Education 2.0: From Promise to Proven Playbooks

Creating the Alumni Ventures Education 2.0 Community and Syndicate

A 10th grader opens her phone after practice. For pennies a day, an AI tutor watches her solve two algebra steps, spots the exact misconception, and rewrites the next problem on the fly — no waiting, no shame, faster progress. Now put that next to the classroom we’ve known since 1925: one teacher, 30 students, one pace. That gap represents the once-in-a-century opportunity to rewire a $6 trillion global education and training market with AI.

Alumni Ventures wants to invite you to be part of that opportunity. We’re launching the AV Education 2.0 Community & Syndicate so you can back the first winners across K‑12, higher‑ed, workforce, and language learning to take advantage of this AI revolution.

Why This Wave Is Different

Unprecedented market dynamics are converging with the transformative power of AI, fundamentally reshaping the education landscape in ways previously unimaginable. This new wave of innovation promises to unlock personalized and scalable learning experiences that address long-standing challenges in the sector in four key ways.

Personalization got cheap.

Large‑language and multimodal models can give instant, tailored explanations and step‑by‑step feedback that used to require a human tutor.

Why it matters: AI models have better unit economics than older solutions. A cheap monthly subscription can deliver meaningful progress without hiring costly 1:1 help.

Investor lens: Keen investors should be on the lookout for products that show their work, adapt within the teaching sessions, and improve outcomes in weeks, not semesters.

People will pay for progress.

Parents, adult learners, and employers are opening wallets to close skill gaps, win scholarships, or speed onboarding.

Why it matters: This clear willingness‑to‑pay creates room for business models that convert from freemium to paid and boosts expansion on seat‑based SaaS.

Investor lens: Investors should prioritize products that tie usage to a goal (grade improvements, certifications, promotions) and can prove it, demonstrating valuable and direct benefits to customers.

Platforms are reaching learners directly.

App stores, social video, and creator partnerships let startups bypass educational district sales cycles that can take up to 12-24 months.

Why it matters: Direct-to-consumer (D2C) models, like with Duolingo, show that demand can be cultivated more easily and converted to paying customers faster than trying to navigate longer institutional sales cycles.

Investor lens: D2C traction can pre-empt later B2B channels, so investors should watch for classroom adoption that follows student demand.

Data compounds an unfair advantage.

Every interaction users have with the underlying technology and AI models (voice snippets, usage statistics, engagement patterns) can be fed back into training and adding additional context, which improves later recommendations and error diagnosis.

Why it matters: Technologies that constantly refine and improve themselves with greater usage deepen their competitive advantages as they scale, compounding their moats.

Investor lens: Investors should look for ventures that not only provide superior results but can also protect their advantages against increasingly sophisticated and common AI models.

