Spike Ventures Community Newsletter —November 2022

Content at the intersection of entrepreneurship, venture capital, and our Stanford community.

IN THIS ISSUE: Join Spike Ventures Fund 6; recent portfolio company updates on SURGE Therapeutics, FreeWire, and Secureframe; 3 Minutes, 3 Questions with Spike Ventures; and more.

Join Spike Ventures Fund 6!

Spike Fund 6 is open to our entire community. If you would like to learn more, you can connect with us 1×1 for specific questions or visit our secure portal to access all fund materials.

UPCOMING WEBINAR

Spike Ventures Portfolio Update

Thursday, November 17, 5:00 PM ET

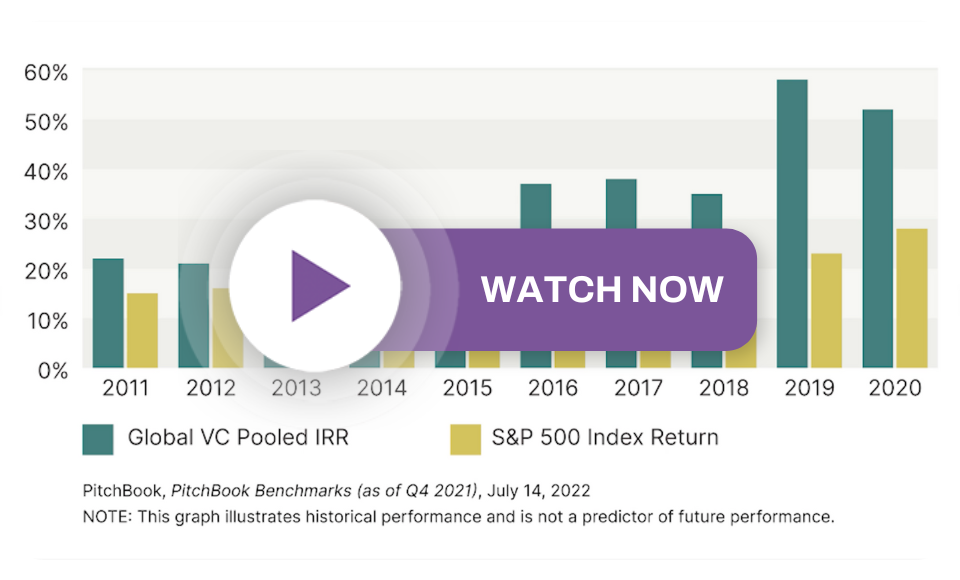

The deadline for Spike Fund 6 is coming up and we are already beginning to deploy capital and build the portfolio. Join Managing Partner Todd McIntyre for a webinar discussing the fund and how the team builds a diversified venture portfolio.

Spike Ventures Portfolio Updates

SURGE Therapeutics (formerly Stimit) seeks to dramatically improve cancer patient survival by disrupting how, when, and where cancer immunotherapy is deployed. Spike Ventures deployed capital in the company’s recently announced $26 million Series A led by Camford Capital. The funds will be used to accelerate the development of the intraoperative immunotherapy approach, expand the team, and initiate clinical trials for its injectable biodegradable hydrogel.

FreeWire is a mobility technology company that develops smart, flexible, battery-integrated electric vehicle chargers as an alternative to current infrastructure-heavy chargers. The company just hit a key milestone — the first installation of its chargers at Phillips 66’s flagship fuel station near its headquarters in Houston. This is the first step in the partnership between FreeWire and Phillips to install chargers at 7,000 Phillips 66, Conoco, and 76 branded U.S sites and other strategic locations. Spike Ventures deployed capital in the company’s $15 million Series A in December 2018. Learn More »

Secureframe, the modern, all-in-one platform for security and privacy compliance, announced new partnerships and launch partners for the Secureframe Trust API as part of its expanded Secureframe Trusted Partner Program. Spike Ventures deployed capital in the company’s $56 million funding round led by Accomplice in February. Learn More »

FOR CURRENT INVESTORS

Thinking of becoming an investor? Access Materials »

Visit Your Club Portal

We invite existing investors to visit your Club portal for updates from Managing Partner Todd McIntyre (MBA ’94) and our team, including webinars and events, Syndications, portfolio news, and more. Visit Club Portal »

What’s New at Alumni Ventures

Nothing Ventured: In the latest episode of our series “Nothing Ventured,” Alumni Ventures Chief Community Officer Luke Antal explains the stages of venture investing, from seed capital to Series A rounds to growth financing. Watch Now »

Synthesis Case Study: A prime example of AV’s value-add is our collaboration with Synthesis, an innovative learning experience created by the founder of a school for Elon Musk’s children. The program is designed to cultivate student voice, strategic thinking, and collaborative problem solving for kids ages 6 to 14. Learn More »

AV Talent Referrals

Interested in joining a cutting-edge startup or know someone who might be? Our portfolio companies are growing and always looking for high-caliber talent. Check out their open positions on our job board. If you find a match, fill out this short form, and we will try to make a personal referral. Visit Job Board »

Want to learn more?

View all our available funds and secure data rooms, or schedule an intro call.

New to AV?

Sign up and access exclusive venture content.

Contact [email protected] for additional information. To see additional risk factors and investment considerations, visit av-funds.com/disclosures.