Inside The Crimson Circle: Why Investors Are Competing for Harvard Access

Why One University Keeps Building the World’s Most Enduring Companies

If you use modern technology, healthcare, or consumer platforms, you are already living inside the Harvard startup ecosystem. This post explores how a single university has quietly built one of the most powerful founder networks in the world — and why that system continues to produce category-defining companies at scale.

About the Authors

Laura Rippy

Managing Partner, Alumni Ventures Board MemberLaura Rippy is a Managing Partner and Board Member at Alumni Ventures. She runs the Harvard-focused fund (The Yard Ventures), the Dartmouth-focused fund (Green D Ventures), the Women's Fund at Alumni Ventures, and our US Strategic Tech fund. Alumni Ventures is "America's Largest Venture Firm for Individuals" with $1.5B raised, and 1500 portfolio companies. AV is one of the top 3 most active venture capital firms globally, per Pitchbook 2018-24. Previously, Laura was a serial CEO, Chairman, Board Member, Advisor, and Executive in high-technology companies including Microsoft. Business Insider ranked Laura in the Best Early Stage Investors of 2024 and 2025. Laura Rippy holds an MBA from Harvard Business School and an AB in Government from Dartmouth College.

Luca Giani

Senior PrincipalLuca Giani is a Senior Principal, investor, and serial entrepreneur with experience in venture creation, M&A, and translational science. He focuses on building mission-driven ventures at the intersection of science, strategy, and capital. Luca is the Founder & CEO of Ilios Therapeutics, a neuroscience company developing novel therapies for ALS, Parkinson’s, and Alzheimer’s disease. He is a Termeer Fellow, former Blavatnik Fellow at Harvard Business School, and previously served as a Technology and Public Purpose Fellow at Harvard’s Belfer Center. Luca co-founded Innbiotec Pharma and Somnifix, led MedTech and digital health investments at 5Lion Ventures, and began his career at Credit Suisse and Bain & Company. He holds a Master with Distinction from Harvard and a B.S. magna cum laude from Georgetown University.

The Harvard Ecosystem Surrounds You

If you recently checked your sleep score on an Oura, booked a stay on Airbnb, utilized AI models from OpenAI or Anthropic, benefited from an mRNA vaccine developed by Moderna, or caught up with a friend on Facebook, you have touched the Harvard ecosystem.

Not indirectly. Directly.

Each one traces back to Harvard alumni, research, or leadership. Each one reflects a system that repeatedly transforms ideas into companies that reshape the world.

The world tends to celebrate individual companies. What it misses is the deeper truth: the most powerful companies emerge from communities. Harvard is one of the most impactful communities for startups on earth. It is a compounding system that has been quietly and consistently building category leaders for over a century.

This is what we call The Crimson Circle.

Harvard by the Numbers

Harvard alumni have founded more than 146,000 companies, generating approximately $3.9 trillion in annual revenue and supporting over 20 million jobs worldwide¹. If these companies were a single economy, they would rank among the largest in the world.

This is not an abstract academic footprint. It is a living system that continuously shapes global markets across technology, healthcare, finance, and climate. From artificial intelligence platforms and life-saving biotech breakthroughs to fintech infrastructure and consumer brands used by hundreds of millions of people, Harvard-affiliated founders sit behind a disproportionate share of the world’s most valuable private and public companies.

More than 100 billion-dollar startups² trace their roots to the Harvard ecosystem. Alumni-founded companies have created $282 billion in public market value since 2019³. New unicorns continue to emerge at a steady pace: roughly 9 new ones per year⁴. This sustained output is not the result of a single moment, sector, or generation. It is the product of a distinctively powerful founder network that converts ideas into lasting companies at a global scale.

At a Glance: Harvard’s Advantage Isn’t Luck

Harvard’s advantage isn’t luck or location. It’s systematic founder quality backed by decades of proof and the data backing this is undeniable:

- 146,000+ ventures founded by Harvard alumni worldwide

- $3.9 trillion in annual revenue generated by alumni-founded companies

- 20.4 million jobs supported globally

- 100+ unicorns, including 109 private unicorns valued at approximately $394 billion

These outcomes place Harvard among the most productive founder networks in the world, not just by company count, but by sustained value creation across decades, geographies, and industries. This isn’t random. This is a Harvard-backed network that truly scales.

