Generate Biomedicines: Changing How Medicines Are Made

Generate Bio’s AI/ML tech can generate biologic drugs to treat previously intractable diseases

Alumni Ventures portfolio company Generate Biomedicines replaces tedious, trial-and-error drug discovery with fast, precise protein engineering — reducing the usual years-long process to just eight months.

The global medicine market is expected to grow at 3–6% CAGR through 2027 to about $1.9 trillion. With value that high, it’s perhaps surprising that development of new drugs remains a slow, expensive, trial-and-error process — and comes with a high failure rate.

The average R&D-to-marketplace cost for just one new medicine is nearly $4 billion, and can sometimes exceed $10 billion. Many pharmaceutical giants deploy as much as 25% of their revenue on R&D. Most of this spend is tied up in the earliest phases of drug discovery. According to McKinsey Life Science Insights, “Over the past decade, the average time for taking a new medication from candidate nomination to launch has been about 12 years.”

Generate Bio is radically changing this process with its ability to create new, on-demand drugs more quickly and cost-effectively. Its platform was trained from the ground up across millions of protein sequences to serve a wide range of therapies and diseases.

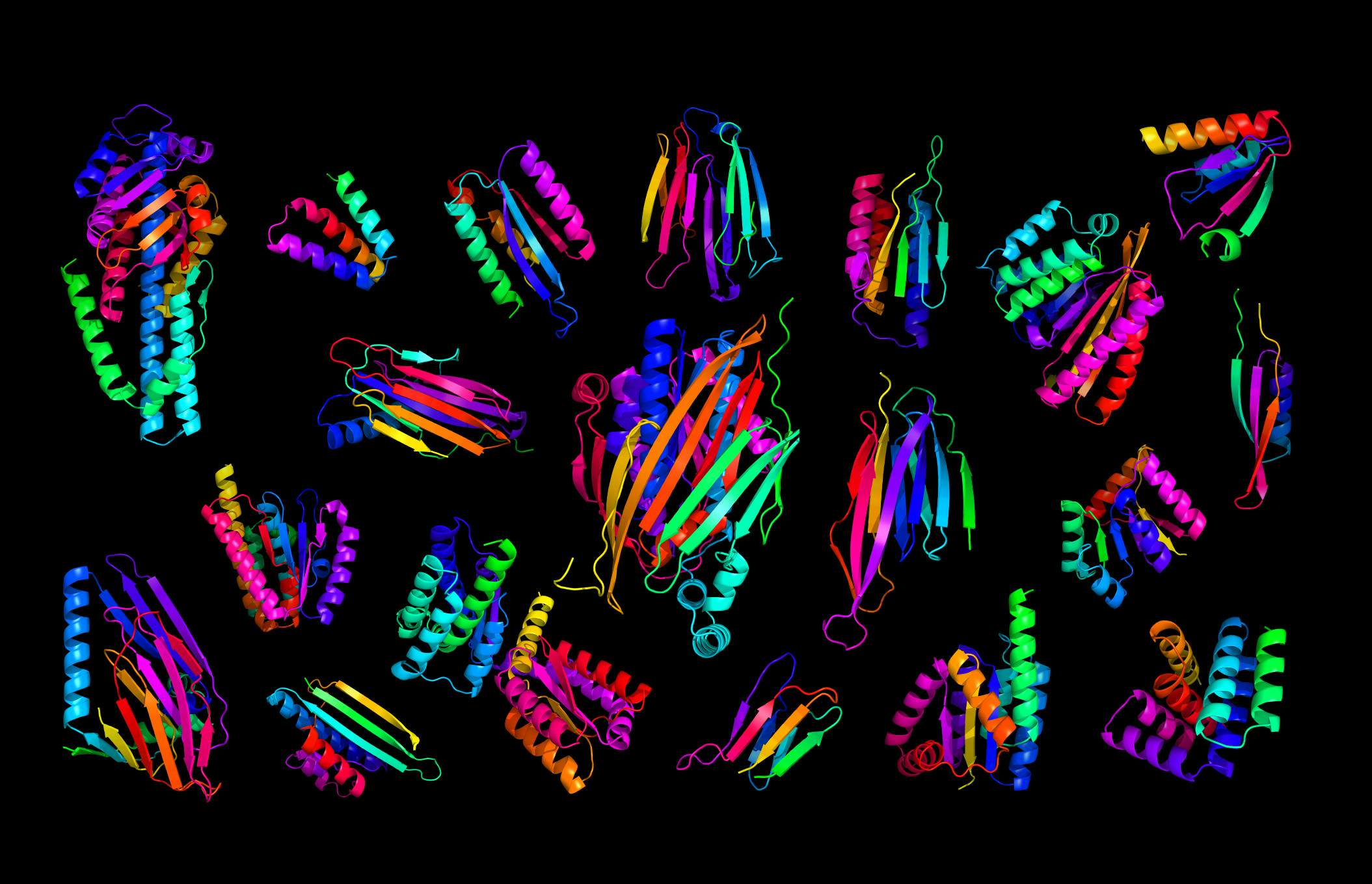

Proteins are the “doers” of cells; a partial list of the feats they perform include replicating DNA, fending off invading viruses, and keeping cells alive and healthy. That’s why most medicines approved today are, in fact, proteins.

