Owning the Arteries of Commerce

Why and How AV is Leading the Way in Supply Chain and Logistics

Why Supply Chain

Our 21st-century American lives — accustomed to a seemingly endless and instantaneously accessible consumerism — are powered by an often-forgotten, rarely disrupted mega-network of transportation and logistics. Only when our packages begin to show up late do we remember. Shaken from our bliss, we watched when the Ports of LA/Long Beach ground to a halt during COVID, the Suez Canal was blocked for six days in March 2021, and US shipping was brought to a standstill last October by once-in-a-generation dockworker strikes. All of these bring back the nightmare of a world where the things we need (or want) don’t show up, even when we select “Next Day” or “Priority Shipping.”

But this once-reliable system is changing for the first time in a generation. In an era marked by seismic shifts in global trade, profound supply chain realignment, and heightened geopolitical tensions, supply chain tech — and the infrastructure, robotics, and protection that facilitate the global movement of goods — is emerging as a crucial and exceptionally dynamic investment landscape. The convergence of macroeconomic trends — including accelerating US reshoring initiatives, persistent trade conflicts, strategic geopolitical maneuvering, and an escalating global competition for critical minerals — creates unprecedented opportunities and significant demand for innovative solutions across logistics, robotics, advanced manufacturing, and maritime operations. Further, as pressures to modernize aging infrastructure meet the rise of AI, autonomy, and decarbonization mandates, the transport sectors (shipping, trucking, rail, etc.) — long resistant to digitization — are increasingly a hotbed of tech adoption. Maritime shipping in particular, which is responsible for moving ~80% of global goods, represents a huge opportunity to build the connective tissue of a modern, efficient, and resilient supply chain.

A recent Packy McCormick article perhaps puts it best:

The chaos in global supply chains will accelerate, and increase the odds of, startups replacing incumbents atop large industries. Startups are the trickster, wayless and flexible enough to thrive in chaos. As the economic architecture of the world shifts, they are better positioned to adapt and capitalize than sclerotic incumbents.”

And VCs are responding. By mid-to-late 2024, estimates suggest logistics and supply chain tech startups raised $15+ billion for the year. A noteworthy trend is the number of startup acquisitions and exits lately. According to one analysis, over 150 supply chain startups were acquired in the past two years. Mega rounds are making headlines, like Relativity Space (3D-printed rockets for supply chain resilience in space) and Exiger ($1.2 billion invested in its supply chain risk software). The common thread is investors are looking for technologies that address the vulnerabilities exposed in recent years — whether that’s making supply chains more flexible, more digital, or more sustainable. At its core, confidence is underpinned by the fact that the logistics and supply chain sector sits at roughly 10% of US GDP and remains technologically underpenetrated, so the long-run fundamentals support more tech investment.

Start Investing With Logistics & Supply Chain Syndicate

Take 5 seconds. No document uploads.

Beyond the clear dollar return case for building and investing in the space, what is increasingly causing supply chain and logistics to be so dynamic is the baked-in mission. If making sure Americans get the things they need to live good lives and — at a higher level — making sure America has what it needs to thrive in a hostile new world doesn’t excite you, I’m not sure what will. Historically, the sector has been confined to large contractors with specialized knowledge of building practices and/or government processes. That remains an important piece of the ecosystem — but there’s a new generation of fast-moving, motivated entrepreneurs who will shape the next century of American prosperity. They’re who we’re investing in.

Before exploring the sub-sector pillars where we’re deploying capital, it’s worth more thoroughly articulating the key macro insights that underpin our investment outlook.

The 5 Key Macros

Post-Pandemic Boom-Bust

The pandemic induced a massive surge in goods consumption as services shut down, corresponding with a US freight boom. US e-commerce volumes skyrocketed by ~30% in 2020, expanding a vital component of the overall US economy and insulating against a complete crash. As delivery networks became strained, carriers expanded capacity and ordered new trucks, container ships, and inventory. However, by late 2022 and into 2023, a reversal hit: consumer spending rotated back to services, global trade volumes stagnated, and overcapacity sent freight rates plummeting. Freight volumes fell and spot shipping rates dropped, squeezing carrier revenues. Indeed, 2023 saw the collapse of Convoy — the Seattle-based digital freight broker backed by Jeff Bezos and Bill Gates that became a poster child for the sector with a peak valuation of $3.8 billion. By 2024, excess inventory had largely been cleared and the market began rebalancing, though at more normalized growth levels. This whiplash taught shippers and investors a lesson in volatility: supply chains need to be flexible for demand swings, and many are turning to tech (forecasting tools, on-demand warehousing, etc.) to better manage these cycles.

