&A, and technology. He focuses on foundational technologies that rewire how the real world operates — betting on enduring platforms across deep tech sectors such as climate, energy, infrastructure, space, and AI. His work is rooted in a belief that innovation at the intersection of the physical and digital worlds is key to building a more equitable and sustainable future. At Alumni Ventures, Carl backs companies with the potential to tilt markets and drive systemic change. He gravitates toward mission-driven founders with deep technical insight — those unlocking new layers of productivity, resilience, and sustainability while reshaping legacy systems. His thesis centers on platform technologies with long time horizons and compounding strategic advantages — businesses that scale with time and fundamentally transform how industries operate. Prior to Alumni Ventures, Carl was a Principal at Solasta Ventures, where he led investments in deep tech and enterprise software. He previously held corporate development and strategy roles at Upwork and Riverbed Technology, and began his finance career at London Capital Management before moving into investment banking at J.P. Morgan in San Francisco. Hailing from Korea and Canada, Carl holds a double degree in Mathematics and Business Administration from the University of Waterloo and Wilfrid Laurier University, and an MBA from UC Berkeley Haas. Outside of work, he enjoys spirited competition on the soccer field, at the poker table, or over hours-long board games.

Mason Hale

Venture AnalystBefore joining Chestnut Street Ventures, Mason attended Waseda Business School in Tokyo, Japan where he earned an MSc in Finance and wrote a master’s thesis linking founders’ attributes and strategic partnerships to firm performance in new ventures. While attending Waseda Business School, Mason was selected as a G51 Venture Scholar and participated in the Global Venture Catalyst where he served as a graduate startup advisor. Mason also holds a BA in Economics from The University of Texas at Austin.

Join Us (For Free)

Start Investing With Energy & Strategic Minerals Syndicate

- Home

Easy Sign-Up

Click a button. 5 seconds. - Home

No Obligation to Invest

Only invest in deals you like. - Home

Co-Invest with Elite VCs

Frequent co-investors include a16z, Sequoia, Khosla, Accel, and more. - Home

Deal Transparency

Due Diligence and Investment Memos provided. Live Deal discussions with our investment teams.

This communication includes forward-looking statements, generally consisting of any statement pertaining to any issue other than historical fact, including without limitation predictions, financial projections, the anticipated results of the execution of any plan or strategy, the expectation or belief of the speaker, or other events or circumstances to exist in the future. Forward looking statements are not representations of actual fact, depend on certain assumptions that may not be realized, and are not guaranteed to occur. Any forward-looking statements included in this communication speak only as of the date of the communication. AV and its affiliates disclaim any obligation to update, amend, or alter such forward-looking statements whether due to subsequent events, new information, or otherwise. While the information herein is collected and compiled with care, to the extent such information was obtained from portfolio company management and/or other third party sources, neither AV nor any of its affiliated companies warrants or guarantees the accuracy or the completeness of such information.

This communication is neither an offer to sell, nor a solicitation of an offer to purchase, any security. Such offers are only made to eligible investors pursuant to the formal offering documents for the applicable investment fund. Venture capital investing involves substantial risk, including risk of loss of all capital invested. These risks are described in more detail here.