Based on its exhaustive studies of proteins, Generate Bio has learned generalizable rules by which nature encodes function. It can apply those learned rules to create novel medicines with specific therapeutic functions. This breakthrough, called generative biology, represents a fundamental shift in what’s possible in the field of therapeutic development.

By marrying bio and tech in an integrated platform, Generate is able to simultaneously work on groundbreaking science while scaling discoveries for market to create a pipeline of life-changing medicines.

Building Biotech’s Future

Generate Biomedicines’ revolutionary approach to drug development was made possible by the company’s close-knit, cross-disciplinary team. Experts in machine learning (ML), biological engineering, and medicines — all conversant in each other’s fields — combine talents to create a new field.

In its due diligence, AV identified Generate Bio’s team as one of the company’s primary strengths. The team includes Gevorg Grigoryan, Generate’s Co-Founder and Chief Technology Officer, who is also a tenured chemistry professor at Dartmouth and a widely published author. Molly Gipson, Chief Strategy / Innovation Officer, also helped co-found Generate as part of Flagship Pioneerings’ venture-creation team. CEO Mike Nally was previously CMO at Merck & Co., responsible for global marketing and brand strategy across a portfolio of innovative medicines and vaccines exceeding $40 billion in revenue.

Since Nally’s tenure began in 2021, Generate has raised $370 million in Series B financing to advance its platform. It also signed its first research collaboration agreement with a pioneering biotechnology firm — with a potential transaction value of $1.9 billion, plus future royalties. And the company secured growing room with 140k+ square feet of new space at Boynton Yards and Andover locations in Massachusetts.

“Our people and culture are what give me the confidence that we can turn the seemingly impossible into possible as we push the boundaries of science to save and improve lives.”

What We Liked About Generate Biomedicines

Purple Arch Ventures (for the Northwestern community) sponsored our initial investment in Generate Bio. Among the company’s strengths identified by Purple Arch in its due diligence:

- Home

Breakthrough Science

Generate’s proprietary model represents one of the most comprehensive datasets on protein sequences built to date. The ML engine wrapped around this data was built from the bottom up to not only improve existing therapeutics but generate new ones across all modalities. - Home

High Defensibility

Generate has 100+ patent applications filed across 29 patent families, with additional filings anticipated by the end of 2023. - Home

Innovative Care Model

Unlike traditional brick-and-mortar models, Forta’s AI-driven therapy selection enables care delivery by parents trained as registered behavior therapists. - Home

Scalability

Since activating the platform in 2021, Generate has achieved exponential growth in the speed of protein discovery and creation. - Home

Platform Play

Generate is built to apply across protein modalities — whereas leaders in AI-powered drug discovery generally focus on one modality (e.g., antibodies vs. small molecules) and one stage of the process (identifying targets vs. optimizing drug development). - Home

Strong Board

Includes the CEO of Moderna and Nobel Laureate Frances Arnold.

How We Are Involved

In September 2023, Generate Bio announced it had closed a $273M Series C. The funding will advance a pipeline of 17 existing programs and approximately 10 new starts annually. Since 2020, the company has raised nearly $700 million in equity financing.

Alumni Ventures joined the Series C raise alongside lead investor Flagship Pioneering, who has funded 100+ science-based businesses — including both Generate and Moderna — worth more than $30 billion in aggregate value. Other investors in the round include Amgen, one of the largest global biotech companies, and NVentures, the VC arm of leading AI hardware and software developer NVIDIA.

Participating alongside Purple Arch were the following AV Funds: 116 Street Fund, Arbor Street Fund, The Fence Fund, Fowler Street Fund, Healthtech Fund, and Total Access Fund, as well as AV investors who participated in a Syndication opportunity.

View Fund Performance

Login to our secure data room.

Schedule a Call to Speak with Us

Ask questions important to you.

Contact [email protected] for additional information. To see additional risk factors and investment considerations, visit av-funds.com/disclosures.