China Diversification and Resource Competition

Logistics is inherently global — and today’s geopolitical currents are having profound effects on how and where goods flow. One major dynamic is the reorientation of global trade networks in response to geopolitical tensions. US-China strategic competition has led to tariffs, export controls (especially on tech items), and a general push by Western firms to diversify away from over-reliance on China. The US-China trade war, initiated under the first Trump Administration and in many ways continued by the Biden Administration, is still largely in effect, with tariffs on hundreds of billions of dollars of goods. We see multinational companies adopting “China+1” strategies — keeping some manufacturing in China but shifting incremental production to Southeast Asia, India, or other locations. India, for example, has gained new smartphone and electronics factories as firms seek alternatives to China; this is reflected in venture funding as well, with Indian logistics startups capturing a growing share of investment in 2023. Vietnam, Thailand, and Indonesia have also seen upticks in export manufacturing. This trend is supported by trade policies: comprehensive agreements like RCEP (Asia) and IPEF (Indo-Pacific Economic Framework) aim to solidify regional supply chains among allied nations. For logistics, this means new trade lanes opening (more intra-Asia and Asia-to-India routes) even as the classic China–US shipping volumes moderate. Ocean carriers and freight forwarders are adjusting capacity — for instance, more direct Vietnam-US routes, and investments in Indian port infrastructure – anticipating sustained growth in those corridors. Nearshoring to Mexico for US supply chains has also accelerated (Mexico now tops China as the US’s largest trading partner in some recent data), thanks to geographic proximity and updated trade agreements. The macro driver here is risk management: over-reliance on any single foreign source is seen as a vulnerability, so supply chains are becoming more regionalized. This has implications for transportation flows — we expect increased north-south freight volumes within North America, for instance, which bodes well for cross-border logistics services and infrastructure at the US-Mexico border.

But diversifying our supply chain is only half of the competitive dynamic at play here: the strategic resource battle is the other core element of the logistics equation. Supply chains for critical minerals like lithium and cobalt, which are used in effectively all modern electronics including EVs, smartphones, military hardware, etc., are under extraordinary geopolitical strain, with countries like China controlling large portions of processing. The process of extracting and refining rare earth minerals was once dominated by the United States. But in part thanks to China’s willingness to accept levels of pollution and environmental degradation unacceptable in the West, we were relatively content to offshore rare earth extraction to China in more peaceful times. Now, the door is open to technological advancements in the sector, allowing it to return to the Western nations that pioneered its technologies a mere 30-40 years ago. Thus, the US and her allies are strategizing to create more secure critical mineral supply lines — through mining investments in Africa and Australia, or recycling. Japan, Europe, and the US are signing partnerships for supply chain security of these resources. Such moves could re-route existing flows (for example, battery production shifting locations) and create new logistics needs (new refineries, new trade lanes for these materials).

Bipartisan Federal Infrastructure Investments

Government stimulus targeted at infrastructure — such as the US $1.2 trillion Bipartisan Infrastructure Law of 2021 — is pumping money into roads, bridges, rail upgrades, ports, and broadband. This should gradually improve the backbone that logistics relies on (less highway congestion, modernized ports with better rail connections, etc.), though these are long-term projects. In parallel, industrial policy like the CHIPS Act and Inflation Reduction Act (IRA) are incentivizing domestic manufacturing (semiconductors, EVs, batteries), which will create new logistics needs as we move more and more raw materials and components internally rather than importing. The Infrastructure Investment and Jobs Act (IIJA) dedicates billions to modernizing ports (to reduce bottlenecks like those seen in Los Angeles/Long Beach), expanding freight rail and intermodal facilities, and improving highways critical for trucking corridors. One notable program is the Department of Transportation’s grants for Mega Projects, which have funded upgrades like expanding capacity at Port of Savannah and rebuilding key freight bottleneck bridges.

