Venture-Backed Companies Driving Deep Tech Innovation

Exploring key trends and venture opportunities in the Deep Tech space

Alumni Ventures’ Deep Tech Fund will invest in a portfolio of diverse startups solving technically complex problems.

From developing safe, net-zero energy solutions to planning and implementing the future of man-made infrastructure in low-earth orbit, these startups employ precision engineering, bleeding-edge scientific discoveries, and visionary entrepreneurship to reshape the world.

An Introduction to Alumni Ventures’ Deep Tech Fund

See video policy below.

Deep tech investments cover a wide variety of industries, nearly all of which are growing at blistering rates. For example, the U.S. defense and aerospace industry alone was estimated to have grown from $416 billion to $550 billion from 2020 to 2021. As countries turn to renewable and clean energy, that industry too has seen incredible growth and is forecast to reach $1.9 trillion by 2030. In short, the demand for science-backed solutions to complex problems is at an all-time high.

Below you’ll find sample investments from AV’s existing Deep Tech portfolio that illustrate the types of high-potential companies we will source for this year’s fund.

Deep Tech Fund 3 Closing Soon

Alumni Ventures’ Deep Tech Fund offers a portfolio of ~20-30 diverse companies tackling the toughest and potentially most lucrative tech challenges. Recent events have underscored the critical importance of science and rational thought for the well-being of society and the planet. To learn more, click below to review fund materials or book a call with a Senior Partner.

Aviation

A slew of technological advances has transformed the aviation and transportation industries over the past few decades, including composite materials, lightning-fast software, and alternative energy sources. Startups are working to integrate these advances into everyday air travel, safeguard aircraft from drones, and increase the reliability and safety of both airplanes and terrestrial vehicles. VCs and industry leaders share an interest in supporting sustainable aviation solutions. In October 2021, Cathie Wood (CEO of Ark Invest), Woven Capital, Alaska Air Group, and others launched a $230 million fund for affordable alternative air transportation.

Region: California

Investment Stage: Seed

SkySafe’s security system protects airspace from drone attacks or surveillance. Using advanced radio tech, reverse engineering, and deep threat analysis, SkySafe detects and controls malicious and reckless drones and provides tools to safely operate authorized drones.

Region: California

Investment Stage: Series A

ZeroAvia is the developer of electric powertrains for aviation. The company uses hydrogen fuel cells to lower fuel and maintenance costs, resulting in up to 50% total trip cost reduction compared to traditional jet powertrains.

AI and Robotics

Some of the most critical advances in recent years were made possible by the hand-in-hand development of artificial intelligence and robotics. The collaboration between these fields has resulted in unprecedented capabilities of autonomous systems, ranging from welding robots on automobile assembly lines to self-driving vehicles and disaster response drones. The demand from manufacturers, governments, and private organizations resulted in VCs investing over $75 billion in AI-adjacent startups in 2020 alone. Investments in robotics alone were $15 billion in 2021.

Region: Pennsylvania

Investment Stage: Seed

Ghost Robotics designs and manufactures legged, unmanned ground vehicles for defense, industrial, and academic markets. Their robots are designed with limited mechanical complexity to increase durability, agility, and battery life while lowering capital and operating costs.

Region: California

Investment Stage: Seed

RIOS is reinventing factory automation. They are helping enterprises automate their entire factories, warehouses, or supply chain operations by deploying AI-powered end-to-end robotic work cells.

Clean Energy

Spurred by spiking global temperatures, regional conflicts, and a desire for energy independence, clean and renewable energy startups have steadily attracted significant capital. In 2021, private investment in renewable energy reached the highest levels since 2008, according to data compiled by Mercom Capital Group. The same report saw investment in U.S. solar startups top $4.5 billion in 2021, nearly triple the amount raised in 2020. As the urgency to head off the effects of global warming builds, we expect the momentum in this area to only grow with time.

Region: California

Investment Stage: Series A

Sepion Technologies combines the latest in nanoscience, polymer chemistry, and cell engineering to deliver lithium-metal batteries. These innovative batteries offer comparable performance, economic, and environmental benefits to incumbent lithium-ion technology.

Region: Maryland

Investment Stage: Series B

X-energy develops commercial nuclear reactors, giving users access to zero-emission energy that is safe, reliable, secure, and affordable. Their high-temperature, gas-cooled nuclear reactors are smaller, simpler, and meltdown proof when compared to conventional nuclear designs.

Cybersecurity

While the digital age ushered in an unparalleled level of interconnectivity and global communication, it also heralded the arrival of new types of scams, infrastructure vulnerabilities, and identity fraud. In 2020 alone, hackers caused nearly $1 trillion worth of damage per expert estimates. Beyond monetary damage, global organizations have decried the existential threat that disinformation and cyberattacks by both government and non-governmental actors pose to democracies. These forces have created a heightened and sustained demand for cybersecurity solutions.

Region: California

Investment Stage: Seed

Appaegis offers a secure, agentless, zero-trust solution that connects authorized users and devices to enterprise applications. Their cloud-native solution integrates with existing workflows and security infrastructure to block attacks and provide customers insight into user behavior.