Why You Should Care About the Crimson Circle

At Yard Ventures, we believe the Harvard founder network represents one of the most concentrated sources of entrepreneurial talent in the world.

This is where breakthrough companies are built. And through Yard Ventures individual investors can gain early access to them.

Harvard-affiliated founders have led multiple waves of innovation, from biotech and life sciences to consumer platforms, fintech, and now artificial intelligence.

Today, the next generation of category-defining companies is emerging from Harvard alumni and research-driven teams. These include Airbnb, OpenAI, Oura, Stripe, Lyft, Cloudflare and Moderna.

Yard Ventures exists to give individual investors structured access to the Harvard innovation ecosystem, by having a professional team of investors source and diligence elite, highly competitive deals and enabling co-investment alongside top venture firms like a16z, Sequoia, and Accel.

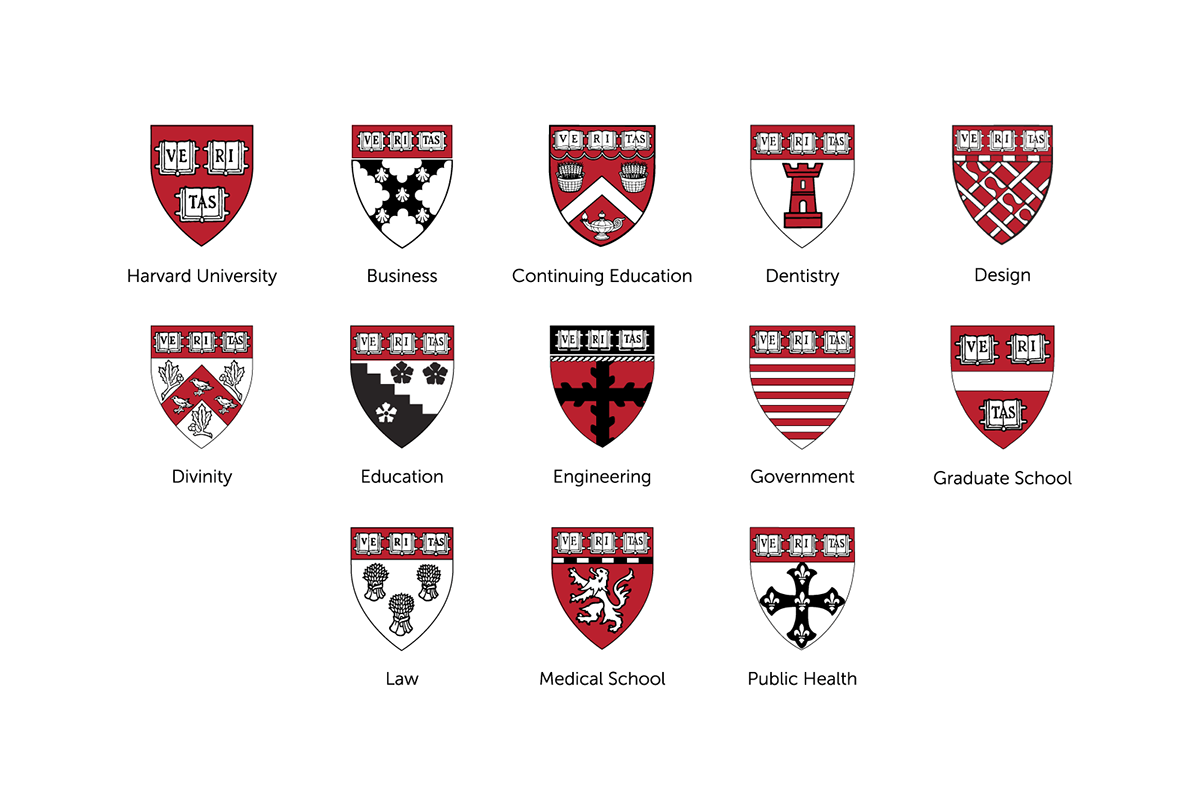

Thirteen Schools. One Founder Network.

Harvard is not a single founder factory. It is thirteen schools producing complementary talent, ideas, and leadership that form one of the most powerful founder networks in the world. A company might begin with a breakthrough from Harvard Medical School, gain technical depth through Engineering, and scale with leadership from Harvard Business School. Legal and policy complexity flows from Harvard Law or the Kennedy School. What matters is the speed and frequency with which these disciplines collide. Complex companies need teams that move fluently across science, engineering, business, and policy. Harvard’s structure lowers the friction at the moment it matters most: when ideas are fragile and execution risk is highest.