The SHIPS Act (Supplying Help to Infrastructure in Ports and Shipyards), introduced with bipartisan support to bolster US shipyards, complements these efforts by strengthening the domestic maritime industrial base. It allocates federal funding and incentives to expand US shipbuilding capacity, modernize repair yards, and enhance naval logistics resilience. The legislation aims to reduce US dependence on foreign shipbuilders — particularly China and South Korea — while bolstering the workforce and supply chains required for commercial and defense vessel production. In doing so, it not only supports the Navy’s fleet readiness but also catalyzes private investment in advanced shipyard automation, propulsion innovation, and maritime materials technology.

As investors, we monitor these policies closely because they reshape the physical and financial architecture of supply chains. Public dollars flowing into transport infrastructure and shipbuilding act as leverage for private innovation — creating tailwinds for startups building the enabling technologies: construction robotics, advanced materials, AI-powered maintenance systems, and digital logistics platforms. The takeaway is clear: government industrial policy is not crowding out private investment — it’s catalyzing it. Understanding how these fiscal flows align with sectoral bottlenecks allows investors to position capital at the inflection points where federal incentive meets private efficiency.

Organized Labor and Trade Uncertainty

The logistics sector has faced labor unrest and talent shortages leading to a number of high-profile labor negotiations in the past two years. Paired with the major shifts in US trade policy under Trump’s second administration, it goes without saying that labor and trade policies influence supply chain and logistics investing. The longshore labor deal on the West Coast in 2023, which provided well-earned wage increases but also set restrictions on automation, is an essential case study. On the trucking side, the implementation of electronic logging devices (ELDs) and stricter Hours-of-Service rules over the past few years has reduced effective driver hours, constraining capacity. Trade policy (tariffs, etc.) affects volume and flows: ongoing tariffs on Chinese goods have led some importers to route more shipments through ports in Mexico or Canada to mitigate costs, thus altering logistics patterns. There’s also border infrastructure to consider — the US-Mexico-Canada Agreement (USMCA, successor to NAFTA) is up for review in 2026, and its continuation (or not) will shape North American trade lanes. As a result of these crosscurrents (and of course others, like the lingering impacts of war in Europe and the Middle East; when violence threatens the Red Sea, for example, shipping companies sometimes opt to reroute ships around the longer Cape of Good Hope route, which can cut global maritime capacity by ~15%), global trade growth overall has slowed from historical averages. The World Trade Organization projected only around 2.6–2.7% growth in merchandise trade for 2024, which represents a modest rate. Protectionist measures are on the rise with a sharp increase across all G20 nations in trade restrictions in recent years. This fragmentation of trade could reduce efficiency (more regionalization, less global scale) but also creates opportunities for localized logistics solutions. The takeaway is that volatility in labor and trade policy directly shapes where and how capital should be deployed. Labor agreements and protectionist trade shifts can act as both friction and catalyst — slowing automation adoption in some areas while accelerating it in others. The winners will be those companies that help enterprises and carriers adapt quickly to these structural shocks. As supply chains become more regional and politically influenced, investors should think in terms of optionality — backing solutions that thrive under multiple trade regimes and can flex with labor dynamics rather than be constrained by them.

A Cleaner Supply Chain

Another global pressure is the push for sustainability and carbon reduction in international transport. The International Maritime Organization (IMO) has implemented new emissions rules — like a sulfur cap and a carbon intensity rule — that force shipping lines to use cleaner fuels or slow-steam to reduce emissions. This is raising costs for ocean carriers — and for a time in 2023, contributed to very high container rates as capacity effectively shrank due to slow-steaming. In aviation, there’s an industry commitment (via ICAO) to net-zero by 2050, and airlines are investing in sustainable aviation fuel (SAF) and newer aircraft. Europe is also introducing a Carbon Border Adjustment Mechanism (CBAM) that will put a carbon price on imported goods like steel and cement; this kind of policy pressures companies to measure and reduce the carbon footprint of their supply chain or face financial penalties. All of this means that globally, logistics providers are not just competing on cost and speed, but increasingly on carbon efficiency. From an investment view, this global trend validates the importance of sustainability technologies, which will be in demand not only in the US but internationally.

