Chestnut Street Ventures’ Fund and Syndicate

Venture Investing With Fellow Penn Alums

What It Is

A private investing community for Penn alums, featuring both a diversified venture fund and deal-by-deal syndications. Chestnut Street invests in cutting-edge ventures, co-invested alongside leading venture capital firms. Members have access to venture deals with low minimums and due diligence sharing on each deal. Chestnut Street is built on the premise that we do better together.

Who It Is For

Accredited Penn alumni who want strategic exposure to venture capital. Ideal if you believe in innovation, technology and entrepreneurship—and you value investing with fellow alums (alongside leading venture capitalists).

Take 5 seconds. No document uploads.

It’s All About Access to Life-Changing Deals

You Get Access to Deals Led by Top VC Firms: Quality, Quantity, Diversification.

Customize Your Venture Portfolio

Build a venture portfolio to fit your goals. Alumni Ventures invests across stages and geographies, co-investing with elite firms.

- Home

Pre-seed to Later-Stage

We invest at a variety of stages, always evaluating upside vs. price. - Home

Diverse Geographies + Leads

We look for great deals everywhere and co-invest alongside a wide variety of strong lead VC firms. - Home

Due Diligence by Alumni Ventures

America's Largest Venture Firm for Individuals and an “America’s Top 20 Venture Capital Firm of 2025” (Time ’25). - Home

Favorite Sectors? We’ve got you Covered

Interested in Medicine 3.0? Strategic Tech? Women’s Founders? Early Stage AI Deals? Customize the fund and deals you want to see and add your portfolio - Home

You Decide

Invest in funds for maximum coverage. Invest deal-by-deal for maximum exposure.

Co-Invest With Elite VCs

The best ventures have their pick of lead investors — it only makes sense to invest alongside them. These firms have co-invested in many deals with Alumni Ventures:

- Home

Andreessen Horowitz

51 investments with AV - Home

Sequoia

25 investments with AV - Home

Bessemer Venture Partners

22 investments with AV - Home

Y Combinator

56 investments with AV - Home

Founders Fund

28 investments with AV - Home

Kleiner Perkins

23 investments with AV - Home

Khosla Ventures

56 investments with AV

Getting Started with Us

How You Want to Partner With Us Is Up to You.

Our Fund

- Home

Simplest Way to a Startup Portfolio

An annual fund of 20-30 high-quality diversified investments — offering you the most efficient way to build a large portfolio. - Home

Diversification Across Many Dimensions

Diversification across sector, stage, geography, and lead investor — mitigating risk while capturing the potential upside of breakthrough innovations. - Home

Leave It up to Us

Our team gets up every day to strategically deploy your capital over ~12-18 months, reserving ~20% to pursue follow-on opportunities in the most promising portfolio investments.

Our Syndicate

- Home

Real-Time Deal Flow

You see deals as we see them - about a deal a month (it ebbs and flows). Deals move fast and sometimes fill up. - Home

Access to Our Diligence Portal

Access due diligence and view "Why We Are Investing" video briefs. - Home

Hands-On Capital Management

You decide which investment opportunities are right for you and how much to invest.