Region: England

Investment Stage: Series A

Qredo uses the latest innovations in cryptography and distributed ledger technology to deliver unique solutions for securing and trading digital assets. Qredo’s decentralized custodian protocol incorporates compliance and governance controls into its consensus mechanism.

Region: California

Investment Stage: Series B

Secureframe’s platform automates the compliance certification process for software companies — streamlining SOC 2, ISO 27001 (international SOC 2), and HIPAA certifications. This helps boost revenue for fast-growing SaaS startups looking to sell software to large customers.

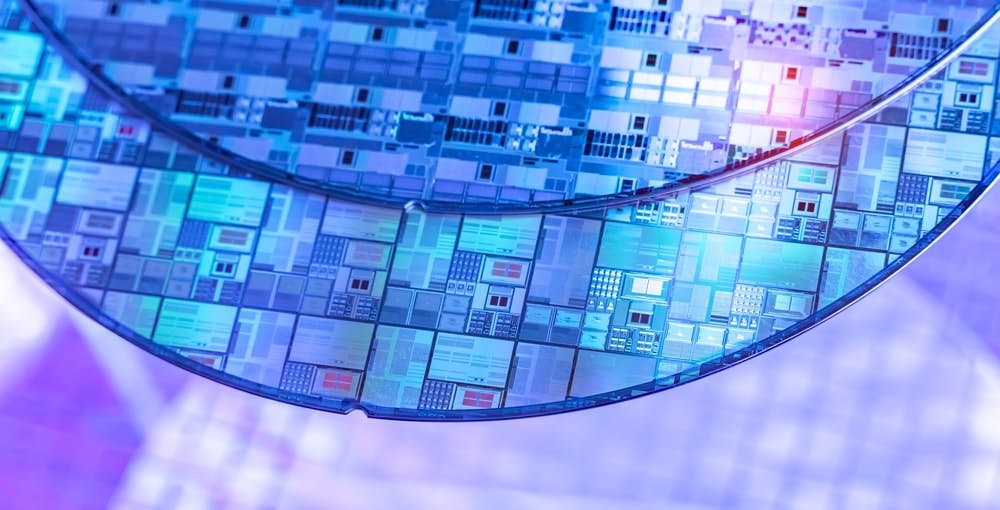

Quantum Computing

Quantum computing promises a revolutionary leap in data processing capabilities. Quantum computers possess incredible potential in cryptographic security, artificial intelligence, complex physics simulations, and more. As a result, quantum computing will impact virtually all industries and sectors in the next few decades. IDC projects customer spending for quantum computing to grow from $412 million in 2020 to $8.6 billion in 2027 — a six-year CAGR of 50.9%.

Region: Israel

Investment Stage: Series B

Classiq provides developers quantum software that can be seamlessly deployed on quantum clouds and hardware devices of the developer’s choice. Its patented platform delivers the higher-level abstraction needed to enable the creation of scalable, industrial-grade quantum circuits — turning months into minutes of work.

Region: Israel

Investment Stage: Series B

Quantum Machines (QM) has developed hardware and software platforms that increase the productivity of quantum computers. QM’s products streamline control and communication with quantum computers — intuitively simplifying complex algorithms while optimizing computer performance.

Region: California

Investment Stage: Series B

Rigetti is a full-stack quantum computing company. It is focused on designing and manufacturing superconducting quantum integrated circuits and developing software for quantum computing and integrating their systems into a cloud infrastructure.

Space Exploration

Space travel has experienced a renaissance in recent years, spurred on by the likes of SpaceX, Blue Origin, and Virgin Galactic. Privately held companies are pushing the state of the art forward, using advanced manufacturing techniques, rigorous testing, and precise engineering. The result is a collection of rapidly growing industries, including space tourism. Statista forecasts the space industry will reach $239 million by 2031. Quilty Analytics estimates that the market for communications satellites alone is around $22.5 billion, and is projected to grow further over the next five years.

Region: Texas

Investment Stage: Series B

Axiom Space is making life and work in space a reality, catalyzing innovations for life on Earth, and enabling the exploration of deep space. They provide crew missions to the International Space Station while building the commercial space station of tomorrow.

Region: Washington

Investment Stage: Seed

Radian Aerospace is developing space systems to carry passengers to low Earth orbit and back. Their products and capabilities give commercial and government customers easy access to orbital space planes.

Region: Washington

Investment Stage: Seed

Xplore is a Space-as-a-Service company that provides hosted payloads, communication relay services, and exclusive datasets to its customers via the Xcraft®, the company’s multi-mission spacecraft. Xplore gathers data by combining multiple sensors on the same spacecraft resulting in dramatic cost advantages versus single-sensor satellites.

Deep Tech Fund 3 Closing Soon

Alumni Ventures’ Deep Tech Fund offers a portfolio of ~20-30 diverse companies tackling the toughest and potentially most lucrative tech challenges. Recent events have underscored the critical importance of science and rational thought for the well-being of society and the planet. To learn more, click below to review fund materials or book a call with a Senior Partner.

Contact [email protected] for additional information. To see additional risk factors and investment considerations, visit av-funds.com/disclosures.