What the Winners Have in Common

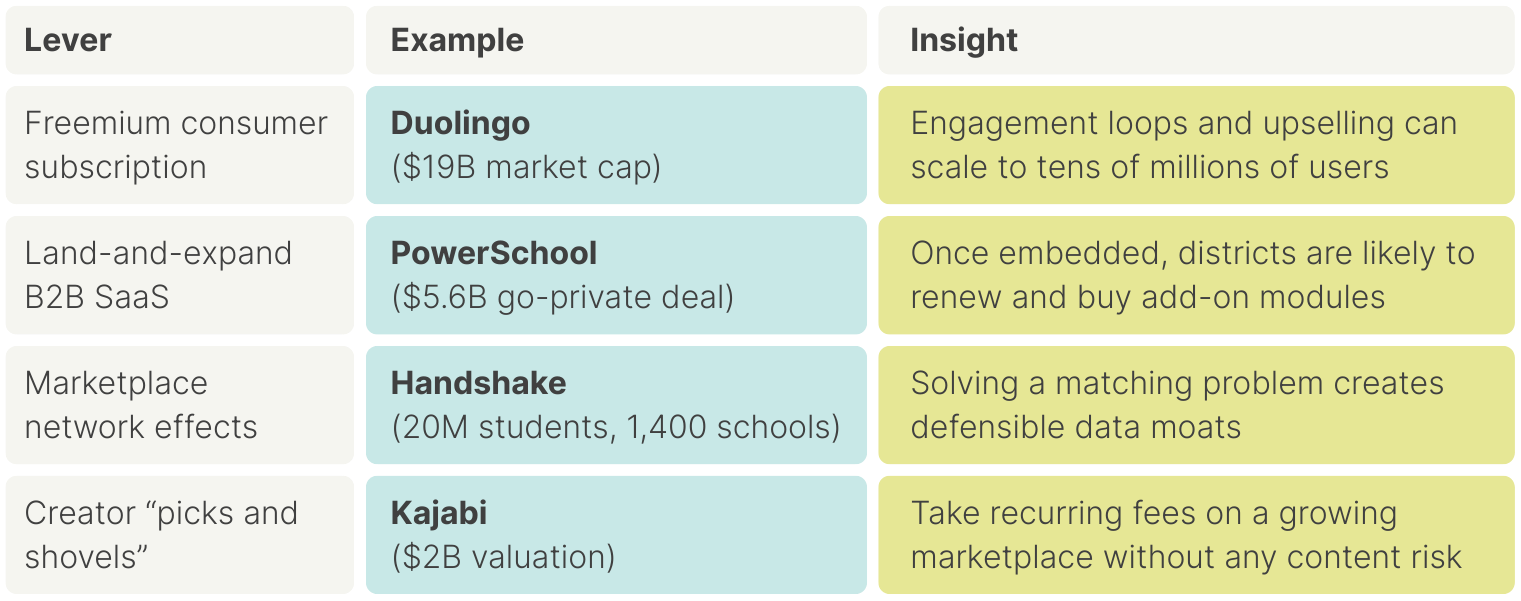

Research into 20 North American edtech unicorns and exits reveals repeatable playbooks.

Companies mentioned are for context only and do not represent investments made by any AV fund.

Conversely, incumbents that failed to re-platform around AI (e.g., Chegg) saw market-cap erosion, proving “AI as a feature” is no longer enough.

Lessons from the AV Portfolio

Panorama Education and Numerade show two exciting, durable paths we’re backing — AI embedded in existing educational workflows and AI that rewrites the core learning experience — both compounding through proprietary data tied to measurable results.

Panorama Education: AI Inside the K-12 Workflow

What it does: Panorama is the student‑success platform that districts already use for student support interventions (like MTSS), social and emotional learning, attendance, behavior, and academics. Because it sits in daily workflows, it has the trusted data (and the distribution) to help educators move from dashboards to action and improve outcomes.

Alumni Ventures first invested in Panorama’s Series B in 2017. Since then, the company has raised a $60 million Series C at a $700 million post-money valuation and embedded themselves within hundreds of school districts, including half of the 100 largest in the country.

What’s its AI playbook: Panorama’s embedded AI platform (Solara) turns district data into drafted support and education plans, early‑warning summaries, and family communications, all within minutes and aligned to local policies. It’s privacy‑first (compliant with FERPA/COPPA) and sold as an add‑on to an existing SaaS platform they’ve built out, so sales friction has been low and usage has been high. As lesson plans and curricula get created and measured, data related to how educators use and interact with the platform strengthens the accuracy and relevance of their AI models, increasing their defensibility and further embedding themselves in workflows.

This is our “AI in the workflow” playbook. Focus on distribution first, understand and measure the time‑to‑intervention, and build a feedback loop of improving data and models rooted in real results.

Numerade: Rewriting Tutoring With AI

What it does: Numerade pairs a TikTok‑style library of 1 million expert‑made STEM videos with an AI study coach that serves students from middle school through college. Learners can drop in a problem, get a targeted explanation, and follow a guided practice path, at any time and at their own pace.

Alumni Ventures participated in Numerade’s Series A valuing them at $100 million, backing the team’s content scale and distribution.

What’s its AI playbook: Numerade’s AI-native coach uses retrieval over the video corpus plus conversational guidance to identify the underlying concepts in problems, stitch the most relevant micro‑lessons, and generate step‑by‑step practice with checks for understanding. Every session (what you watch, where you pause, what you get wrong) feeds personalized engagement and mastery signals that sharpen recommendations and keep learners progressing.