In summary, macro dynamics are forcing logistics networks to become more flexible and regionally diversified. The era of hyper-globalization efficiency is ceding to an era of strategic resilience — even if it means extra cost. Companies that can navigate tariff changes, juggle multi-country production, and quickly adjust to conflicts, disasters, or climate change will fare best. As investors, we are drawn to platforms and services that enable that agility, whether it’s software that quickly replans sourcing, or 3PLs that have warehousing ready in multiple regions, or digital freight networks that can find capacity on alternative routes in real time. The intersection of these macros and supply chain is complex, but within that complexity lies opportunity for those solutions that make global trade more shockproof and adaptive.

Start Investing With Logistics & Supply Chain Syndicate

Take 5 seconds. No document uploads.

AV’s 5 Supply Chain Investment Pillars

The above macro dynamics create the scaffolding for where we deploy capital. From that launch point, this syndicate has been meticulously structured around five specific investment areas, each addressing key pain points and technological advancements reshaping global commerce:

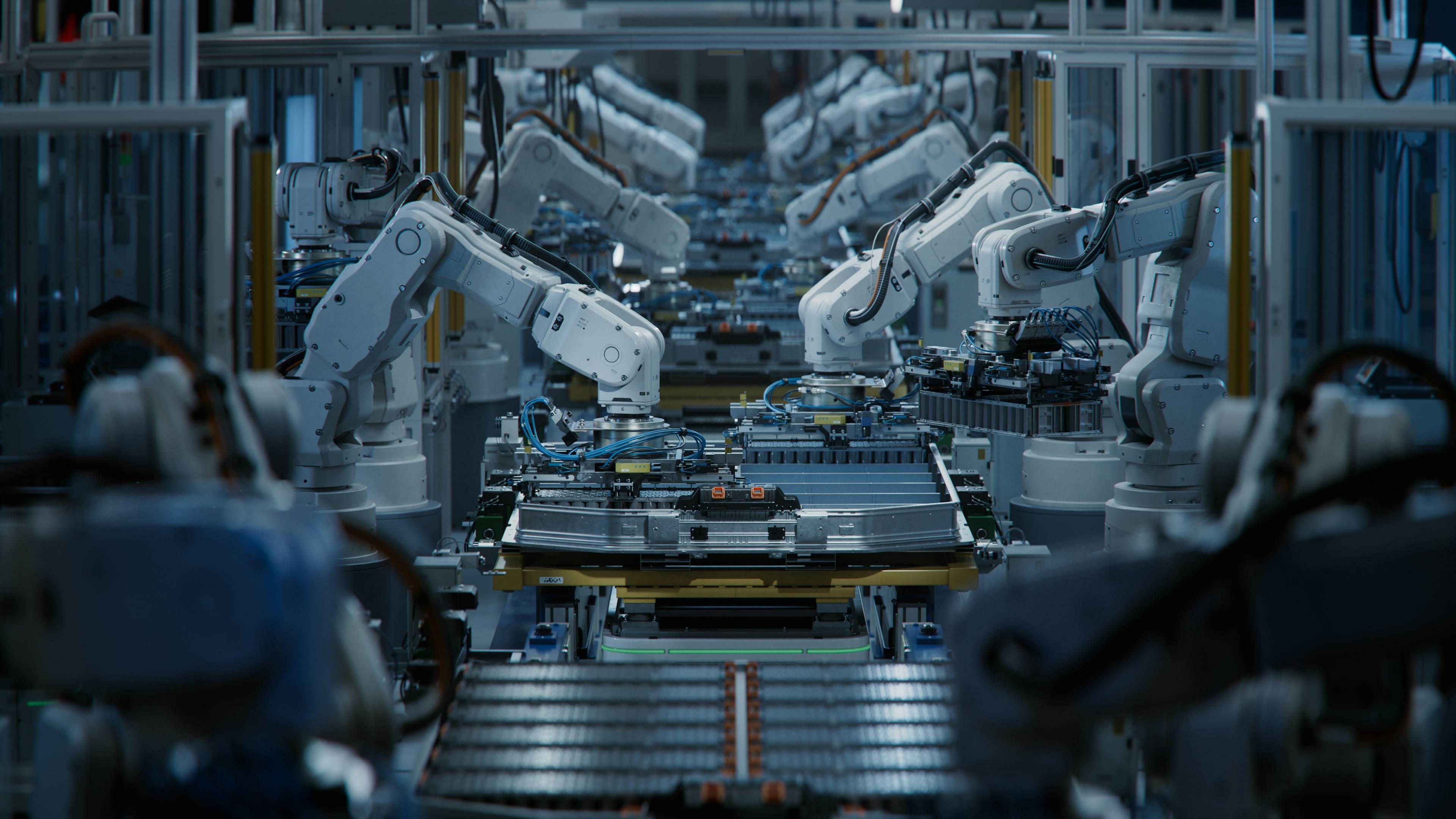

1. Supply Chain Robotics and Infrastructure – Warehouse, Logistics, and Port Automation

From Amazon fulfillment centers to global ports, the automation of logistics infrastructure is accelerating dramatically: nearly half of large warehouses are expected to deploy robotic systems by the end of 2025. Startups are developing autonomous cranes, AGVs (automated guided vehicles) and AMRs (autonomous mobile robots), driverless forklifts, and robotic arms for picking. Commercially, labor shortages and just-in-time pressures make automation critical; robots can work 24/7 without fatigue, offering efficiency gains of 25–30% in many facilities. In 2022, sales of professional service robots for logistics jumped 44%, with over 86,000 mobile robots deployed in transportation and warehousing according to the International Federation of Robotics — and those numbers have been on a steady incline since then. These range from AMRs that ferry inventory across warehouses, to collaborative robots (“cobots”) that assist human workers in picking and packing tasks. Logistics robots have moved beyond pilot phase into scaled operations – for example, Amazon now utilizes nearly a million robots in its fulfillment centers, and 2023 saw headline acquisitions like Rockwell Automation’s $470 million purchase of Clearpath Robotics (maker of warehouse AMRs) to integrate robotics into mainstream industry.

On the defense side, the military faces similar challenges in expeditionary logistics, contested resupply, and throughput at forward operating bases. The overlap lies in ruggedized, adaptable systems capable of operating in chaotic, infrastructure-poor environments. Companies that can modularize and harden logistics robotics will find demand in both Walmart-scale operations and defense-related mobility planning.

