Seeding the Future: Smarter Seed Investing

Our “Seeding the Future” series explores trends, opportunities, and companies from the seed and pre-seed venture world. This is the investment focus of AVG’s newest Basecamp Fund. The fund is now open! Click below to learn more.

Next time a friend or relative approaches you for that brilliant, one-off seed investment, we have a perfect response for you. “Thanks, but I’ve already got a full portfolio there.”

Beyond the emotional baggage and risks to friend/family dynamics, investing in your relative’s random, one-off seed investment is basically buying an expensive lottery ticket. Venture capital is a high-risk, high-reward asset class best described as a “hits business.” Especially when you’re committing to seed stage companies, investors should know how to turn “betting” into “investing.”

AVG’s Four Rules of Seed Investing

Seed investing is attractive due to market inefficiencies, lower investment minimums, and the potential for compounding. To help optimize the odds of winning and mitigating the risks at this stage, consider incorporating these four key strategies:

- Power law investing

- Portfolio theory

- Systematic evaluation

- Disciplined follow-on

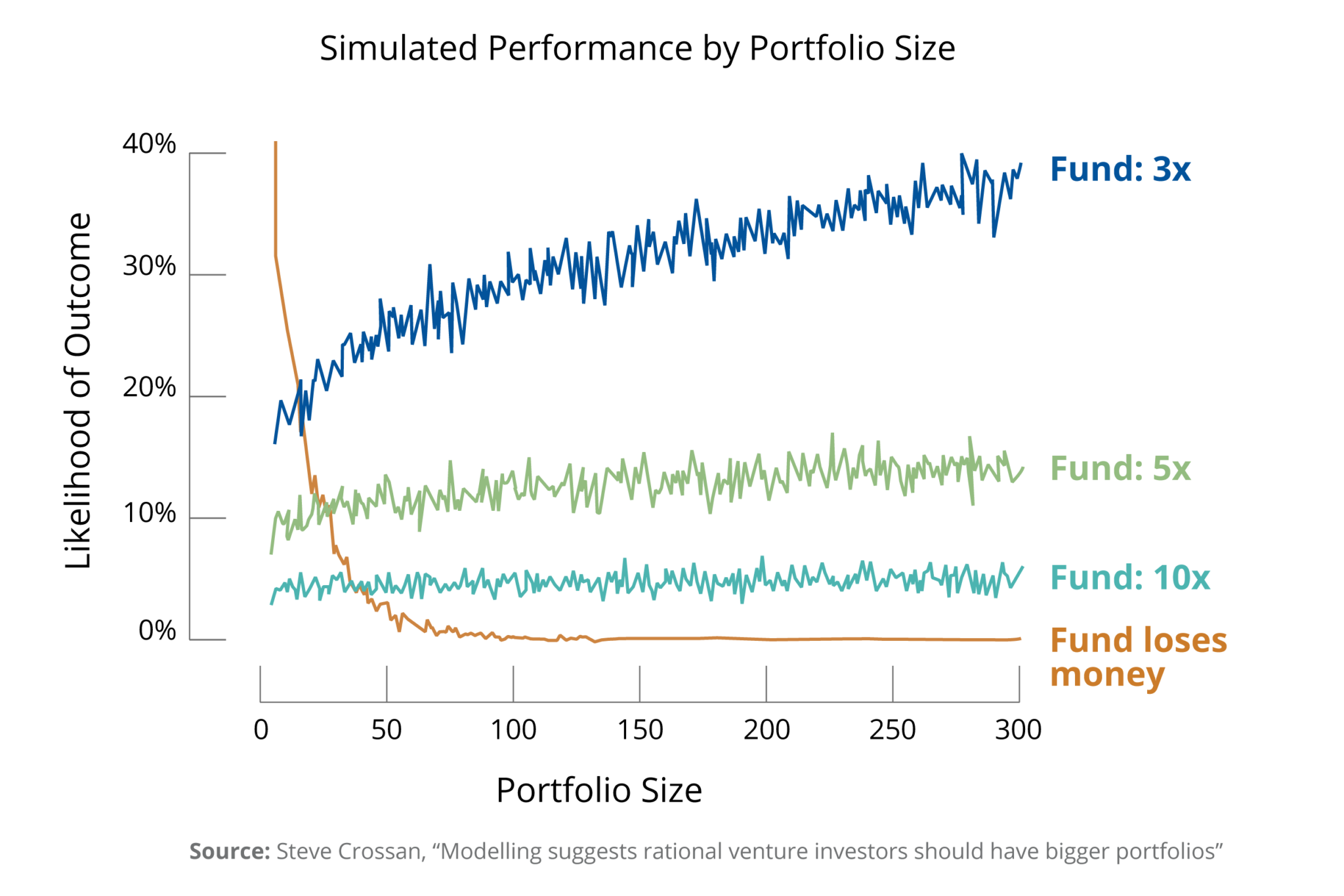

1. The power law is particularly applicable in seed investing. Simply put, the idea is that investing in many deals gives you a better chance of not missing the best-performing opportunities that more than repay your failures and also-rans.

Per this Kauffman report, “The typical investor with a 100-investment portfolio outperforms the typical investor with a single investment by almost 9% a year.” Further, investors with large portfolios focusing on deals at the very earliest stage “get a high density of unicorns (about 1%). Investors in later rounds make less money and struggle to beat the S&P.”

2. Portfolio theory states that “portfolio diversification can reduce investment risk.” For a seed investor, that means spreading investments across different sectors, geographies, and lead investors to mitigate against risk. This is particularly important given that most individual seed investing tends to be hyperfocused around a city (usually your locality), sector (only software), or syndicate (Y Combinator deals only).

3. Process-based investing is another recommended guideline for seed investors. As Atul Gawande articulates it, checklists or frameworks are valuable ways to solve complex problems — like which deals to invest in. This blog indicates the variety of frameworks that can be applied to investments. The key things are to thoughtfully prep the framework, measure results, evolve, AND apply it consistently.

4. Monitor your portfolio so you can “chase winners” is another sound seed investing strategy. Seed investing has a high mortality rate, but the winners start to appear after a year or two. Methodically cut your losers and pursue the top-performing investments in your portfolio through application of reserves to “pile on the best.”

Investing in a Large Seed Stage Portfolio

These four concepts describe AVG’s approach to seed investing. If you aren’t properly allocated to this asset class and these ideas resonate with you, check us out.

Our Basecamp Fund offers a deep portfolio of ~100-200 deals, diversified by sector, region, and lead investor. Though we leverage the diligence of the lead investors, who are experts in the sector, we also rigorously vet and score every deal using the same scorecard. In addition, we reserve ~25% of the fund for follow-on investing.

Whether you join us or decide to construct your own seed portfolio, we hope you’ll keep these concepts in mind. For more about AVG’s approach to seed investing, explore our Basecamp Fund website.

AVG’s Basecamp Fund offers investors a portfolio of ~100 pre-seed and seed investments diversified across sector and region. Approximately 25% of the fund is reserved for follow-on investments. Minimum starts at $25K. The fund is now open! Click below to learn more.

Contact [email protected] for additional information. To see additional risk factors and investment considerations, visit avg-funds.com/Disclosures.