At Harvard, entrepreneurship is the norm. Students are surrounded by classmates building companies while still on campus. This culture was built through repetition: alumni mentoring, founders investing, companies becoming case studies.

Harvard Business School anchors the framework through core courses like The Entrepreneurial Manager and Startup Bootcamp. Harvard Medical School trains students to translate clinical discoveries into viable technologies through programs such as Anatomy of Innovation. Harvard College offers ES 94: Entrepreneurship and Innovation. Every graduate school follows the same model.

Then all schools converge at the Harvard Innovation Labs. Since opening in 2011, the i-labs have supported more than 6,500 ventures that have collectively raised more than $9 billion. Participation is large and increasing. During the 2024-2025 academic year, more than 2,900 students from all 13 Harvard schools joined the Harvard Innovation Labs, representing roughly one in nine degree-seeking students at the university*. From the i-labs, founders move into more specialized environments. Launch Lab X supports alumni-led ventures as they transition from formation to scale. The Pagliuca Harvard Life Lab provides wet-lab space and resources designed for early-stage life sciences companies, like Vaxess Technologies we mentioned before..

Scientifically research-driven ventures flow through the Office of Technology Development. Since 2000, Harvard-developed IP has formed the basis of almost 300 startup companies, which have collectively raised more than $15.6 billion in financing.

Ideas flow in. Companies come out. Year after year, independent of market cycles. The thirteen schools create the talent. The infrastructure scales it. The culture makes it inevitable.

*SOURCE: directly from the Harvard ILAB by email

Where Harvard Founders Win Disproportionately

Harvard-connected founders consistently build companies in sectors where complexity, regulation, and long time horizons create real barriers to entry.

These are not fast-moving consumer trends. They are systems-level businesses built around science, infrastructure, and durable advantage.

That pattern shows up clearly across several categories, and Yard Ventures have invested in some of the most promising startups that have come out of the ecosystem:

Artificial Intelligence and Data Infrastructure

In artificial intelligence, Harvard-affiliated companies mostly focus on foundational systems rather than surface-level applications.

- Cohere builds large language models designed for enterprise use, emphasizing security, reliability, and deployment inside real organizations.

- Groq builds inference infrastructure optimized for speed and efficiency at scale, solving the compute bottleneck in AI deployment. These are infrastructure designed to scale, not experiments.

Energy, Engineering, and Physical Systems

Some of the most ambitious companies emerging from the Harvard ecosystem tackle problems rooted in physics, materials, and infrastructure.

Companies such as Aalo, RedoxBlox, and Astro Mechanica address challenges in nuclear energy, long-duration energy storage, and aerospace engineering. These are problems that demand patient capital, regulatory fluency, and deep technical expertise.

Across all these sectors, the pattern is consistent: Harvard-affiliated companies are designed for durability, not hype

The Harvard Playbook: Three Case Studies

The Crimson Circle produces companies that are not only innovative, but investable.

Yard Ventures partners with founders emerging from this ecosystem and co-invests alongside leading institutional firms in highly competitive rounds. The following companies illustrate how this network translates into durable, category-defining businesses.

Healthcare and Life Sciences

Harvard’s strength in medicine, biology, and public health translates into companies designed for clinical rigor and measurable outcomes.

- SURGE Therapeutics applies insights from cancer immunology and surgery to develop intraoperative immunotherapies that reprogram the body’s immune response at the moment of tumor removal, targeting cancer recurrence at its source.

- Oura builds foundational infrastructure for personal health, combining biology, hardware, and data science to generate continuous, high-fidelity biometric data at global scale. Together, they reflect a common pattern: life sciences companies that emerge from deep domain insight and are built to operate inside real clinical and regulatory systems, not around them.

SURGE Therapeutics: From Harvard Insight to Clinical Impact

Reimagining Surgery as an Opportunity for Immunotherapy

Dr. Michael Goldberg, PhD, was an assistant professor of cancer immunology at Harvard Medical School and Dana-Farber Cancer Institute when he honed in on a critical but underappreciated problem in oncology: while surgery removes the primary tumor, it also triggers an inflammatory response that can suppress the immune system and enable cancer recurrence and metastasis.