Indeed, beyond robotics, infrastructure tech includes innovations in the physical logistics infrastructure. This can mean smarter warehouses and hubs (with IoT sensors, digital twins of facilities for flow optimization, etc.), or tech-enabled infrastructure at ports and borders (like blockchain-based cargo tracking to speed up customs). Governments are investing in digitizing freight corridors: for example, the US Department of Transportation’s new National Freight Strategic Plan emphasizes data-sharing infrastructure so that ports, rail, and trucking operators can coordinate more seamlessly. There’s also growth in hyperloop and high-speed freight concepts; while many are experimental, projects aiming to move cargo in ultra-fast tunnels or via autonomous electric rail are garnering attention for the long term.

2. Advanced Manufacturing – Shipbuilding, Tooling, and Modular Fabrication

The next era of advanced manufacturing — spanning shipbuilding, tooling, modular fabrication, and beyond — is increasingly defined by innovations like digital twins, additive manufacturing, and modular construction. Commercial shipbuilders, rail engineers, aerospace manufacturers, and infrastructure stakeholders face growing pressures from demand volatility and the need for flexible, responsive production capacity. Simultaneously, allied forces are enhancing rapid prototyping, distributed manufacturing networks, and advanced tooling capabilities to sustain fleet readiness and strategic advantage. Startups pioneering composite materials, intelligent welding technologies, automated fabrication systems, and integrated design-to-manufacturing platforms can effectively serve diverse industries. The Department of Defense and allied militaries are increasingly emphasizing dual-use design — encouraging manufacturing standards and digital specifications that allow civilian industrial capacity to be rapidly repurposed for defense production in times of need, such as retooling an auto parts factory to produce missile or drone components. Critically, there is a heightened focus across sectors on strengthening domestic industrial resilience and empowering skilled labor.

This resurgence in manufacturing represents a structural rebalancing of the global industrial map. After decades of offshoring, reshoring momentum in the United States and allied nations is accelerating as both economic necessity and geopolitical imperative. The shift is underpinned by policy incentives — such as the CHIPS and Science Act, the SHIPS Act, and IRA manufacturing credits — that reward domestic production of critical systems and components. In this context, US shipyards, aerospace tooling facilities, and modular construction hubs are evolving into digitally networked, capital-efficient production centers. Where the 20th century industrial base relied on linear supply chains and physical proximity, the 21st-century equivalent relies on data-driven coordination, distributed fabrication, and software-defined quality control.