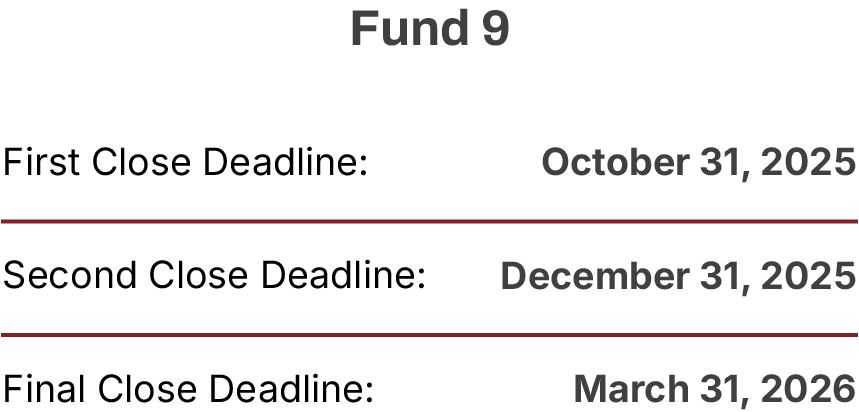

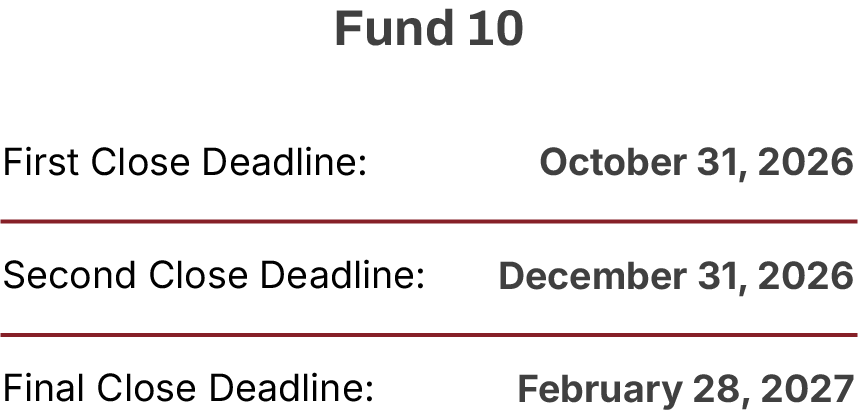

Timeline for the Annual Chestnut Street Fund

Take 5 seconds. No document uploads.

About Alumni Ventures

- Home

Top-Tier and Battle Tested

PitchBook names AV the #1 most active VC in the U.S. (’22–’23) and CB Insights slots us in its 2024 Top 20; our 2016-20 funds sit in Cambridge Associates’ top-quartile performance ranks. - Home

Diversification From Day One

$1.4B+ deployed across 1,400+ venture-backed companies, with ~250-300 new investments added annually; diversification spreads risk and upside across stage, sector, and geography. - Home

Co-Investing With the Best

AV routinely co-invests alongside leading venture firms such as Andreessen Horowitz, Sequoia, and NEA, giving you the benefits of their negotiated terms and their support to portco companies. - Home

Network You Can Lean On

11,000 accredited investors and an 850,000-strong alumni & entrepreneur community create proprietary deal flow, talent pipelines, and follow-on capital impossible to assemble alone. - Home

Dedicated, Nationwide Team

40 full-time venture professionals spread across five U.S. offices source 50-75 fresh opportunities each quarter, vet them rigorously, and present only the deals we commit to doing for our funds.

See video policy below.

Meet the Team

Your classmates and community members who wake up everyday to assemble a great venture portfolio.

- Investment Team

- Investment Committee

- Venture Fellows

- AV Support Team

Chestnut Street Ventures Content & News

Content at the intersection of entrepreneurship, venture capital, and our shared alma mater.

The Chestnut Street Portfolio

We invest alongside other established venture firms in a broad range of ventures to help build you a diversified venture portfolio.

- 5x

- Accolade

- Active Protective

- Activeloop

- Aethero Space

- Agile Stacks

- Air Company

- Allevi

- Arcadia Power

- Arcus

- Arris Composites

- Astro Mechanica

- Atom Computing

- Aurora Insight

- Avalanche

- Bainbridge Health

- Base Venture

- Beam Benefits

- BEGin

- BetterView

- BlueQubit

- BlueX Trade

- Brightside

- Burrow

- Canvas Construction

- Capella Space

- CarbonCapture

- Casper

- Celularity

- Centaur.ai

- Certa

- Chef Robotics

- Circle

- CNEX Labs

- Common Bond

- ControlRooms

- Cornelis Networks

- Cosy

- Data.World

- Dataminr

- Deserve

- Dextrous Robotics

- Diem

- Dirac

- Dog Spot

- Domo

- Downstream Impact

- Duplo

- Eclypsium

- Endolith Mining

- Enfabrica

- Esports One

- Excision Bio

- Expo

- Fabric

- FarmWise

- Fleet Space Technologies

- Flex Index

- FreeWire

- Freshly

- Ghost Robotics

- Haiqu

- HawkEye 360

- Heading Health

- Headroom

- Hercules AI

- High Brew Coffee

- Highlight

- Honor

- HopSkipDrive

- Hyperion Biosystems

- Iambic

Interested in Seeing Elite Venture Deals (for Free)?

Sign up and receive a $50 credit to the AV Swag Store, full of high-end men’s and women’s apparel and accessories.

- Home

Easy Sign-Up

Click a button. 5 seconds. - Home

No Obligation to Invest

Only invest in deals you like. - Home

Co-Invest with Elite VCs

Frequent co-investors include a16z, Sequoia, Khosla, Accel, and more. - Home

Deal Transparency

Due Diligence and Investment Memos provided. Live Deal discussions with our investment teams.