This insight became the foundation of SURGE Therapeutics, the intraoperative immunotherapy companyTM. SURGE was built to transform surgery from a purely physical intervention into a therapeutic opportunity as well. Rather than treating the tumor itself, SURGE’s approach focuses on reprogramming the body’s response to surgery, shifting it from immunosuppressive to immunostimulatory in order to address minimal residual disease, whether local or distal.

This is a classic Harvard founder story: deep academic insight, translated through rigorous science, clinical understanding, and regulatory strategy into a company designed for real-world impact.

Yard Ventures invested alongside Khosla Ventures and 8VC, as SURGE has progressed from early research to first-in-human clinical trials. The company has raised approximately $64 million through Series B. The syndicate reflects what the Crimson Circle attracts: deep-pocketed, mission-aligned capital willing to back high-potential, category-defining ventures.

SURGE is presently preparing to advance three programs into mid- and late-stage clinical trials, with the potential to expand to additional tumor types. The company’s long-term vision is ambitious but focused: to reduce post-surgical cancer recurrence by making immunotherapy an integral part of surgery itself.

Oura: From Health Insights to Continuous Data

Personal Health Monitoring. Foundational Source of Biometric Data.

Tom Hale, Oura’s CEO, is a Harvard graduate who recognized a systems-level problem: personal health data was fragmented across competing devices, each collecting incomplete signals. When he joined Oura, he brought the vision to consolidate that data into a single, continuous source of truth.

Oura was founded in 2013 by researchers who asked a fundamental question: what if the compute layer for personal health could be purpose-built, rather than adapted from consumer fitness devices? Back then wearable devices were fundamentally limited by form factor and sensor placement. They spent years developing a ring-based platform that could collect biometric data continuously and accurately from a location where existing devices failed.

This required a company who understood both deep biology and hardware engineering: a rare combination. The team brought that discipline. They tested every wearable on the market and concluded they had to build something from first principles. The result: a titanium ring with infrared LEDs that captures heart rate variability, sleep stages, body temperature, and respiratory rate with accuracy that outperformed everything available at the time.

Oura is building foundational infrastructure for personal health. The hardware and algorithms that enable people to understand how their body responds to stress, sleep, recovery, and lifestyle choices.

Oura has raised more than $1.5 billion across multiple rounds, including a $900M Series E in October 2025 led by Fidelity and participated by ICONIQ. The company is currently valued at approximately $11 billion and has achieved large-scale commercial deployment, with millions of users generating continuous health data streams. Yard Ventures has backed Oura since its Series B, in 2019: a pivotal period just before the company’s breakout growth.

Oura’s trajectory mirrors the pattern of Crimson Circle companies: it identified a systems-level problem, assembled a team capable of solving it, and attracted capital from investors who understand the long-term value of foundational technologies. The company now sits on nearly a decade of highly accurate biometric data from millions of people: a dataset that becomes more valuable with every year of collection and every AI innovation that follows.

Osmo: From Sensing Research to Digital Smell

Machine Olfaction. Opening New Dimensions of AI.

Osmo was founded by researchers who recognized a gap in machine perception. Computers can see, hear, and process language. But smell? That frontier remained closed.

Dr. Alex Wiltschko did his PhD in olfactory neuroscience at Harvard under Sandeep Robert Datta, trained by Nobel laureate Richard Axel. After Harvard, he founded and sold two AI companies before joining Google Brain in 2017 with a single mission: crack olfaction using machine learning.

At Google, his team achieved the breakthrough: machine learning models that predict what a molecule smells like more accurately than humans can describe it. They built a computational map of odor. Scent, for the first time, could be digitized.

Then Wiltschko made a choice. He could stay at Google. Or he could recognize what this technology actually meant: fragrance, security, diagnostics, insect control. An entirely new category waiting to be built. In 2022, he left to start Osmo.

This represents exactly the type of moonshot that the Crimson Circle enables. It required researchers willing to work at the intersection of neuroscience, material science, and machine learning. It required founders who could translate this research into a venture-scale opportunity. And it required access to capital willing to back frontier science.

Osmo is building the world’s first digital smell engine. Using proprietary data and machine learning algorithms, the company enables computers to identify, generate, and understand scent. Its initial markets include fragrance, security, and diagnostics, opening entirely new interfaces between the physical and digital worlds.