Manufacturing is no longer a low-margin, capital-intensive slog — it’s becoming a software-enhanced, high-leverage sector. The winners will be those enabling flexibility, speed, and vertical integration across industrial networks. Digital twins, AI-driven planning, and additive manufacturing platforms unlock efficiency across asset-heavy industries once thought impervious to software-led disruption. As global manufacturing realigns, there is an expanding frontier for startups that act as the connective tissue between design, production, and logistics. The opportunity lies in bridging the physical and digital worlds — building the systems that make “Made in America” scalable, smart, and strategically indispensable.

3. Protection of Trade – Intelligence, Surveillance, and Reconnaissance (ISR), Maritime Security, and Threat Mitigation

Geopolitical volatility — from Red Sea drone attacks to narco-submarine activity — has elevated the importance of layered supply chain security. Commercial operators increasingly require real-time intelligence, automated threat classification, and coordination with private maritime security firms. For defense users, these capabilities are foundational to naval operations, maritime domain awareness (MDA), and force protection. There is shared interest in uncrewed escort vessels, AI-powered watch systems, and edge-deployed surveillance tools. The biggest commercial opportunity lies in delivering “security-as-a-service” for shipping firms — bundling threat prediction, convoy optimization, and port intelligence into a SaaS platform. Defense, in parallel, is shifting toward software-first ISR to support distributed maritime ops.

And importantly, maritime defense innovation is not just about moving goods — it is fundamental to America’s economic security and financial supremacy. The US dollar is the world’s reserve currency in part because global trade, denominated overwhelmingly in dollars, flows smoothly under the protection of the US Navy and American maritime logistics infrastructure. If America loses control over critical shipping routes — whether in the Indo-Pacific, the Arctic, or the South China Sea — the reliability of dollar-backed trade weakens, opening the door for competing currencies like China’s yuan to gain influence in global transactions.

Beyond currency, securing maritime supply chains ensures the US economy remains more resilient than most against geopolitical shocks. In an era where supply chain disruptions can trigger inflation spikes, industrial slowdowns, and national security vulnerabilities, investing in maritime innovation is not just a competitive edge, but it is a national security and strategic imperative.

History teaches us this: when a dominant naval power steps back, chaos fills the void. Indeed, Pax Britannica’s decline helped fuel the arms races and rivalries that set the stage for the First World War — and the upheavals that followed. If America abdicates its role in securing maritime trade, we should expect not just economic disruption but geopolitical upheaval on a scale unseen in generations. In a new era of great power competition, investment in maritime innovation is not just a glaring financial opportunity but is perhaps the clearest way to contribute to America’s strategic position and technological leadership.

4. Propulsion – Energy Systems, Fuels, and Efficiency

A wave of innovation is transforming how far, fast, and efficiently goods can be transported — from cleaner fuels like ammonia and hydrogen to fully electric propulsion and hybrid configurations. Commercial fleets face mounting pressure from the IMO and EU to decarbonize and disclose their emissions footprints. Macro pressures are forcing civilian and defense fleets alike to focus on energy security, platform endurance, and reducing logistical vulnerability. Dual relevance is emerging in areas like battery optimization, alternative fuel bunkering infrastructure, and waste-heat recovery systems. Startups working on smart energy management, long-range electric drives, or small-scale nuclear propulsion (like micro-reactors) are well-positioned to serve both the commercial “green shipping” market and strategic maritime mobility needs.

On the freight side, a tectonic shift toward electrified and low-emission transportation is underway across freight modes. After decades of diesel domination, battery-electric and other zero-emission vehicles are finally reaching viability for commercial logistics. In 2023, electric truck sales worldwide jumped 35% compared to the prior year — a remarkable growth rate — and this momentum is only set to increase. Leading logistics fleets (UPS, DHL, FedEx, Amazon) as well as trucking manufacturers have committed to aggressive timetables for fleet electrification. For example, Amazon is rolling out tens of thousands of electric delivery vans (through its partnership with Rivian), and major truck OEMs like Volvo, Daimler, and Tesla have delivered electric heavy-duty trucks for regional haul use. Driving this trend (pun intended) are ambitious environmental policies: in the US, new EPA greenhouse gas standards and California’s Advanced Clean Trucks point toward a major fleet transition — the EPA projects that up to 60% of new heavy-duty truck sales could be zero-emission by 2032, while California’s rule explicitly requires 40–75% (depending on class) by 2035. And in Europe, CO₂ standards aim for a 90% reduction in truck emissions by 2040. These regulations essentially lock in an electric future for freight transport, making it a ripe space for investment.

