What the Heck is the Power Law?

The Peculiar But Compelling Math of Venture Capital

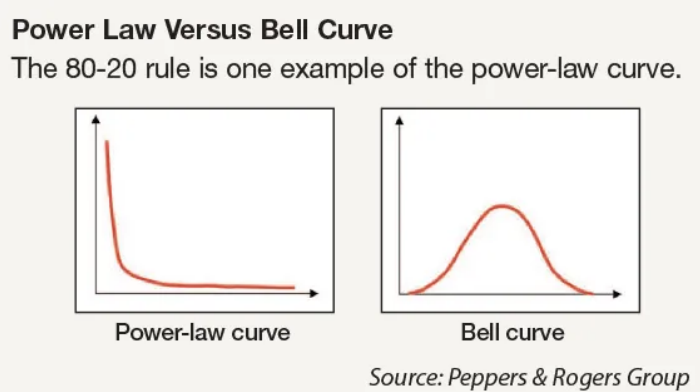

In the world of venture capital, our reality is governed by a mathematical principle that defies the intuition of the broader financial markets: the Power Law. While traditional equity investors often cite the “80/20 rule,” venture capital operates on a far more extreme distribution, typically closer to 95/5.

Start Investing With the Seed Syndicate Today

Take 5 seconds. No document uploads.

This law dictates that a small number of investments will generate the vast majority of our returns. For a venture fund to succeed, we do not need a high volume of moderate successes. Instead, we need one or two outliers to succeed at such a massive scale that they return the entire value of the fund and more. Consequently, our business model is not built on “batting average” or “how often we are right,” but on “slugging percentage” or the magnitude of the win when we are right.

This creates a fundamental divergence between venture capital and almost every other asset class. Public stocks, real estate, and bonds generally follow a Normal Distribution, or a “Bell Curve.” In those worlds, most assets perform near the average, and the primary goal is often to minimize risk and avoid losing capital.

Venture capital, by contrast, follows a Pareto distribution. In our ecosystem, the “average” outcome is actually a loss, as most startups fail, but the right-tail outlier is theoretically uncapped. While a public equity manager might focus on hedging against volatility to avoid a bad year, we must actively hunt for volatility. Missing the single best-performing company in a vintage, like an early Google or Facebook, is not just a missed opportunity; it is a catastrophic failure of strategy that renders the rest of the portfolio irrelevant.

Despite the high failure rate, the returns in venture capital are compelling because of the mechanics of asymmetric risk. When we invest in a startup, our downside is strictly capped: we can only lose 1x our invested capital. However, our upside is uncapped. We can make 10x, 100x, or even 1,000x our money. This asymmetry is the engine that powers the industry. It allows us to be wrong the majority of the time while maintaining the potential to generate superior aggregate returns. We accept that a significant portion of our portfolio may go to zero because the math of a single “home run” is powerful enough to pay for every strikeout and still deliver substantial profit to investors.

Historically, venture capital has functioned as a high-beta, cyclical asset class that delivers exceptional returns during technological booms. For instance, the asset class famously outperformed public markets during the “dot com” era, with the Cambridge Associates U.S. Venture Capital Index generating a staggering 32.4% average annual return from 1995 to 2020. While this can be offset by lagging performance during market downturns, it is important to consider the long-term nature of such investments. Liquidity in venture investing can take 5, 10, or even 15 years to manifest. The upside for such patience and willingness to accept reduced liquidity should ultimately come through superior returns. In more recent times, the VC index returned roughly 17.2% annually from 2010 to 2020 compared to the S&P 500’s 13.9%. It should also be noted, however, that these aggregate figures mask a steep power law where the top quartile of funds drives nearly all industry profits, while the median fund frequently fails to justify the illiquidity risk relative to public benchmarks.

At Alumni Ventures (AV), we have crafted a strategy around co-investing alongside the leading VC firms in our industry. Our performance has been benchmarked against nearly all major North American VC firms. In the past two years, both CB Insights and TIME Magazine have independently determined that AV ranks among the “Top 20” firms in VC, among some illustrious company that includes the likes of Kleiner Perkins, Andreessen Horowitz, General Catalyst, and NEA.

The AV Seed Fund employs a high-volume approach (50+ companies per vintage) designed to align with the Power Law dynamics of venture capital, investing in early-stage opportunities at lower entry valuations. While the risk of is high, successful investments in this stage have historically provided opportunities for outsized returns.

Start Investing With the Seed Syndicate Today

Take 5 seconds. No document uploads.

For an individual investor, venture capital offers a critical role in a well-diversified portfolio by providing a high-beta source of “alpha” that is structurally distinct from public markets. Public companies are generally “efficiently priced,” making it difficult to gain an information advantage. Venture capital captures value during the private, inefficient, and steep-growth phase of a company’s lifecycle, meaning value creation that occurs long before a ticker symbol exists. While illiquid and risky, this asset class provides exposure to innovation and disruption with low correlation to daily stock market fluctuations, offering investors a way to access the potential exponential growth of emerging companies before they become household names.

Alumni Ventures Seed Fund 9 is open to new commitments until December 31st. If you are an accredited investor, you may join our community and gain access to a highly diversified seed-stage venture portfolio, with a minimum investment of $10K. If you are the type of investor who prefers to pick your investments selectively on an individual basis, you may also join the AV Seed Fund syndicate. Syndicate members receive deal information under NDA and may choose to invest selectively in only those opportunities they find most compelling.

Venture capital involves substantial risk, including risk of loss of all capital invested, as well as illiquidity—but for many investors, the potential rewards may justify the tradeoff. Thousands of investors with Alumni Ventures have allocated capital to highly innovative startup teams, seeking to benefit from the Power Law dynamics that have historically driven venture capital returns.

Join Us (For Free)

Start Investing With the Seed Syndicate Today.

- Home

Easy Sign-Up

Click a button. 5 seconds. - Home

No Obligation to Invest

Only invest in deals you like. - Home

Co-Invest with Elite VCs

Frequent co-investors include a16z, Sequoia, Khosla, Accel, and more. - Home

Deal Transparency

Due Diligence and Investment Memos provided. Live Deal discussions with our investment teams.

This communication is from Alumni Ventures, a for-profit venture capital company that is not affiliated with or endorsed by any school. It is not personalized advice, and AV only provides advice to its client funds. This communication is neither an offer to sell, nor a solicitation of an offer to purchase, any security. Such offers are made only pursuant to the formal offering documents for the fund(s) concerned, and describe significant risks and other material information that should be carefully considered before investing. For additional information, please see here. Achievement of investment objectives, including any amount of investment return, cannot be guaranteed. Co-investors are shown for illustrative purposes only, do not reflect all organizations with which AV co-invests, and do not necessarily indicate future co-investors. Example portfolio companies shown are not available to future investors, except potentially in the case of follow-on investments. Venture capital investing involves substantial risk, including risk of loss of all capital invested. This communication includes forward-looking statements, generally consisting of any statement pertaining to any issue other than historical fact, including without limitation predictions, financial projections, the anticipated results of the execution of any plan or strategy, the expectation or belief of the speaker, or other events or circumstances to exist in the future. Forward-looking statements are not representations of actual fact, depend on certain assumptions that may not be realized, and are not guaranteed to occur. Any forward-looking statements included in this communication speak only as of the date of the communication. AV and its affiliates disclaim any obligation to update, amend, or alter such forward-looking statements, whether due to subsequent events, new information, or otherwise.