The outcome is durable engagement and efficient conversion (built on streaks and repeat sessions) on top of high‑margin digital subscriptions: our “AI content + guidance” thesis in action.

Unique Opportunity for AV Community Members

SAVE THE DATE

NYC Edtech Week Kick-off Event

We’re hosting founders and investors on Oct 20 during NYC EdTech Week to map the first Education 2.0 winners — want in? Expect founder lightning talks, live product demos, and discussions on innovations and funding strategy in the model era. Space is limited, so register your interest when you apply.

Monday, October 20

Alumni Ventures, 183 Madison Ave., 18th Floor, NYC

Apply below to reserve your spot and unlock first-look deal flow in the world’s fastest-growing education market.

Concluding Thoughts

AI isn’t just making old tools faster; it’s changing how we teach and how education businesses win. The next leaders will turn proprietary interaction data into better guidance, prove learning gains in weeks — not years — and run models that survive policy swings and cheap foundation models. For founders and investors alike, the lesson is clear: differentiation now lives at the intersection of pedagogy, AI-native products, and tangible outcomes.

Ron Levin

Managing Partner and Head of the AV Seed FundRon brings a dynamic blend of operational leadership, global business acumen, and values-driven investing to early-stage venture capital. As Managing Partner and Head of the AV Seed Fund at Alumni Ventures, he leads investments in bold, frontier technologies that span sectors and geographies. Ron’s experience ranges from founding and scaling unicorn-status startups to guiding impact-focused portfolios that generate both financial and societal returns. Before joining Alumni Ventures in 2019, Ron served on the Investment Committee at Yard Ventures, AV’s fund for the Harvard community. His own entrepreneurial journey includes co-founding and leading TravelPerk, an enterprise travel management platform that reached multibillion-dollar valuation and global scale. Prior to that, he launched the B2B division of Booking.com and held strategic roles at McKinsey & Co., US Airways, the Maersk Group, and Lycos. Ron studied entrepreneurship at Babson College and earned his MBA from Harvard Business School. A frequent speaker at global investor conferences and guest on top VC podcasts, he is also a passionate world traveler—having visited over 140 countries and all 50 U.S. states. He resides near Boston with his wife and three young children, and shares personal reflections and industry insights at ronlevin.substack.com.

This communication is from Alumni Ventures, a for-profit venture capital company that is not affiliated with or endorsed by any school. It is not personalized advice, and AV only provides advice to its client funds. This communication is neither an offer to sell, nor a solicitation of an offer to purchase, any security. Such offers are made only pursuant to the formal offering documents for the fund(s) concerned, and describe significant risks and other material information that should be carefully considered before investing. For additional information, please see here. Achievement of investment objectives, including any amount of investment return, cannot be guaranteed. Co-investors are shown for illustrative purposes only, do not reflect all organizations with which AV co-invests, and do not necessarily indicate future co-investors. Example portfolio companies shown are not available to future investors, except potentially in the case of follow-on investments. Venture capital investing involves substantial risk, including risk of loss of all capital invested. This communication includes forward-looking statements, generally consisting of any statement pertaining to any issue other than historical fact, including without limitation predictions, financial projections, the anticipated results of the execution of any plan or strategy, the expectation or belief of the speaker, or other events or circumstances to exist in the future. Forward-looking statements are not representations of actual fact, depend on certain assumptions that may not be realized, and are not guaranteed to occur. Any forward-looking statements included in this communication speak only as of the date of the communication. AV and its affiliates disclaim any obligation to update, amend, or alter such forward-looking statements, whether due to subsequent events, new information, or otherwise.

Join Us (For Free)

Start Investing With the Education 2.0 Community Today.

- Home

Easy Sign-Up

Click a button. 5 seconds. - Home

No Obligation to Invest

Only invest in deals you like. - Home

Co-Invest with Elite VCs

Frequent co-investors include a16z, Sequoia, Khosla, Accel, and more. - Home

Deal Transparency

Due Diligence and Investment Memos provided. Live Deal discussions with our investment teams.