5. AI – Predictive Supply Chains

If data is the new oil, then logistics — with its billions of shipments, vehicles, and orders — is one of the richest fields to tap. Artificial intelligence is increasingly the “brain” of modern supply chains, enabling a shift from reactive operations to predictive, self-optimizing ones. This is a broad area, touching everything from demand forecasting to dynamic routing. On the demand side, AI-driven forecasting systems ingest vast amounts of data (historical sales, market trends, weather, social media signals) to predict customer demand with far greater accuracy. This helps companies optimize inventory levels and placement, reducing stockouts and overstocks. Many retailers and CPG firms adopted AI forecasting after the wild demand swings of the pandemic, and it’s now paying dividends in smoother operations.

In transportation, AI-powered route planning and network optimization are boosting efficiency. Machine learning algorithms can compute optimal multi-stop routes for delivery trucks, adjusting on the fly for traffic or delays, far beyond what human dispatchers could do in real time. For example, Walmart’s in-house AI logistics system optimizes truck loading and routing: it avoided 30 million unnecessary driving miles and eliminated 94 million pounds of CO₂ by intelligently mapping deliveries and backhauls. Walmart was so successful that in 2024 it began offering this AI route optimization as a SaaS product to other shippers.

Another critical AI application is supply chain visibility and risk prediction. Companies like Project44 and FourKites (which have grown into unicorns) use AI to aggregate real-time data on shipments across trucks, ships, planes, etc., giving shippers a live map of their supply chain. And beyond visibility, AI can predict downstream disruptions — for instance, forecasting that a late port arrival will likely cause a factory line halt next week, or detecting patterns that indicate a supplier may default on deliveries.

During the past year, we’ve seen AI help companies anticipate and mitigate disruptions from weather events, port congestion, and even geopolitical shifts (by simulating “what-if” scenarios and suggesting alternate sourcing or routing). Generative AI is also starting to play a role: logistics teams are exploring use of gen-AI to automate customer communications (“Where’s my order?” inquiries), generate routing plans based on natural language prompts, or analyze procurement contracts. While still early, the breadth of AI’s impact is evident: there are currently over 500 startups tackling AI in logistics. Our conviction is that AI will be the differentiator between winners and losers in this sector. From an investment standpoint, the opportunity space ranges from horizontal enterprise software to deeply vertical AI solutions tailored to freight, making this a rich area to back innovators.

In sum, we’re bullish on any technology that helps squeeze out inefficiencies in how goods flow. The reality is that logistics networks often run well below optimal efficiency (trucks running empty 20%+ of miles, ships waiting at anchor for berths, etc.). By investing in route optimization algorithms, real-time visibility platforms, and integrated infrastructure tech, we can unlock latent capacity in the system. The outcome is not just cost savings and higher profits but also reduced environmental impact (as optimized routes mean fewer miles and less fuel burned) and service of the national interest. As the sector modernizes, we foresee a future where moving goods from point A to B is orchestrated by data and AI and executed by autonomous vehicles across truly 21st-century infrastructure — maximizing utilization of every truck, warehouse, and container along the way.

Start Investing With Logistics & Supply Chain Syndicate

Take 5 seconds. No document uploads.

Now Is The Time

The sector’s outsized economic role, combined with urgent new demands for speed, efficiency, sustainability, and resilience, create a “perfect storm” of opportunity for technology-driven transformation; that is clear as day. And North American logistics startups are where the action is happening: as recently as 2023, startups in the continent drew ~43% of global logistics funding (up from 30% the year before), as investors squarely refocused on US supply chain modernization. A decade ago, Chinese startups in the logistics space gave American innovators a run for their money… This is no longer the case. China’s tech crackdown over the past several years has severely dampened investments in Chinese logistics startups.