Founded in 2022, Osmo has raised approximately $145 million across multiple rounds, including a $60M Series A led by Lux Capital and GV (Google Ventures), and a $70M series B with investment by Amazon, as well as non-dilutive grant funding from the Bill & Melinda Gates Foundation supporting its work in public health and insect control.

The company has achieved early commercial traction, including fragrance partnerships and the launch of Generation, its AI-powered fragrance house, as well as deployments in product authentication and security-related scent detection. Osmo is currently operating at ~90 employees across AI, chemistry, neuroscience, and perfumery, with active labs and commercial operations spanning New York and Cambridge.

Yard Ventures invested alongside Lux Capital, GV, and Two Sigma, backing a company operating at the frontier of sensing, data, and machine intelligence. These are investors who understand that transformative companies often emerge from problems that seem impossible until solved.

Investment Thesis: The Compounding Effects of the Crimson Circle

Over decades, Harvard has produced one of the world’s most durable and wide-reaching founder networks through a system of talent, ideas, and capital that reinforces itself over time.

The Crimson Circle is defined by structural advantages that persist across generations:

- Cross-disciplinary talent drawn from thirteen schools spanning business, medicine, engineering, law, and public policy

- Entrepreneurship embedded as a core leadership skill, not a niche career path

- Institutional pathways that translate research and insight into venture-scale companies

- Dense alumni networks that accelerate trust, hiring, and early capital formation

- A feedback loop where successful founders return as mentors, investors, and repeat entrepreneurs

As artificial intelligence reshapes how work is done, life sciences push deeper into clinical and biological complexity, and energy and infrastructure companies scale to meet global demand, founders emerging from the Crimson Circle are consistently equipped to operate in high-stakes, regulated, and technically demanding environments.

For investors, participating in the Crimson Circle is not about betting on isolated founders. It is about gaining exposure to a system that has repeatedly produced enduring companies across market cycles and technological shifts.

Yard Ventures provides a structured way to access that system, co-investing alongside leading venture firms in companies shaped by the Crimson Circle and built to last.

The opportunity is not just to invest in great companies. It is to participate in a founder network whose effects continue to multiply.

Sources:

- Harvard Impact Study: Global Economic & Social Impact of Harvard Alumni, Harvard University

- Ilya Strebulaev, Director of the Stanford GSB Venture Capital Initiative

- (2024, November 14). Breaking Down IPO Success: Harvard Business School vs. Harvard College, Phoenix Research

- (2024, December 19). Harvard Produces ~9 Unicorns a Year, Phoenix Research

No representation is intended that any investment outcome presented is representative of the experiences of any AV Fund or investor. Past performance does not guarantee future results.

This communication is from Alumni Ventures, a for-profit venture capital company that is not affiliated with or endorsed by any school. It is not personalized advice, and AV only provides advice to its client funds. This communication is neither an offer to sell, nor a solicitation of an offer to purchase, any security. Such offers are made only pursuant to the formal offering documents for the fund(s) concerned, and describe significant risks and other material information that should be carefully considered before investing. For additional information, please see here. Achievement of investment objectives, including any amount of investment return, cannot be guaranteed. Co-investors are shown for illustrative purposes only, do not reflect all organizations with which AV co-invests, and do not necessarily indicate future co-investors. Example portfolio companies shown are not available to future investors, except potentially in the case of follow-on investments. Venture capital investing involves substantial risk, including risk of loss of all capital invested. This communication includes forward-looking statements, generally consisting of any statement pertaining to any issue other than historical fact, including without limitation predictions, financial projections, the anticipated results of the execution of any plan or strategy, the expectation or belief of the speaker, or other events or circumstances to exist in the future. Forward-looking statements are not representations of actual fact, depend on certain assumptions that may not be realized, and are not guaranteed to occur. Any forward-looking statements included in this communication speak only as of the date of the communication. AV and its affiliates disclaim any obligation to update, amend, or alter such forward-looking statements, whether due to subsequent events, new information, or otherwise.

Interested in seeing elite venture deals (for free)

- Home

Easy Sign-Up

Click a button. 5 seconds. - Home

No Obligation to Invest

Only invest in deals you like. - Home

Co-Invest with Elite VCs

Frequent co-investors include a16z, Sequoia, Khosla, Accel, and more. - Home

Deal Transparency

Due Diligence and Investment Memos provided. Live Deal discussions with our investment teams.