And the results speak for themselves. The mega-carriers, like Amazon, UPS, FedEx, DHL, and Maersk, are doubling down on tech acquisitions and integration. Amazon continues to build out its end-to-end logistics empire — from a growing private air cargo fleet to ocean freight forwarding services – effectively becoming a third-party logistics provider (3PL) in addition to serving itself. It also acquired autonomous warehouse robotics firms (like Canvas Technology in 2019) and is investing in last-mile robotics and EVs (Rivian vans, Zoox autonomous vehicles). Maersk — a global ocean shipping leader — has made arguably the boldest strategy shift: acquiring a string of logistics companies (warehousing, last-mile firms, e-commerce fulfillment specialists) to transform into an end-to-end integrated logistics provider. Since 2021, Maersk spent billions acquiring companies like Pilot Freight (US trucking and logistics), LF Logistics (Asia warehousing), and others, essentially moving well beyond its ocean roots. This reflects the trend of shippers wanting single-provider solutions and the value of door-to-door control.

We mentioned Convoy, but on the flip side, Flexport — the digital freight startup focusing on international logistics — continues to expand its footprint in global freight. Flexport raised a $260 million round in 2023 (convertible note from Shopify as part of a deal for Shopify’s logistics assets), underscoring that investors see great value in its platform. Flexport’s vision of a highly automated, cloud-based forwarding service is something many in the industry are watching (and incumbents are trying to emulate).

Several sector-specific unicorns and soonicorns have emerged in recent years. In supply chain software: Project44 and FourKites, which specialize in real-time shipment visibility, each reached multi-billion-dollar valuations with big funding rounds (Project44 raised $420 million in 2022). In warehouse robotics: companies like Locus Robotics (autonomous warehouse carts) hit unicorn status after deployments in big-name retailers’ warehouses; and Fetch Robotics was acquired by Zebra for $290 million in 2021, validating the space. 2023 saw some significant M&A in robotics/automation: as mentioned, Rockwell Automation acquired Clearpath Robotics (including its OTTO Motors division for autonomous forklifts) for an estimated $500–600 million.

The story is clear: lucrative exit opportunities abound for venture-backed leaders in this fast growing, pain-point riddled space. It is precisely for this reason that Alumni Ventures is investing at the very forefront. We see supply chain innovation not as a niche trend, but as a generational replatforming of the physical economy — one that rivals the software revolution of the past two decades. This is not just an opportunity to generate returns — it’s an opportunity to rebuild the backbone of American competitiveness. The convergence of automation, data intelligence, and industrial resilience will define the next century of global commerce, and the companies that build the connective infrastructure of this new world will define its winners.

Join Us (For Free)

Start Investing With Logistics & Supply Chain Syndicate

- Home

Easy Sign-Up

Click a button. 5 seconds. - Home

No Obligation to Invest

Only invest in deals you like. - Home

Co-Invest with Elite VCs

Frequent co-investors include a16z, Sequoia, Khosla, Accel, and more. - Home

Deal Transparency

Due Diligence and Investment Memos provided. Live Deal discussions with our investment teams.

This communication is from Alumni Ventures, a for-profit venture capital company that is not affiliated with or endorsed by any school. It is not personalized advice, and AV only provides advice to its client funds. This communication is neither an offer to sell, nor a solicitation of an offer to purchase, any security. Such offers are made only pursuant to the formal offering documents for the fund(s) concerned, and describe significant risks and other material information that should be carefully considered before investing. For additional information, please see here. Achievement of investment objectives, including any amount of investment return, cannot be guaranteed. Co-investors are shown for illustrative purposes only, do not reflect all organizations with which AV co-invests, and do not necessarily indicate future co-investors. Example portfolio companies shown are not available to future investors, except potentially in the case of follow-on investments. Venture capital investing involves substantial risk, including risk of loss of all capital invested. This communication includes forward-looking statements, generally consisting of any statement pertaining to any issue other than historical fact, including without limitation predictions, financial projections, the anticipated results of the execution of any plan or strategy, the expectation or belief of the speaker, or other events or circumstances to exist in the future. Forward-looking statements are not representations of actual fact, depend on certain assumptions that may not be realized, and are not guaranteed to occur. Any forward-looking statements included in this communication speak only as of the date of the communication. AV and its affiliates disclaim any obligation to update, amend, or alter such forward-looking statements, whether due to subsequent events, new information, or otherwise.